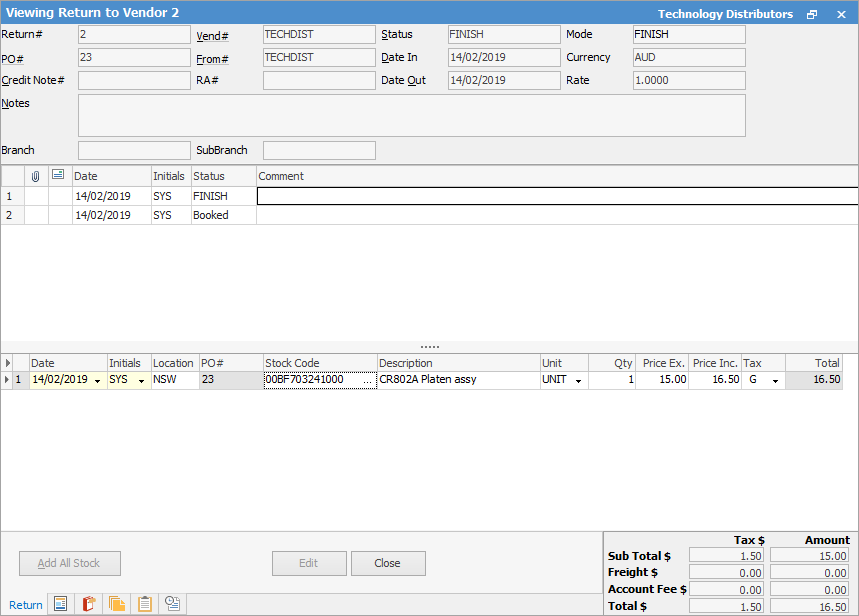

This page outlines and explains the terminology of the Jim2 Return to Vendor (RTV) form. From the RTV form, and the interaction of other default information, accurate and relevant reports can be defined for transmission to your vendor.

As with most businesses, there are times when certain stock items need to be returned to the vendor for various reasons – warranty issues, faulty parts, incorrect quantity ordered, etc. Jim2 has the facility to track stock and allow you to return goods to the vendor, and keep a complete stock control record. RTV is only allowed on stock you have purchased through Jim2 and have not sold to customers as yet. Jim2 tracks all stock to enable the easiest method for returning stock without having to hunt through purchase orders or vendor invoices to locate the details for the stock return.

|

You cannot use RTV against an expense PO – you have to create a negative expense PO. The quantity is entered as a positive amount, but the dollar value is entered as a negative. See Create an Expense Order, Add Expenses to a Purchase Order and Create a Negative Expense Order. |

The Jim2 Return to Vendor form is divided into the following specific information areas that will give you a complete detailed record of:

▪The RTV details via the Return header

▪The stock information via the return stock grid

▪The totals of the return via the Return Footer

|

You will see some letters underlined in the field names within the header, eg. Vend#. Using Alt+ the underlined letter will jump you to the field beside that heading. |

|

The reverse process to a purchase order is the RTV. In strict FIFO (first in first out) fashion you should not be able to return stock from a purchase until you have finalised the purchase. However, there are circumstances where you may have received the purchase order and would like to RTV immediately. |

What you need to be very clear of is:

Receiving a PO |

Quantity count for stock increases, but COGS, GST and creditor are pending until PO is finished. |

Finishing a PO |

COGS, GST and creditors are updated. |

Return to Vendor |

Quantity on hand reduces, GST paid is reversed, creates a creditor credit. |

However, you can add an RTV against a PO that is still on received, but you won't be able to finish the RTV until the PO is also finished.

Restocking Fees

Restocking fees can be treated in one of two ways:

▪the value of the credit is reduced, or

▪an expense order is added.

You can amend the value of a credit from a vendor prior to moving the RTV to Finish. This is the most usual way to do it as it mirrors the value of the credit.

Otherwise, if you wish to finish the RTV for the full value, you can then add an expense order against the vendor for the restocking fee.

Further information:

|

Add a Return to Vendor Against a Different Vendor Add a Return to Vendor Against Multiple POs Add Restocking Fees on a Return to Vendor |

|