Both single and multilevel manufacturing optionally allow the cost of labour to be included as part the total cost within the manufacturing process.

There are two ways to report the labour costs in the general ledger.

1.Where the labour cost is considered a cost of goods only for the sell price calculation:

The parts used may have a cost of $50. Jim2 considers the cost of goods to be $150 for sell price calculation. For example, if the sell price calculation is Last COGS + Markup% (where the Markup % is 40%), Jim2 will calculate by adding 40% to $150 (Sell = $210). The actual asset value of this stock in the Balance Sheet will be $50.

2.Where the labour cost forms part of the asset value of the manufactured stock

In this instance, the manufacture cost on a labour stock code will be considered part of the COGS for making this stock, and will be included in the asset value of the manufactured stock code. If the parts used have a cost of $50, and one hour of labour (at $100)v is used, the asset value of the stock is $150. If this method is used, there will be a corresponding credit against a linked expense account (eg. an account possibly called Wages used in Manufacture).

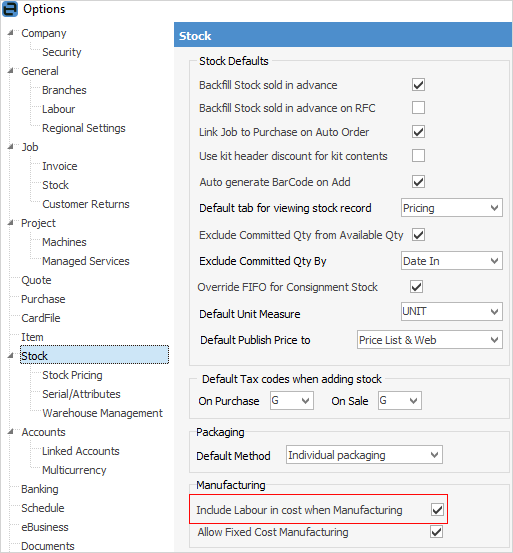

To allow labour to be considered as a cost of manufacture, Include Labour in cost when Manufacturing must be ticked (Tools > Options > Stock), and the Linked Offset account set up.

|

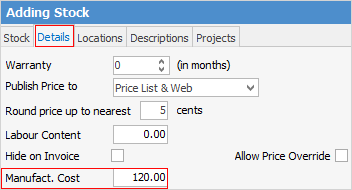

On the Details tab of manufactured stock, the cost of labour should be included in Manufact. Cost, along with the cost of any stock.

|

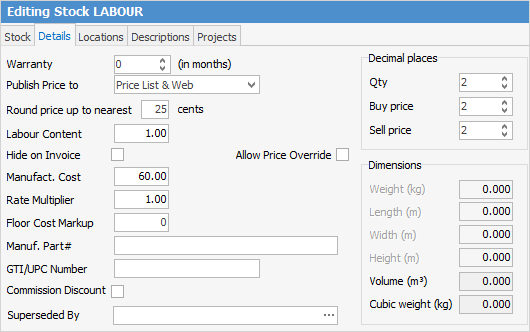

Any labour stock code that will be included in the manufacture will also need to have a Manufact. Cost. which represents the cost of providing one unit (normally an hour) of labour.

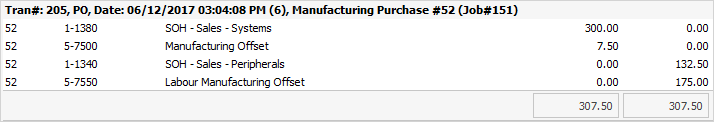

In the example below, a Labour stock code with a Manufact. Cost of $175.00 has been included in the manufacturing job. The value of the manufactured stock code increases by the value set on manufacturing job, and the Labour Offset accounts and Inventory accounts are credited.

The Journal flow will be:

1.Create at least one labour stock code (Type – Labour) specifically used for manufacturing. The unit measure should be HOUR.

|

Remember, the Manufact. Cost is the total cost of labour based on the user's hourly rates plus all other overheads (rent, electricity, etc.). |

2.In the Details tab, enter a Manufacture Cost for one hour of labour. Enter a Labour Content of 1. Edit the Qty field to ensure 2 decimal places.

3.In the COGS or Expenses area of the general ledger, add a detail account for Manufacture Labour. This account will be credited when a manufacture job is manufactured.

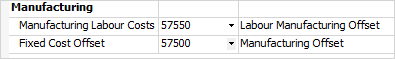

4.On the ribbon, go to Tools > Options > Accounts – Linked Accounts, and link the Manufacturing Labour Cost to the newly added GL Account (in Point 3).

Now, when a manufacturing job has this Labour stock code included in its Bill of Materials, the user enters the number of hours used to manufacture the stock. When the job is manufactured, the new stock causes the stock on hand account to be debited by the value of the depleting/special parts, added to the value of labour. The labour value is credited against the linked manufacture labour account. The depleting/special stock value is credited against their linked stock on hand accounts.

Further information

Kitting v Packaging v Manufacturing

How to

Add Stock to a Manufacturing Item

Add Single Level Manufacturing Stock

Auto Create Manufacturing Jobs and POs