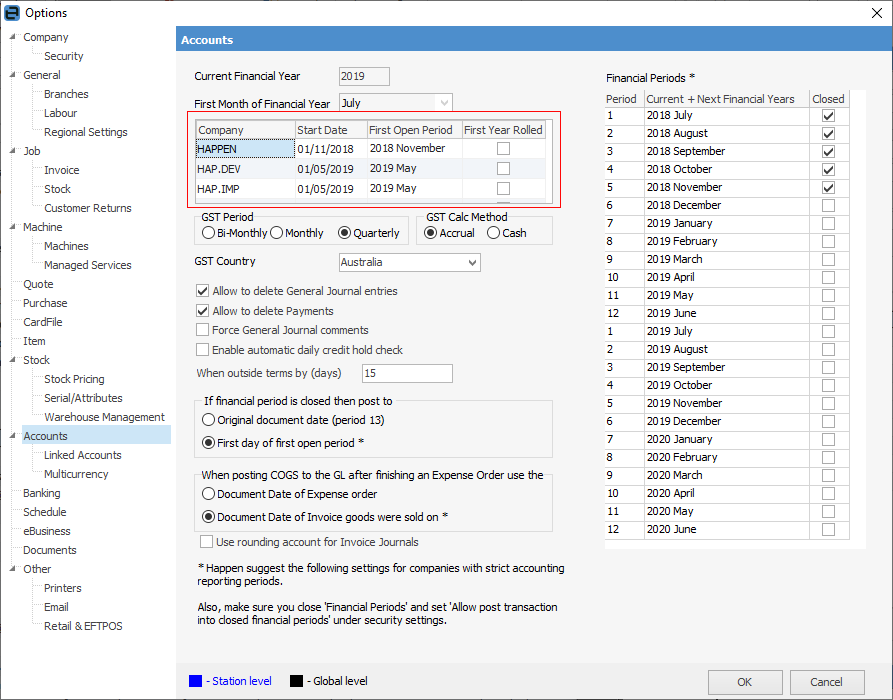

Tools > Options > Accounts

This area of Options shows individual company information (once populated), including whether the first year has been rolled or not.

As seen from the above image, here is where to close periods/months. Once closed, these periods are locked for posting/changing any further transactions.

|

These defaults should be considered carefully as they have a major impact on how Jim2 works, and how the business is run. |

Field |

Explanation |

||

|---|---|---|---|

Current Financial Year |

The financial year information will be entered when using Jim2 for the first time (via the Jim2 Startup Wizard). These fields will show the information relating to the current financial year, first month of financial year, starting month using Jim2 – this is used for locking and reporting purposes. These values cannot be changed. When a financial year is rolled over, the current financial year will automatically update. |

||

First Month of Financial Year |

The starting month of the financial year. |

||

Company fields |

These fields show each company, start date, first open period and whether the first year has been rolled. |

||

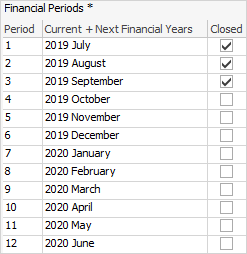

Financial Periods |

As the financial year rolls along and things are finalised for each month, the period should be closed so that no transactions can be posted and no existing transactions can be changed for those periods. To do this, tick the box next to the period to close. A period can be unlocked at any time, as long as the following periods are not locked. For example, the August period cannot be unlocked unless the September and October periods are also unlocked.

|

||

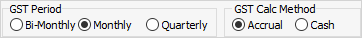

GST Period |

This is where to specify how often to complete a GST/BAS return. This is used when printing the report at default dates, and when editing documents.

|

||

GST Calc Method |

Select either Accrual (default) or Cash GST reporting methods, depending on the company's GST reporting requirements. This option is in the Jim2 Startup Wizard (used when setting up Jim2 for the first time). |

||

GST Country |

Choose from Australia, New Zealand, Canada or South Africa. |

|

For multi-company sites, only one calculation method can be used, either cash or accrual.

It is important that the GST calculation method be selected prior to finishing the first GST session. However, if the GST calculation method is changed at a later time, you can easily identify the calculation method that was used for each session.

Jim2 does not support moving from Accrual to Cash GST reporting without some manual calculations – advice from the company's accountant may be required. For instance, how to determine which invoices have already been reported to the Australian Taxation Office on an accrual basis, that will be paid in the future (and potentially reported again) on a cash basis? |

Field |

Explanation |

|---|---|

Allow to delete General Journal entries |

This and the following two options are more business methodology questions, ie. should users be able to delete general journal entries? There is a further security setting on this option. |

Allow to delete Payments |

Should users be able to delete debtor and creditor payments? There is a further security setting on this option. |

Force General Journal comments |

Should a comment be entered when users add and post general journal entries? |

Enable automatic daily credit hold check |

Tick this box to automatically put customers (debtors) on credit hold if they have invoices that are overdue by a predetermined number of days. Enter that number into the When outside terms by (days) field. The default is 0 (zero) days. |

If Financial Period is closed then post to |

Choose to post to either Original Document Date (Period 13) or First Day of First Open Period* (see |

When Posting COGS to the General Ledger after finishing an Expense Order |

Choose to use either the document date of the expense order or the document date of the invoice the goods were sold on* (see |

Use rounding account for Invoice Journals |

If ticked, when a job is invoiced and there is rounding, instead of putting the rounding into the first income account, Jim2 will use the rounding account instead. This is a 6-XXXX expense account, which would normally have a very low balance. |

|

Happen suggests using the settings indicated by * for companies with strict account reporting periods. Also, make sure to close financial periods and untick Allow post transaction into closed financial periods, under Security settings. |

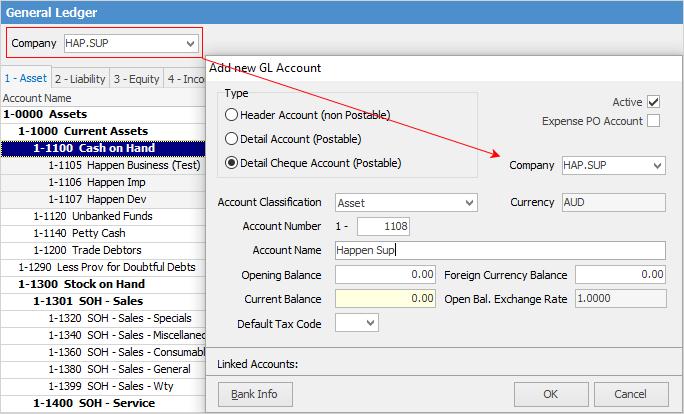

The general ledger is split by company at both a P&L and Balance Sheet levels but can also be viewed across all companies. All general ledger transactions include a Company field in the header, then split as per normal at a P&L level by Branch (if Branches are enabled), Sub-Branch and GL Department.

The general ledger structure must be common across all companies except for Bank Accounts. Bank accounts are flagged as belonging to a specific company and can only be posted to via a transaction related to that company. For example, in the Cheque Book only post between bank accounts related to one company.

When viewing or editing the general ledger it is always in the context of the selected company in the header. In other words, only accounts for the company selected will be shown.

Multi-Currency is fully supported (if licensed), with the exception that all companies must have the same home currency.

Accounts > General Ledger Here, add individual bank accounts, etc. for each company. Note that the Company must be selected in the General Ledger header prior to adding the account.

The general ledger will only show amounts based on the company chosen in the header. Other company accounts will not be shown.

|

General Ledger Opening Balances can only be entered for open Financial years (ie – they cannot be entered for a Financial year that has been closed in Jim2).

Opening balances are entered via the general ledger for the company selected. The actual opening balances are stored in a separate opening balance Journal OBAL for each company where RefNo is the internal company number. So -1 for Company 1, -2 for Company 2, etc. The difference between the opening balance debits and credits is offset in the OBAL journal to the Historical Balance GL Account. The Doc date on the company's related OBAL journal is the starting month for that company.

Implications are as follows: ▪Where one database has not yet closed its first financial period, there is the option to migrate the second company database into the first, keeping the trading history of the first database only. ▪Where the databases have all closed the first financial trading period, opening balances will be entered into the first open period instead..

With all database migrations, all but the transactional history can be brought into the new database. Access to the old databases remains available so users can access transaction history at no additional charge.

|

Accounting periods are common across all companies – the standard current 24-month sliding window of typically current and next financial year. New companies can be added at any time and a start date (Doc Date on the OBAL journal) can be entered. This is regardless of any previous companies being rolled. All companies must be rolled at the same time.

|

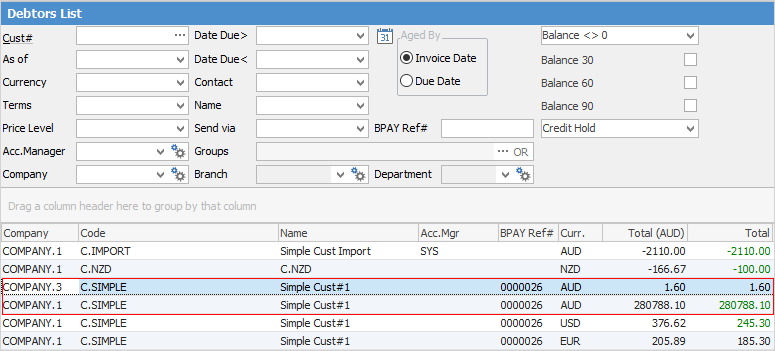

Both Debtors and Creditors are split by company but can be viewed across all companies. When viewing Debtors, for example, the debtor will appear multiple times if they had an outstanding balance in multiple companies. This is similar to how Jim2 splits debtors/creditors by currency.

Statements are sent individually split by customer, company and currency. Credit Hold and Credit Limit are at a global cardfile level, ie. the same for all companies. |

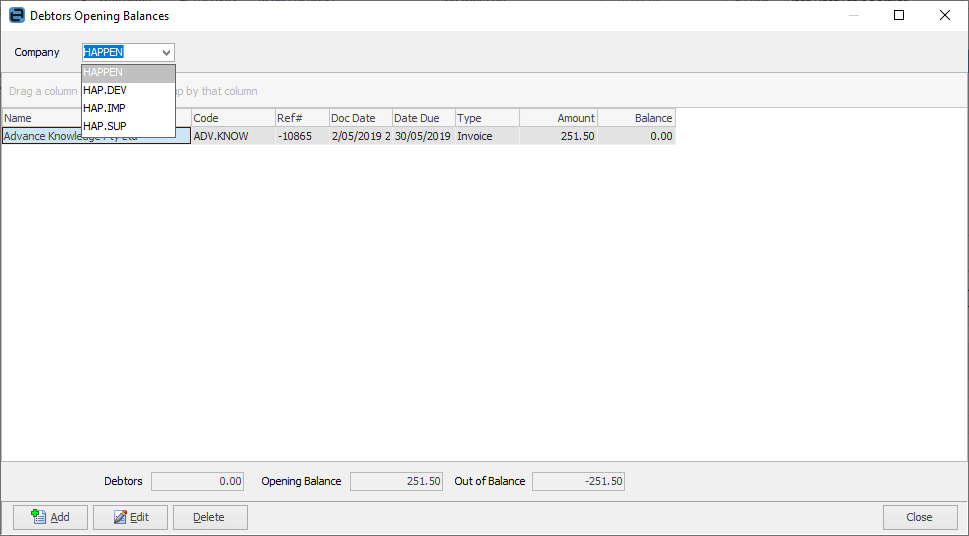

Debtors and Creditors opening balances are added normally, with the exception that Company must now be selected. Once a company has had its first end of financial year roll, balances can no longer be added or edited.

|

Further information

CardFiles, Jobs, Quotes, Purchase Orders

Inter-Company Stock Availability and Usage

Transfer Accounts between Companies