|

The end of financial year process (including checklists) is explained in detail here (including links at the bottom of the page), however there are differences in the Close Financial Year Wizard for multiple companies. The following explains how to use the Close Financial Year Wizard for multiple companies.

The Close Financial Year Wizard can be found on the ribbon under Tools > Close Fin. Year. Jim2 allows up to 2 years to be open, however it will not be possible to trade in a third financial year until the first financial year is closed.

|

|

Jim2Cloud customers will need to contact Happen Business (support@happen.biz) to have us stop the cloud instance prior to closing the financial year.

|

|

|

No other users can be logged on to Jim2 while closing a financial year.

|

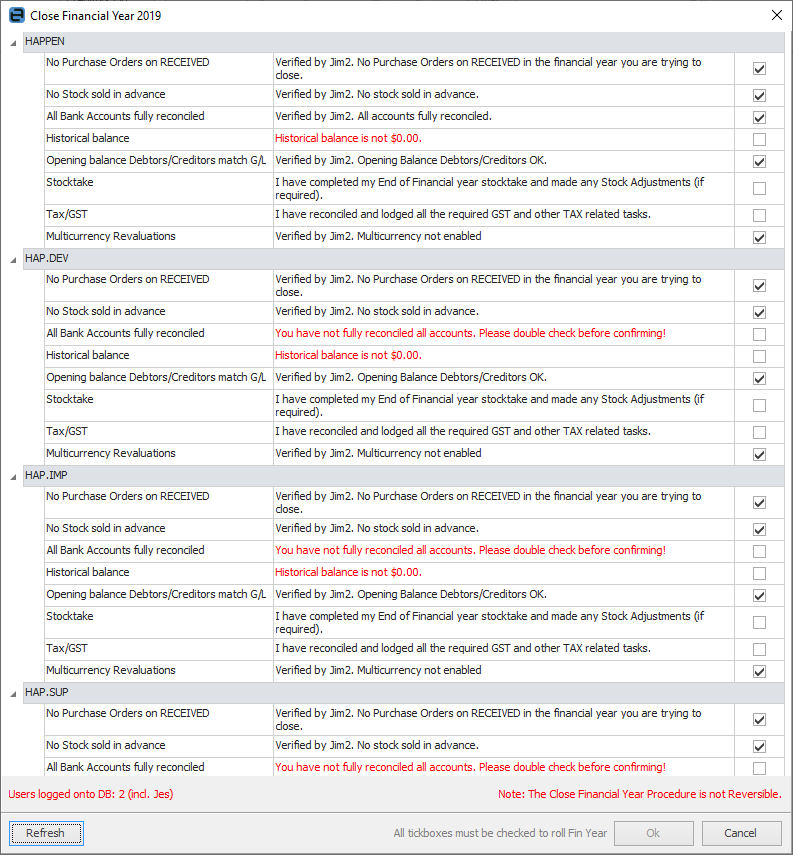

Upon running the Close Financial Year Wizard, the following checklists for each company will appear:

This screen details each company individually. The financial year cannot be closed until all companies have been dealt with.

|

|

|

No Purchase Orders on RECEIVED.

|

The wizard will check the database and automatically set the tick based on the results. All purchase orders that are on the status of Received (where the received date falls within the financial year being closed) must be marked as Finish prior to rolling. This is mandatory.

|

No Stock sold in Advance

|

The wizard will check the database and automatically set the tick based on the results. It is possible that stock may have been sold in advance (perhaps at $0 etc.), so determine if this is correct and base the decision on this. If stock has been sold in advance and the related purchase order or stock adjustment has not been generated, profit will be overstated.

|

All Bank Accounts Fully Reconciled

|

The wizard will check the database and automatically set the tick based on the results. It is possible that there may be general ledger accounts flagged as reconcilable that are not important to the EOFY figures (ie. cheque accounts/credit card accounts that are not used and therefore not reconciled). If satisfied that all relevant accounts have been reconciled, tick this box and continue.

|

Historical Balance

|

The wizard will check the database and automatically set the tick based on the results. The Historical Balance figure in the general ledger must be $0 to be able to close the financial year. This check is mandatory.

|

Opening Balance Debtors/Creditors match General Ledger

|

The wizard will check the database and automatically set the tick based on the results. Opening balance debtors and creditors cannot be out of balance with the figure in the general ledger to be able to close the financial year. This check is mandatory. See here for information on how to clear the Historical Balancing Account.

|

Stocktake

|

Confirm the EOFY stocktake has been completed (if required), along with any stock adjustments, write downs, etc.

|

Tax/GST

|

Confirm all required GST has been reconciled and lodged, as well as other tax-related tasks.

|

Multi-Currency Revaluations

|

If Multi-Currency is enabled in the Jim2 licence key, Multi-Currency revaluations will be included in the EOFY journal.

|

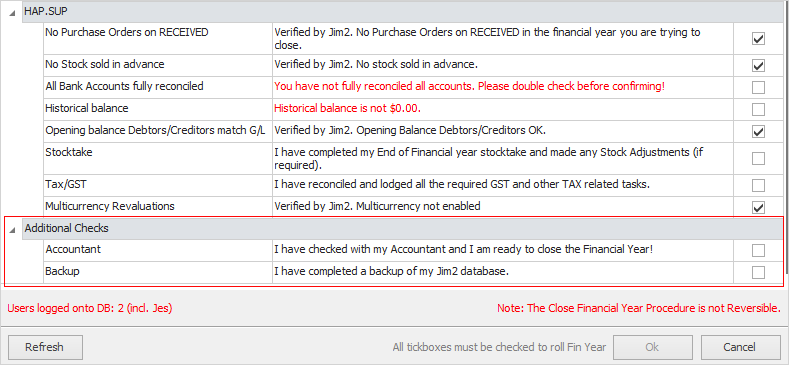

At the bottom of the screen there is one more area that needs to be addressed.

|

|

|

Accountant

|

Confirm checks have been completed with the company's accountant prior to completing the closing the financial year procedure.

|

Backup

|

Confirm a full backup of the Jim2 database has been performed prior to completing the closing the financial year procedure.

Note: The closing the financial year procedure is not reversible.

|

Once all this has been completed, the end of financial year process can be completed – this finalises the year for all companies.

|

|

|

1.After completing all checks, the OK button will be automatically enabled, allowing completion of the close financial year procedure.

2.All Profit & Loss accounts will be adjusted and the corresponding profit (or loss) will be transferred to each company's linked Retained Earnings account. An end of year journal entry will be automatically created, dated the first day of the next financial year.

3.Any closed periods already set in Tools > Options > Accounts > Financial Periods will be cleared and rolled back one year, and the current financial year value will be incremented by one. |

|

|

It is strongly advised to back up the database and test the close financial year in the training database prior to running it in the main (live) database.

|

|

|

|

Jim2Cloud customers will need to contact Happen Business (support@happen.biz) to have us start the cloud instance.

|

Return to Jim2 Configuration Manager to start the Jes Instance. See Jim2 Configuration Manager Tasks for information on how to do this.

Once this is completed in the main database, the financial year has been successfully closed in Jim2 and other users can log on to Jim2 once again.

|

For further assistance, please call Happen Business on 02 9570 4696 or email support@happen.biz

Further information

Multi-Company

Security

Set up and Use Multi-Company

Company Accounts

CardFiles, Jobs, Quotes, Purchase Orders

Inter-Company Stock Availability and Usage

Inter-Company Stock Transfers

Inter-Company Costs Transfer

Transfer Accounts between Companies

Transfer Funds between Companies

Close Financial Year

Business Analysis

Balance Sheet

Profit and Loss

Budgets

|