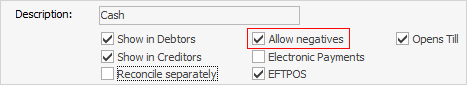

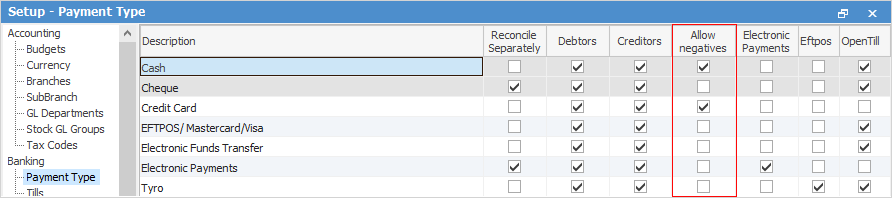

To support the processing of refunds, allowing negative transactions on some payment types needs to be set up. To change payment types to allow for negative transactions, go to Tools > Setups > Banking > Payment Type.

Click Edit, then tick Allow Negatives, then Save.

|

Negatives cannot be allowed on transactions that are related to a bank account, eg. cheque, electronic payments, etc. |

Because payments (via Debtors or the Invoice Payment grid) move to unbanked funds, debtor refunds (negative dollar values) will reduce the total amount available to bank. By setting up certain payment types to allow negatives, process a debtor refund using these payment types. The negative amount will appear in unbanked funds in the Not Banked Deposits list, ready to bank to the nominated account. Example: If unbanked funds of cash for the day is $1040 and -$100, by ticking both transactions, $940 cash will be banked. In this example, $1040 is recorded in debtor payments $100 recorded in debtor refunds.

|

If processing a debtor refund via a Till, nominate which Till the refund is being made from. The negative transaction will appear in that Till Reconciliation. If the refund is being made via any other workstation (ie. not connected to a Till), a Till does not need to be nominated and the negative transaction will go into unbanked funds. There are on-screen prompts to help record these refunds correctly. |

Further information