There a two ways this can be done, with the same end result.

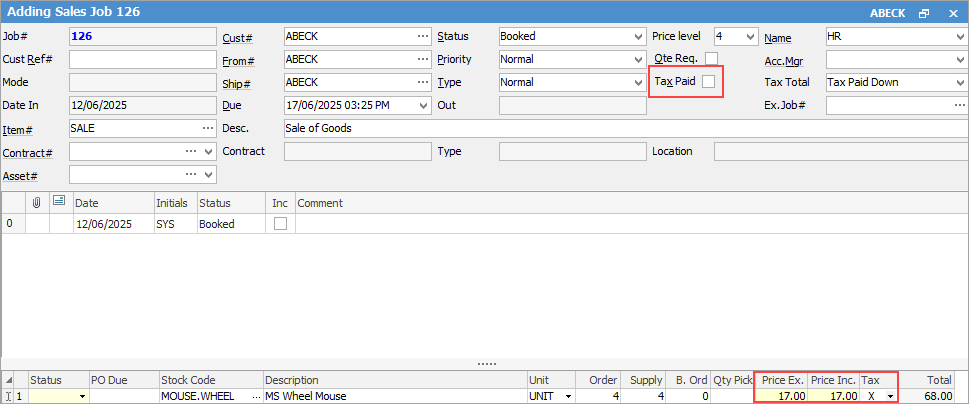

▪Add the stock to a job where Cust# is the recipient of the donation. ▪Ensure that Tax Paid is unticked in the header of the job. ▪Adjust the sell price to equal the current COGS for the stock in question. ▪Change default tax code on sell from G to X (exclude from overall sales reported in BAS).

▪Invoice.

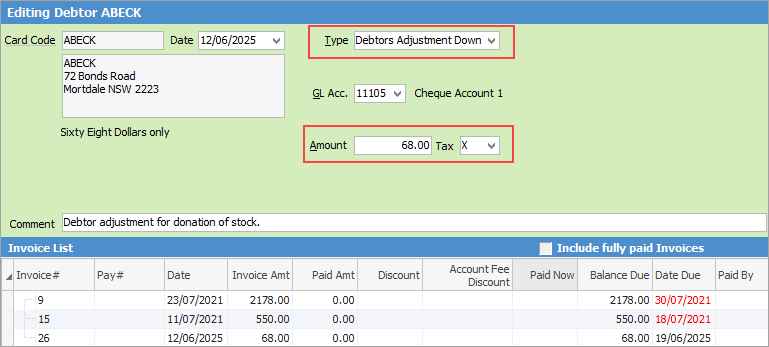

Now your recipient becomes a Debtor. To move the stock COGS to the expense ledger: ▪Open your recipient debtor record. ▪Record a debtor adjustment down against the appropriate expense code (typically 6-XXXX or 1-XXXX for Assets). ▪Make sure tax code on adjustment is also X. ▪You must enter a comment before you can save this.

▪Save.

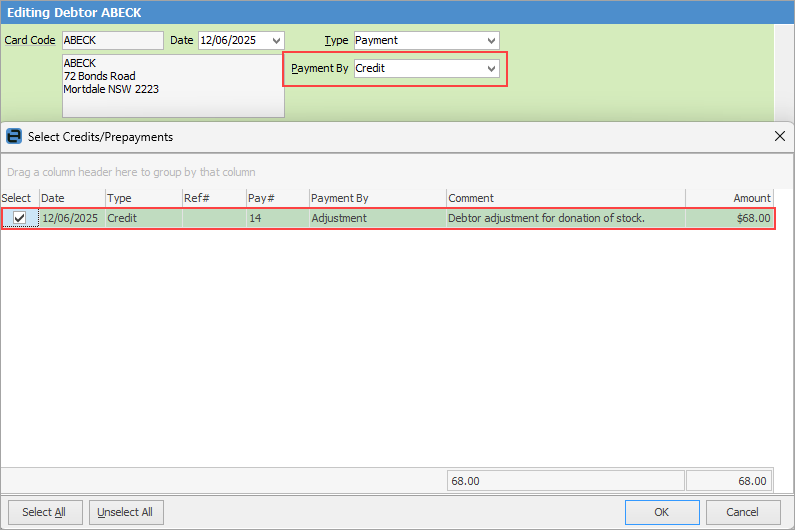

The adjustment down will create a credit that should now be applied to the original invoice.

To apply the credit: ▪Edit the debtor. ▪Select Payment By: Credit. ▪Choose the credit you just created.

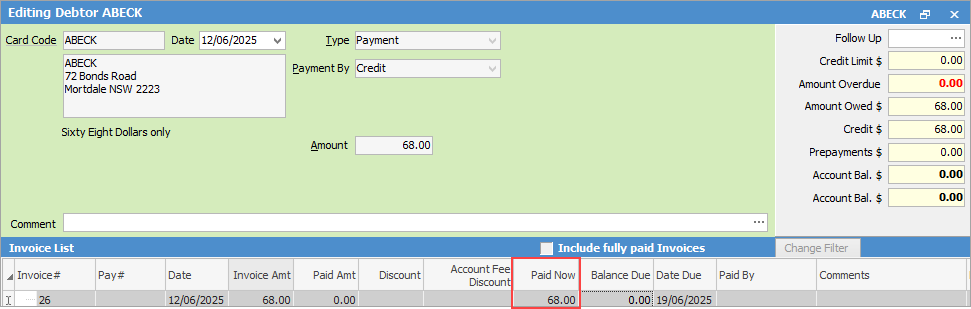

▪Apply in the Paid Now column to clear the Invoice.

▪Save and Close. |

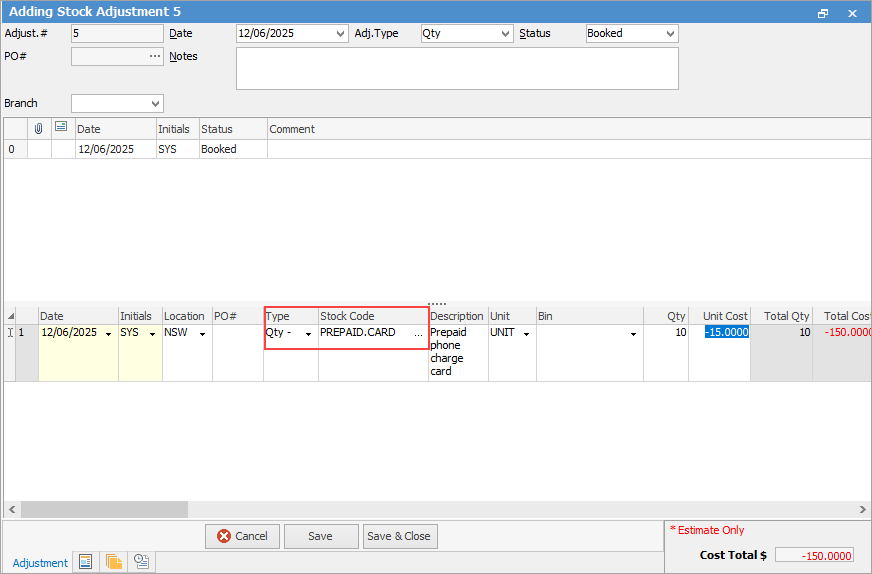

You can use the Stock Adjust Down function to remove the stock from the current stock on hand count, then use a general journal to move the $ total to expenses. ▪Add a stock adjustment. ▪Select QTY - and the correct stock code to reflect which product(s) was used.

▪Finish the stock adjustment.

It then needs to be journalled to the correct expense account/s.

You have the choice at this point to allocate to specific branch, sub-branch or GL departments. ▪Add a General Journal. ▪Select the 5-XXXX Stock Adjustment Account. ▪Enter the total in the Credit column (credit back the Stock Adjustment account) tax code X. ▪Select the 6-XXXX Expense Account. ▪Enter the total in the Debit column (debit the Expense account instead) tax code X. |

Further information