There are times when a customer will pay an invoice and the payment is dishonoured (bounced cheque) by the bank. The debtor's record needs to be altered to remove the payment from the debtor's record.

There are two important things that need addressing when a cheque is dishonoured:

1.The customer now owes the money again.

2.The bank will have made a negative transaction for the cheque amount, and charged a fee.

The cheque was banked and needs to be reconciled as normal. Deleting the payment doesn't solve the problem because the original amount is going to appear on the bank statement. Create the negative transaction in Jim2 to match what will appear on the actual bank statement to be able to reconcile correctly. Create a transaction for the fee that will appear on the bank statement and add a debtors adjustment to show that they do owe that money again (along with the bank dishonour fee).

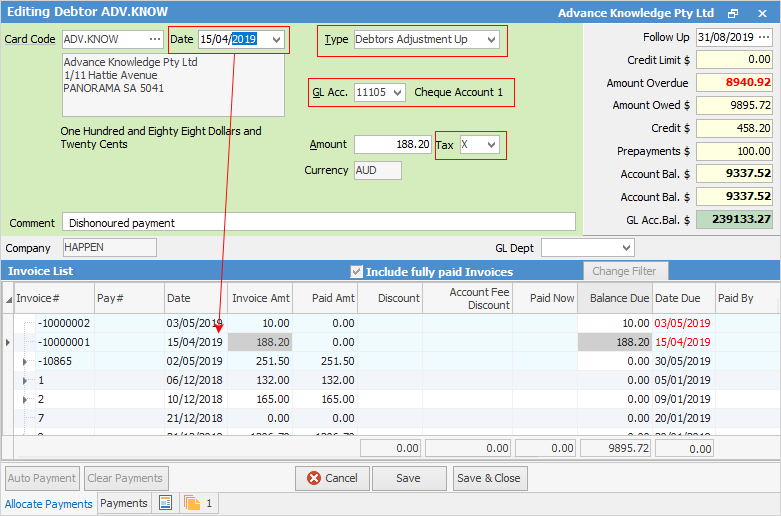

1.On the ribbon, go to the debtor's record. Add a debtors adjustment up for the amount of the cheque that was dishonoured.

|

Some letters in the field names within the header are underlined, eg. Type. Using Alt+ the underlined letter will jump to the field beside that heading. |

It needs to be allocated to the same general ledger account for the bank account it was banked to – use that general ledger code in the Account field and select a tax code of X, as no GST applies (it is already in the invoicing and doesn't need to be repeated here). Remember to adjust the transaction date to match the bank statement. Saving this transaction will do two things:

i.the debtor record will now show an amount outstanding to deal with as per any normal debtor transaction

ii.the bank account selected for the debtors adjustment will now show a negative figure to reconcile the dishonour against.

|

This transaction does not need to be moved from Jim2 Banking – it goes straight to the Bank Reconciliation. |

2.The bank will have charged a dishonour fee. Add this when doing the normal Jim2 Bank Reconciliation using the Bank button, then selecting the general ledger account that would normally be used (eg. 6XXXX Miscellaneous Bank Charges). Check with the bank whether a tax applies to this fee – some banks include it in the fee, whilst others don't bother. Make sure to use the right tax code for the transaction.

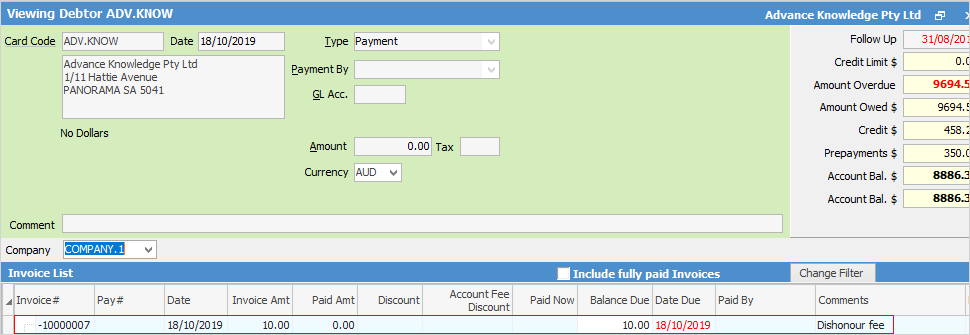

3.To on-charge the dishonour fee to the customer, add this final step to above. Add a debtors adjustment up for the dishonour amount, allocating it to the general ledger account normally used (eg. 6XXXX Miscellaneous Bank Fees). As above, check the tax situation on the fee. When saved, this adjustment will show the additional amount in the debtor's record. When they make payment against this amount, the funds will be correctly allocated back to the 6XXXX general ledger account, effectively showing that the customer has paid this amount, and it has not been an expense incurred to the business.

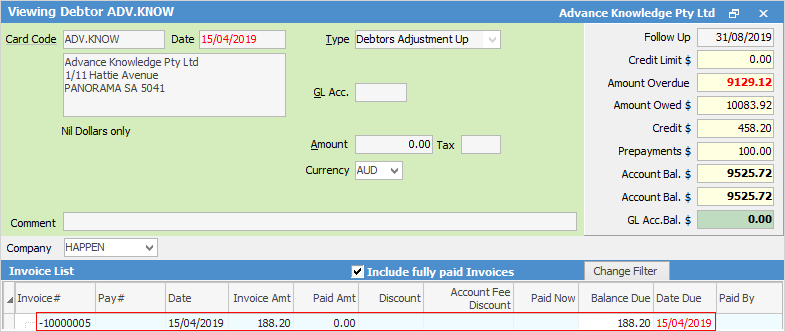

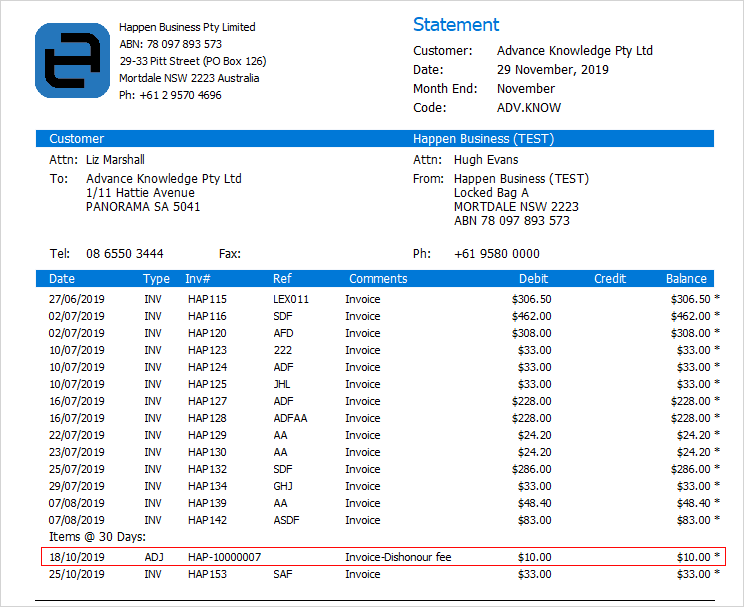

By handling the dishonour this way, the debtor has an outstanding amount (or amounts) that does not use the normal invoice or RFC numbering.

It will show clearly in the debtor transaction reports, and also on their debtor statement.

When they make payment for this and any other transactions, allocate the new payment as usual.

How to

Create a Recurring Cheque Entry