The types of transactions which flow through the cheque book, but are not added through this function, are:

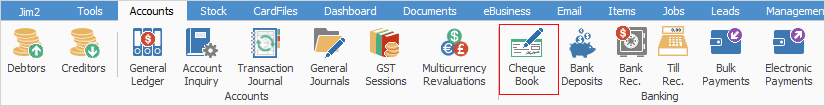

To access the cheque book:

▪in the Nav Tree, right click on Accounts and select Cheque Book

or

▪on the ribbon, go to Accounts > Cheque Book.

The cheque book feature in Jim2 is used to record payments to and deposits from bank accounts, and keep track of next available cheque numbers. There are certain transactions that relate directly to the cheque book but are not entered through this feature – they are creditors, debtors cheques, bank fees and bank interest entries.

|

Creditor and debtor payments must be entered via Creditors or Debtors respectively, not via the cheque book. A cheque entered via the cheque book will not appear in the debtor/creditor records. Examples of cheques written from the cheque book would be payments to the ATO, transferring from one bank account to another, etc. |

The cheque book is divided into the following information areas that will provide a complete detailed record of:

▪the Cheque Book list, providing the option to select one or a group of cheque book entries

▪single cheque or deposit information from the cheque book form

▪the details of the cheque via the Cheque Details grid and the Cheque footer information.

|

It is very important to use appropriate security levels when users are accessing and/or editing information that directly affects the company financial records. |

|

A cheque date cannot be changed. If it is a creditor's cheque incorrectly entered on the wrong date, unallocate the payment, then cancel the cheque in order to re-enter the cheque on the correct date. |

Further information

Other Cheque Book Transactions

How to

Create a Recurring Cheque Entry

Dealing with Dishonoured Cheques