Payments being received outside the normal sales/debtor payment cycle are dealt with using the Bank Deposits function (via Cheque Book). All sales/debtor payments move through unbanked funds, then banking sessions are used to move the money into the specified bank account. An example of this type would be commission income.

Previously, a deposit moved straight through to Bank Reconciliation, bypassing bank deposits, therefore not being part of the banking session report.

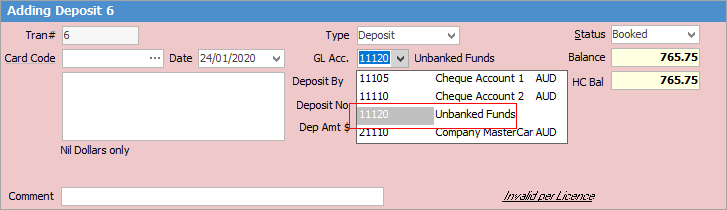

When making a deposit into Unbanked Funds, it will appear in the banking list (just like a debtor payment), and will be picked up by the banking report.

|

Some letters in the field names within the header are underlined, eg. Status. Using Alt+ the underlined letter will jump to the field beside that heading. |

|

To lower COGS on stock where a dealer rebate or price protection is received, rather than record income, use negative expense orders linked to purchase orders. Then use Payment – Refund in the creditor record. The option to refund into unbanked funds is available to match the Deposit function. |

Further information

Grouping/Sorting in Banking Sessions

How to