From time to time, a payment is received where the customer to allocate it to is not known.

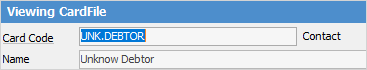

First, set up a debtor cardfile (card code UNK.DEBTOR, or similar) to allocate these payments to until the correct customer can be located.

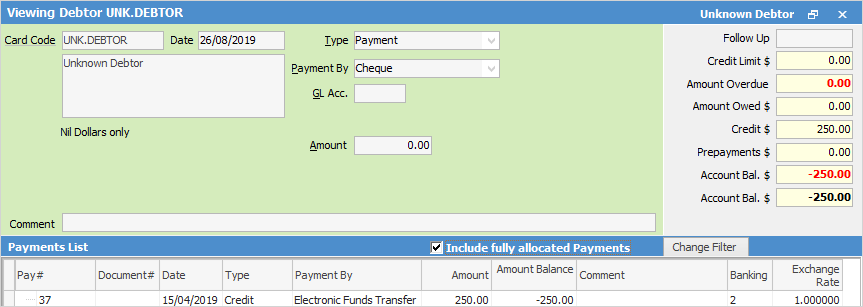

Add the payment against the unknown debtor's account via the debtor form – this account will now show a credit balance.

Once the correct customer is established, use the debtor adjustment functionality to move the balance from the unknown debtor account to the correct debtor account.

1.From the unknown account:

Add a debtor's adjustment up, tax code X, GL Account 4-XXXX debtor/creditor adjustments. This will produce an outstanding value.

2.From the correct debtor account:

Add a debtor's adjustment down, tax code X, GL Account 4-XXXX debtor/creditor adjustments. This will produce a credit. Allocate the credit to the outstanding invoice.

How to