Every stock record in the Jim2 database is assigned to a Stock GL Group. Stock GL Groups are the mechanism that Jim2 uses to record all transactions relating to stock.

Non depleting and journal stock require GL Groups that have income and COGS accounts (they may sometimes utilise liability accounts).

Where a non depleting or journal stock is part of a GL Group that has been set up for depleting stock, a separate GL Group is not necessary if the standard groups are suitable.

Labour stock codes only require an income account (as they are only sold). These codes usually require a separate GL Group (Labour) as the general ledger reporting is typically not the same for income as any other GL Group.

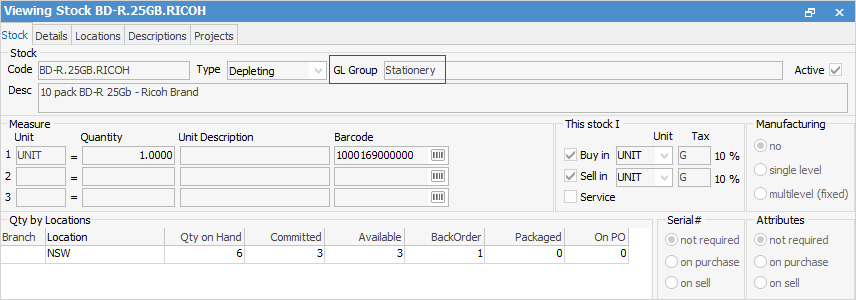

Stock GL group example

When purchasing stock on a purchase order, once the status of the purchase order is Finish the value of the stock on that purchase order will automatically flow to the SOH asset account assigned to the Stock GL Group that the stock belongs to. Similarly, when selling that stock, the SOH account will reduce by the amount of the stock sold, the COGS account will increase by that amount and the income account will record income received for that stock.

In the example above, the stock BD-R.25GB.RICOH belongs to the GL Group Stationery.

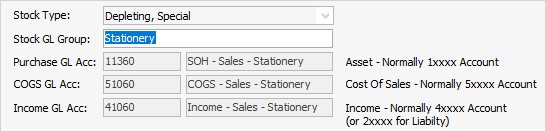

The Stock GL Group Setup for Stationery shows that it is linked to the following accounts:

▪SOH – Sales – Stationery

▪COGS – Sales – Stationery

▪Income – Sales – Stationery

Therefore, all transactions that occur relating to this stock will be recorded in those general ledger accounts.

|

Most details of the Stock GL Group assigned to a stock code cannot be changed once there are transactions recorded against that stock. The exception is the group name itself, which can be changed via Tools > Setups > Accounting > Stock GL Groups. |

Further information