There may be a job set up for a customer who needs to pay a deposit towards that job.

It is best to handle invoicing the deposit separately, ie. on a separate job/invoice.

1.Set up a new general ledger account for customer deposits. This may be something to discuss with the company accountant first.

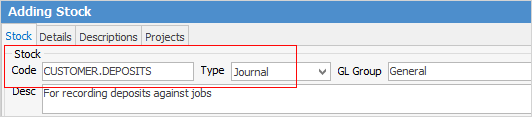

2.Add a new stock record, Type = Journal, that points to the customer deposits general ledger account.

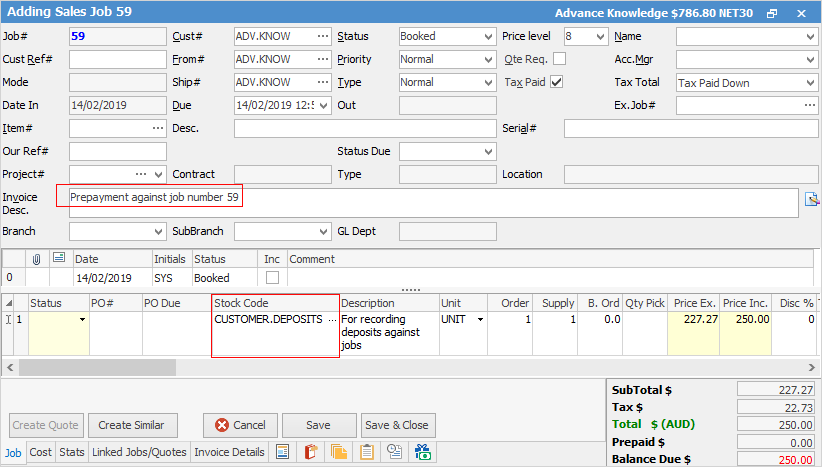

3.Add a job and enter the new customer deposit journal stock code, then bill the customer. Add any required information in the Invoice Desc. field.

4.Invoice the job.

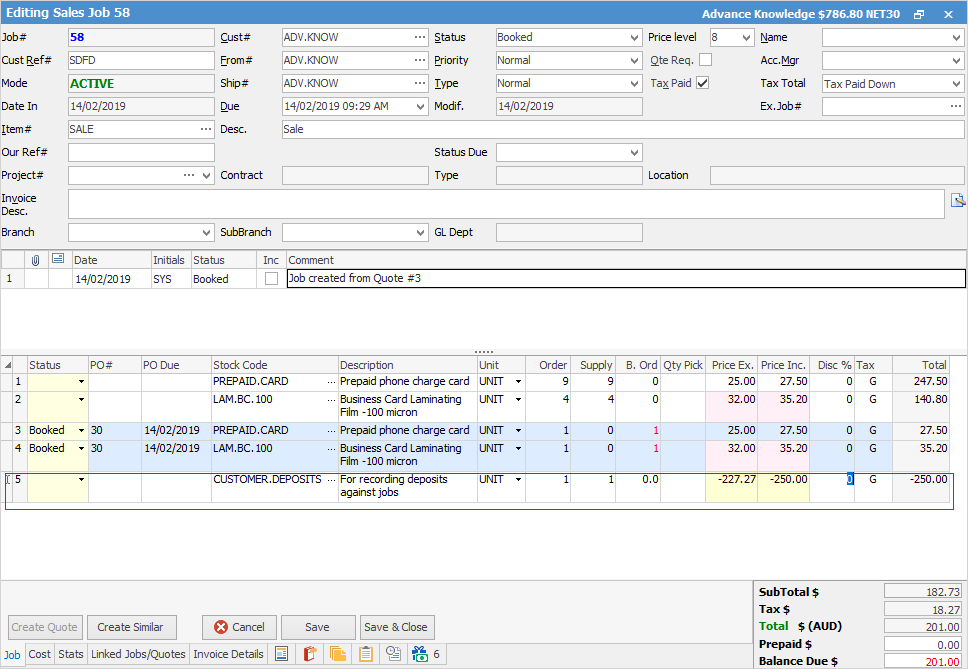

5.This same stock code should then be added to the job where the actual work is being performed (and parts are being used) as a negative value to pull the deposit value back to $0 in the general ledger. The actual job/invoice for the special stock is what ultimately ends up reporting in the general ledger.