The following information relates to both debtor and creditor bad debts.

Payment by bad debt should only be used when there is no chance of ever recovering the stock back from a sale, and no chance of ever recovering the money from the customer, or simply a customer whose debt you want to write off.

Rather than paying the outstanding invoices by cheque or credit card, etc., you nominate that they are effectively being paid by bad debt.

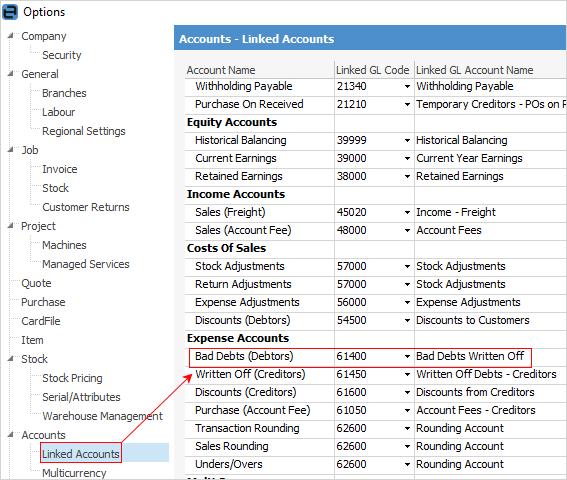

Jim2 moves the total value of the bad debt to the correct linked GL account, and moves the monetary value of the invoices involved to the BAS. When using the bad debts as a payment method in debtors, Jim2 includes the credit on the GST in the entry.

|

Note: if the amount you wish to clear originated from an opening balance, Jim2 will not take up a credit for GST, as there was no recording of GST in the opening balance entry. |

To write off a bad debt, follow the steps below.

|

You can write off single, part or multiple purchases (or invoices) at one time if required. |

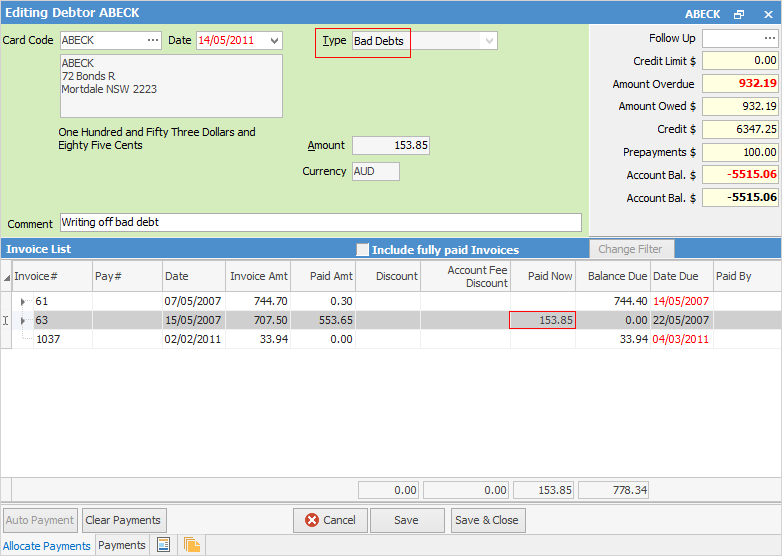

1.Go to Accounts > Debtors (or Creditors) and bring into view the record you wish to write off.

2.Click Edit.

3.Enter the required date, or use the default one already shown (today).

4.Select Type Bad Debts. The GL Acc., Payment By and Cheque No fields are not displayed for this type of transaction.

5.To enter the amount, select the Paid Now field of the purchase (or invoice) line (this will remove any discounts and/or account fees), then enter the amount required to be written off. If necessary, repeat this for any other lines. The Amount field in the form header will be updated to show the total amount that is being written off.

6.You must enter a comment when entering a bad debt. You will not be able to save the transaction if you haven't entered one.

7.Click Save.

|

The Payment By field is not shown in the form header, as it isn't required when entering bad debts. The Amount field in the form header is not editable, and is updated as each amount is entered into the Paid Now field. |

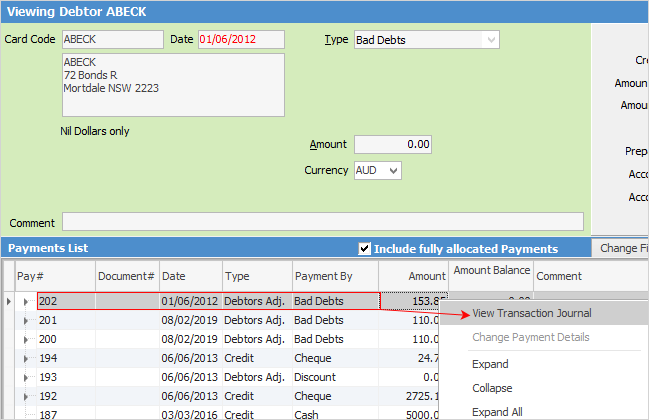

To view information relating to the bad debt, you can right click on the bad debt and select View Transaction Journal:

This will show all information relating to accounts used.

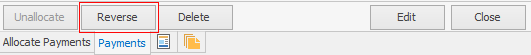

Reverse a Bad Debt

To reverse a bad debt, follow these steps:

1.Do not go into Edit mode.

2.Select the Payments tab at the foot of the debtor's record.

3.Locate the bad debt that you need to reverse.

4.Click Reverse.

5.You will be prompted with a message screen to confirm this action.

6.Click Yes.

7.Now the bad debt will not be shown, and the/purchase/invoice balance will have been amended.

|

You must be in View mode in order to reverse a bad debt. |

|

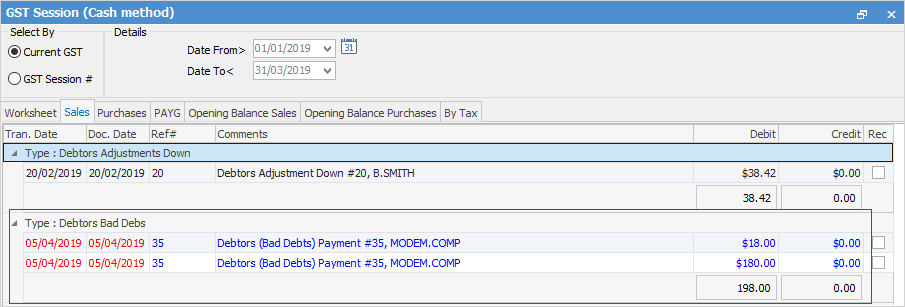

If you want to write off invoices that were brought into Jim2 as Debtor Opening Balance invoices, you will need to use a Debtor Adjustment Down, post to the bad debts GL accounts 6-XXXX, and use tax code G, as there is no GST flagged on these invoices. The Bad Debts function automatically reverses the GST on invoices generated in Jim2.

There should be no stock being returned to prompt a bad debt. You are recording the fact that no payment will ever be received for a legitimate supply invoice. |

Further information: