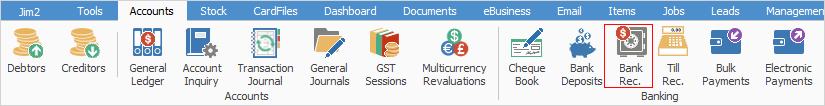

On the ribbon, go to Accounts > Bank Rec.

The bank reconciliation function in Jim2 ensures that the record of transactions for a particular bank account matches those on the statement(s) that are received from the bank. Each time a deposit is made into a bank account, a cheque is written, a debit card is used or a withdrawal is made from a bank account, Jim2 keeps a record of that transaction.

Bank reconciliation involves making sure that the record of account transactions matches that of the bank. Bank reconciliation, among other things, helps to flag any bank errors or fraudulent transactions on the account.

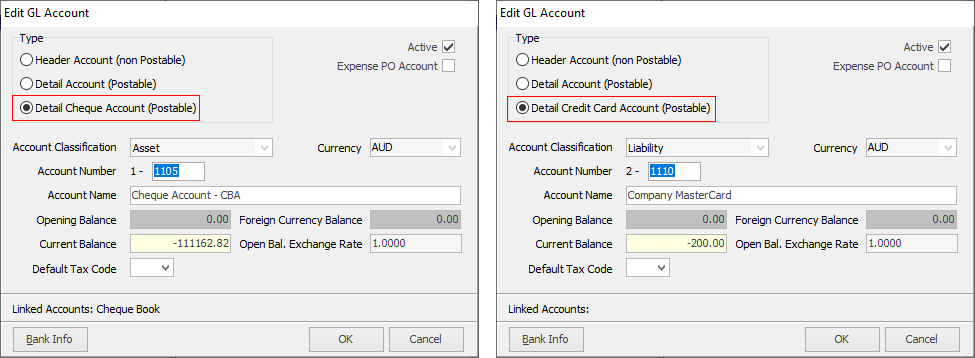

Bank accounts include asset accounts that are Type – Cheque, and liability accounts that are Type – Credit Card:

Sessions can be exported in XLSX format. To export or print a session, right click in the grid and select Export, Print or Print Preview from the pop–up menu.

Jim2 Bank Reconciliation is divided into the following specific information areas that will provide a complete detailed record of:

▪the Bank Reconciliation header – holding the bank account information

▪bank Reconciliation Details Grid – listing all withdrawals and deposits

▪the functions included in the Bank Reconciliation via the Bank Reconciliation footer

▪bank Entries through the Bank Reconciliation screen – bank fees and interest.

|

It is important to use appropriate security levels when users are accessing and/or editing information that directly affects the company's financial records. |

Further information

Bank Reconciliation Details Grid

Enter Initial Bank Reconciliation

Locate a Previous Bank Reconciliation

Make Entries Through Bank Reconciliation