You cannot post to the Current Year Earnings account as it is a calculated balance showing the result of the P&L.

When you close a financial year, the balance in Current Year Earnings rolls up into Retained Earnings, however you can journal to the Retained Earnings account if your accountant needs to do a historical adjustment.

We generally advise against this, but the net result would be the same once you close the financial year. |

Jim2 allows for having only two financial years open concurrently. If the previous financial year was not closed in Jim2 before the last day of this financial year, it must be performed before Jim2 will allow you to proceed. For example, if it is 1 July 2018, the 2017 financial year must be closed off at this time. Go to Tools > Options > Accounts where which financial year is still open can be seen. |

Jes must be stopped before the financial year can be closed. Furthermore, only one user can be logged on to Jim2 (the person who is closing the financial year). Go to Jim2 (top left in the file menu), then Logged Users to see who is logged on to Jim2. Jes and yourself should be the only ones in the list. Jes will appear as the user sys with the entire line greyed out. See the company system administrator for assistance with stopping Jes if unsure. |

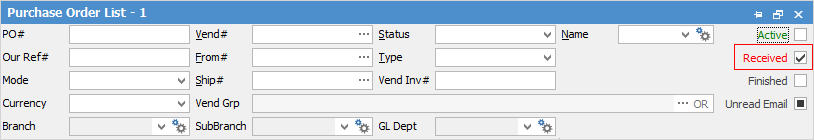

On the ribbon, go to Purchases > Create PO List with only Received ticked at the top right of the list, and identify those with a vendor invoice date in the financial year to be closed. These purchase orders need to be finished before closing the financial year, but they should also be investigated as to why they are still on a status of Received.

|

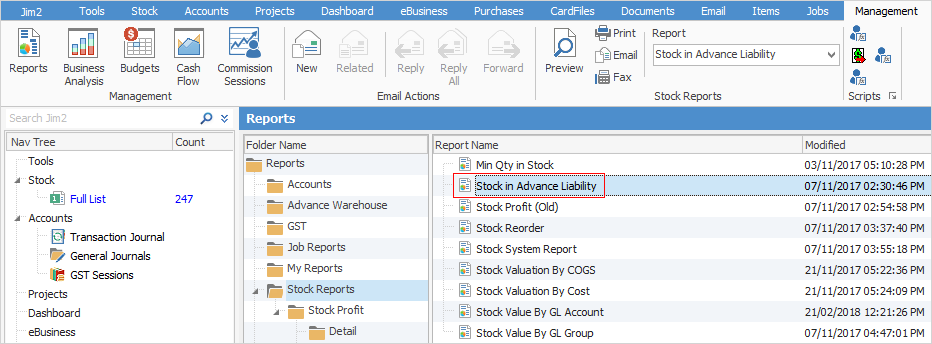

On the ribbon, go to Management > Reports > Stock Reports and run the Stock in Advance Liability report up to the end of the financial year being closed.

The report is in two sections: 1.The first section lists stock that is actually sold in advance (ie. Jim2 does not have any of this stock, however the customer was invoiced anyway). 2.The second section lists stock that is sold from purchase orders on Received, which is okay, but the purchase orders must be on Finish.

Print the report if there is stock sold in advance, as this will need to be investigated further. There might be purchase orders in Jim2 for this stock which have not yet been finished or received. The stock might not have been entirely correct when the company changed over to Jim2, so a stock adjustment may need to be added to correct what was sold in advance. This should be dated 30/06/yyyy, where yyyy is the year being closed (for New Zealand the date would be 31/03/yyyy).

|

Jim2 does not differentiate which year the stock was sold in advance, so it warns that stock is sold in advance in the current year as well as previous years.

If there is definitely no stock sold in advance for the year being closed, tick the box to override the warning. |

Review the bank and credit card accounts that are set up in the general ledger, as there may be some old accounts that are no longer used. If confident that all active accounts have been reconciled past the end of the year being closed, tick the box to override the warning. |

The historical balancing account indicates that the general ledger account opening balance debits and credits are out of balance by this amount. The historical balancing account must be cleared by correcting the general ledger opening balances. To find out how to do this, refer to How to Clear the Historical Balancing Account. |

There are two opening balances on the trade debtors and trade creditors general ledger control accounts. They are the opening balances that have been manually entered against the general ledger accounts (which should match the closing balance from the previous system) and the calculated opening balance (which is the total of all the individual entries against debtors and creditors). These figures must match before closing the first financial year in Jim2. If these figures do not agree, the difference is impacting on the historical balancing account. Refer to the topic How to Clear the Historical Balancing Account. |

It is important to make a backup of the Jim2 database immediately before closing a financial year. This is because Jim2 is a live system, meaning some areas of Jim2 cannot be backdated. Keep this as an archive copy in case there is a need to refer back to it. |

The Happen Support team is available to assist, by calling 02 9570 4696, or emailing support@happen.biz.

Further information

Accountants End of Year Adjustments

EOFY Process for NZ Current Year