June 1 ▪Review all Jim2 lists. Check all lists daily, eg. job list, quote list. It is also good practice to follow the end of month procedures on a regular basis. ▪Commence debtors clean up: –chase up outstanding debts, and collect the payments. Record the payments in Jim2 –write off old debts not expected to be collected (debtor adjustment down or bad debt) –write off/adjust rounding and other errors which have left debtors owing small amounts (eg. $0.01) (debtor adjustment down or discount) –apply all unallocated prepayments and credits.

▪Commence creditors clean-up: –finalise any outstanding issues with vendors, including returns to vendor –allocate all vendor credits –review all vendor payments due. Record vendor payments in Jim2, including direct debit, EFTPOS and credit cards. ▪Petty Cash: –reconcile petty cash account and reimburse the float. ▪Banking: –bank all received money –complete all banking sessions, and fix all problems with unbanked funds.

June 23-30 ▪Ensure any stock sold in advance has been back-filled. ▪Perform and finish stocktake(s). ▪Finish all stock adjustments.

June 30 ▪Final stock valuation. ▪Final Multi-Currency valuation (if applicable). ▪Archive the Jim2 database as at June 30. Ensure a backup of the Accounts Only database is performed before trade on July 1 (last activity on June 30).

▪Print Reports:

–Stock Valuation by COGS at close of business on June 30

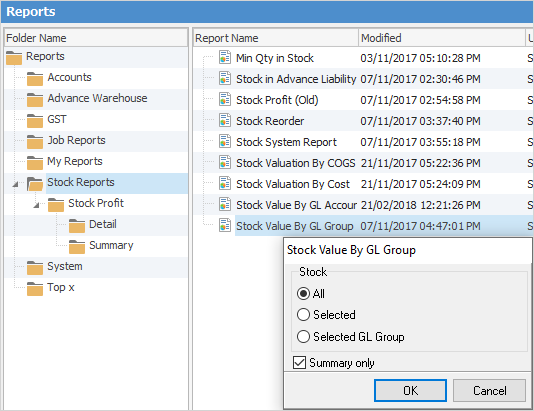

–Stock Value by GL Group (Summary) report, to ensure the stock value balances with the general ledger  –Detailed Aged Receivables (as soon as all June transactions are complete) –Detailed Aged Payables (as soon as all June transactions are complete)

July 1-15 ▪Reconcile all bank, credit card and petty cash accounts. ▪Complete the June GST session. |

▪Resolve any old entries that are still outstanding, as they may be impacting on debtor and creditor records. ▪Tax/GST compliance has been completed and lodged. ▪All Multi-Currency valuations have been completed (if applicable). ▪Ensure that all adjusting general journals issued by the company's accountant have been finished. ▪Ensure that any previous financial years have been closed off. Jim2 allows for running two financial years concurrently, however no more. |

Further information

Accountants End of Year Adjustments

EOFY Process for NZ Current Year