Your business may purchase a capital asset, such as a vehicle, and take out finance or a loan to pay for it. The setup to reflect this in Jim2 is as follows:

|

We suggest you discuss asset purchases with your accountant prior to recording in Jim2. |

Setting up the General Ledger Accounts

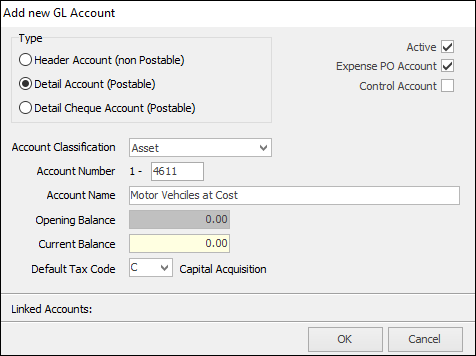

1.Go to Accounts > General Ledger > Assets, and locate a relevant GL account for the capital asset and ensure that it is ticked as an Expense PO account with a default tax code of C.

If there is not a suitable GL asset account, then add a new one.

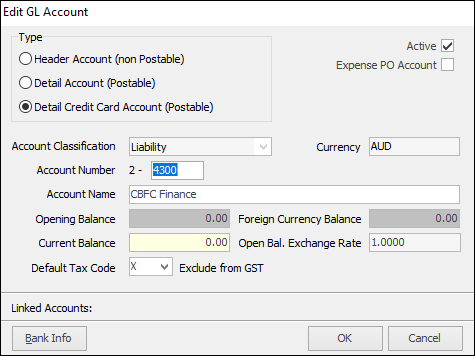

2.Go to Accounts > General Ledger > Liability, and add a new GL account for the finance/loan under the Long Term Liabilities section.

Select Type = Detailed Credit Card Postable (so you can do bank reconciliations on this account if required), with the default tax code set to X (no GST on payments to the account).

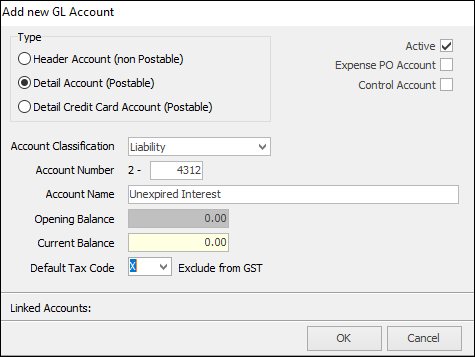

3.Go to Accounts > General Ledger > Liabilities, and add a new GL account for the unexpired interest for the finance/loan under the Long Term Liabilities section.

Select Type = Detail Account, with the default tax code set to X (no GST on transactions to the account).

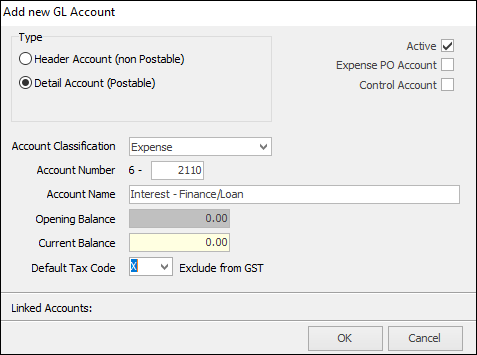

4.Go to Accounts > General Ledger > Expenses, and add a new GL account for the interest on the finance/loan with a default tax code of X.

Close the general ledger.

Adding the Vendors

Add a card file for the vendor where you purchased the vehicle from, and for the finance provider.

Recording the Purchase

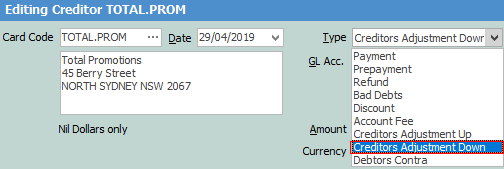

Add an expense PO for the purchase of the vehicle from the vendor, using tax code C. After finishing the expense PO, open the creditor record and click Edit. Select Type – Payment and change to Type – Creditors Adjustment Down.

Select the GL account for the new 2-XXXX Finance/Loan account for the full amount owing, using tax code X.

Add a comment Move to Finance/Loan Account, and save. Add a Type – Payment, select Payment By – CREDIT, apply the adjustment credit to the invoice, and save.

You have now moved the amount owed from the creditor account to the finance/loan liability account.

Recording the Unexpired Interest

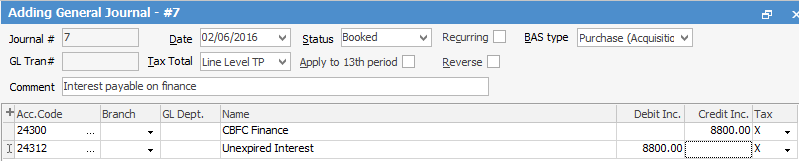

Add a general journal to increase the 2-xxxx liability to include the interest component payable on the finance/loan.

Recording the Monthly Repayments and Monthly Interest Expense

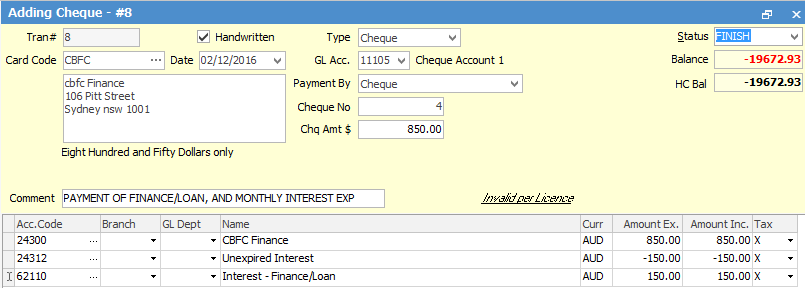

Go to Accounts > Cheque Book, and click Add. Select the card file for the loan provider. Enter the total amount of the repayment. If you have details of the monthly interest components, you can enter the amount of interest that is being expensed as per the example below.

|

If you do not have all the information, or are unsure about how to record the interest, we suggest you discuss this with your accountant before you start recording the payments. |

Further information: