Below is an explanation of how to write off a fixed asset (ie.plant & equipment).

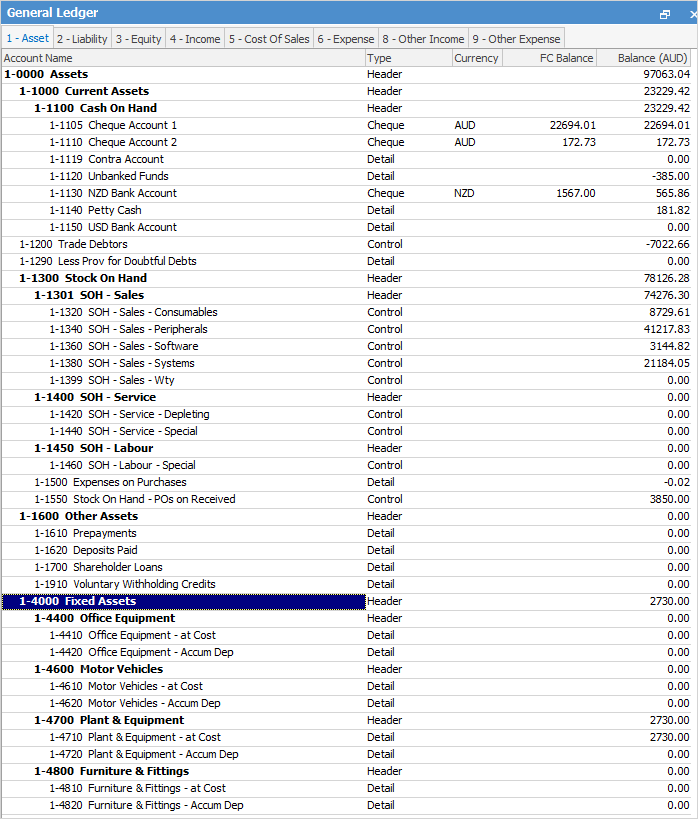

Typically, the general ledger fixed assets are grouped together into categories like Plant & Equipment, Computers, etc. The Jim2 General Ledger will show the value of this equipment.

Most businesses keep the detail of what equipment makes up this value with their external accountant or on a spreadsheet.

Most fixed assets accounts have an associated accumulated depreciation account which tracks the value written down.

You first first need to find out the full value of the plant & equipment as well as the associated depreciation. For example Forklift cost $2,730 in 2013, and for the past 5 years was been depreciated $5 a year, so accumulated depreciation is also $2,500.

In this example you would create a general journal as follows

▪Debit Accum Depr $2,500

▪Credit Fixed Asset $2,500.

If the depreciation is less than the value, a third account will be needed. Using example above $2,500 in 2015, depreciated at $500 per year so accumulated depreciation is $1,000.

So journal for this example would be

▪Debit Accum Depr $1,000

▪Debit Equipment Exp $1,500

▪Credit Fixed Asset $2,500.

Further information:

Move Stock from Depleting to Asset