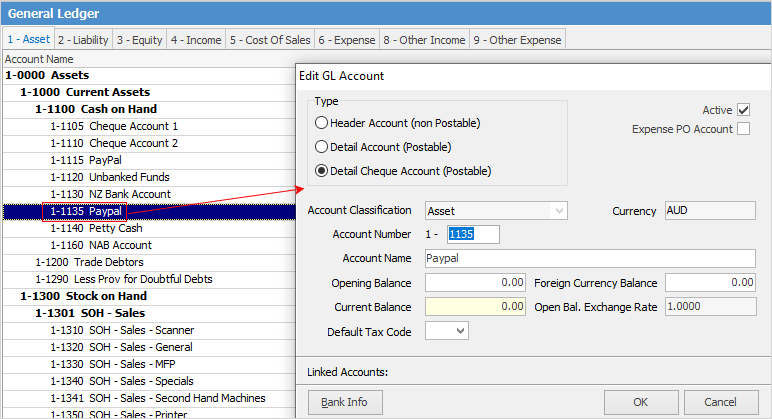

1.Add a new GL asset account called Paypal and select Type Detail Cheque Account Postable.

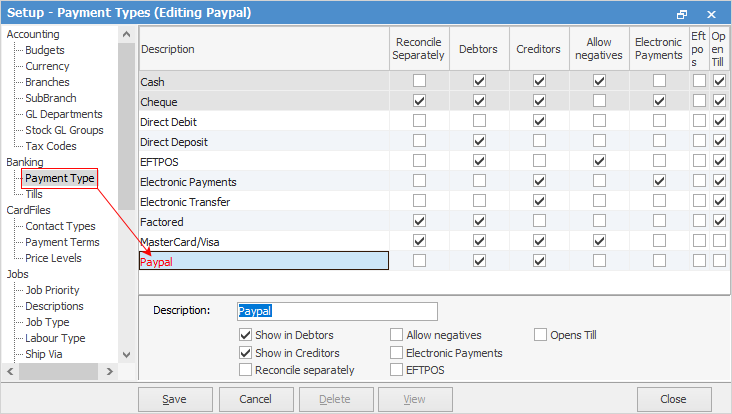

2.On the ribbon go to Tools > Setups > Payment Types and add Paypal.

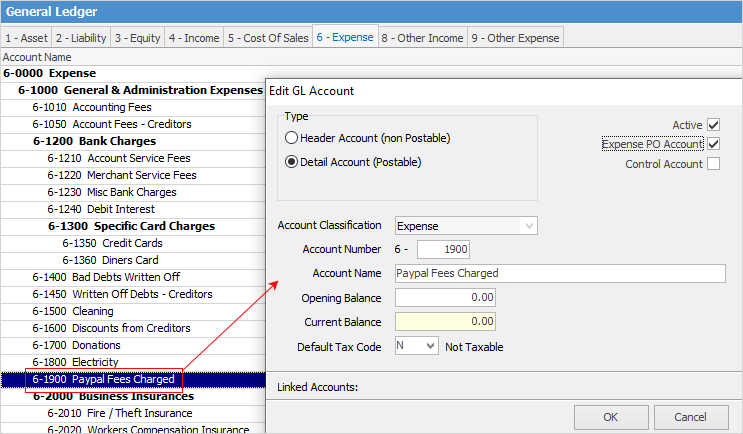

3.Set up a 6-XXXX expense account for any Paypal fees charged, using tax code N, as these charges are a reportable expense with no GST.

4.You can also set up a Paypal vendor card file.

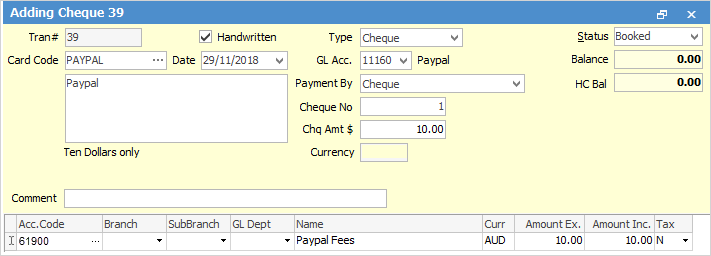

The simplest way to handle Paypal fees is to:

1.Receive the full amount, including the Paypal fee, against the debtor.

2.Make a cheque entry from the Paypal account to the 6-XXX Paypal fees account.

3.If required, you can transfer the rest of the amount from the Paypal account to another bank account.

Other types this refers to are epay, bartercard, integrapay, etc.

Further information: