|

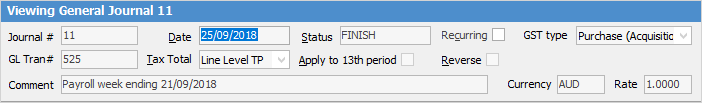

Tax Total, Apply to 13th period, Reverse, Recurring, GST type – selecting Alt+ the underlined letter will take you directly to that field. |

The General Journal header fields are explained below:

Field |

Explanation |

|---|---|

Journal # |

The general journal number – created by Jim2. |

GLTran# |

The general ledger transaction number used in the transaction journal – created by Jim2. |

Date |

The date of the entry – the document date you require, not the transaction date. |

Tax Total |

How you want to calculate your tax value – Tax Free Up or Tax Paid Down (ex GST or inc GST). |

Status |

When adding a general journal, the default status is Booked. A GJ has no effect on the general ledger until the status is changed to Finish. |

Apply the 13th period |

Tick this box if you want an entry to be allocated to the 13th Period. |

Recurring |

Tick this box if you want to flag this general journal as a recurring entry. |

Reverse |

Tick this box if you want the ability to reverse the general journal at a later date. |

GST type |

Sale (supply) or Purchase (acquisition) – You must select the GST type for the general journal. It is important you understand the transaction you are entering, and where it reports on the BAS. The Purchase GST type is used when entering transactions where you are spending money. Sale GST type is used when recording money received. For further information on this, seek advice from your accountant. |

Comment |

Enter a comment relative to this general journal – any comment entered will be displayed in the Comment field in the grid of an Account Inquiry and in the header of the entry in the Transaction Journal. |

|

You will see two dates in many areas of Jim2: ▪The Document date is the date that the transaction will impact on your general ledger accounts. ▪The Transaction date is the date you entered the transaction into Jim2. |

Further information: