|

The GST reports found under Management Reports pre-date the introduction of GST Sessions, and were designed for accrual method only. All transactions are automatically used to calculate the liability, and do not reconcile transactions. These legacy GST reports have been renamed as GST [reportname] (old). Happen Business advises using GST Sessions to calculate GST liability and produce reports. |

There are a number of reports that can be run from a GST session.

From the Worksheet Tab, you can run the GST Calculation Worksheet report to obtain the summary results of the GST Session:

This will produce a full report of the Calculation Sheet. The GST Summary report will list a summary of the information on the Worksheet.

From the By Tax tab, you can run the GST Detailed report, which can be printed or saved as an Excel file. This is done by right clicking in the grid and selecting Export Data.The Excel file will display the detailed transactions exactly as they are reporting in the worksheet.

Tick Partly reconciled only to view only those entries that have been reconciled to date.

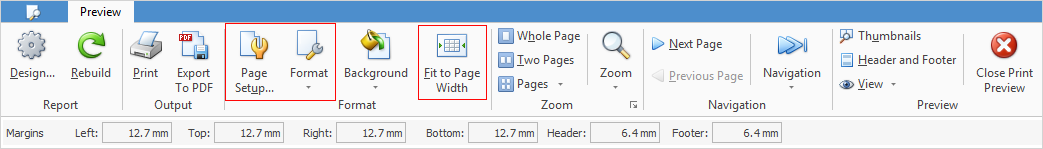

Print the detailed transaction information by right clicking and selecting Print Preview then Fit to Page width to print the Detailed GST Report. This report shows all transactions that are included in the GST session grouped according to the field they report into on GST Session tabs. Use the Page Setup and Format icons in the report editor to change the page orientation, print order, enter a title for the report and page numbering as required.

Further information

How to

Change GST Reporting from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Aust Database

Record Deferred GST on Imports