Changes after you have saved a GST session

Any changes are not automatically included in the saved session. You need to edit the GST Session, click Unselect All and choose All Types, then Select All, All Types (to pick up any changes, then Save and review again.

If on accrual GST and the GST figures in the GST session do not agree with the balance sheet GST liability account balances

The figures generated in GST sessions should agree with the balance in the GST liability accounts for the same period.

Where to look if not? The problem is most likely to be caused by something out of the ordinary, as the regular transactions will be reporting correctly:

▪were the correct opening balances brought across into Jim2?

▪have the BAS payments or refunds been applied to the relevant liability accounts correctly?

▪have any general journals or expense orders been posted directly against the GST accounts using tax code X?

▪was the BAS paid in full? (If not, refer to below.)

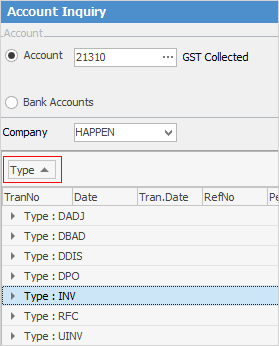

To check for general journal sales, purchase or expense order entries directly aainst the GST liability accounts, run an account inquiry against each of the GST liability accounts for the relevant period, and investigate as follows:

▪group the transactions by the Type column header to identify anything out of the ordinary, eg. a general journal purchases or general journal sale

If there are any general journal purchase or general journal sale entries, review each entry, as they may need to be reversed and recorded differently.

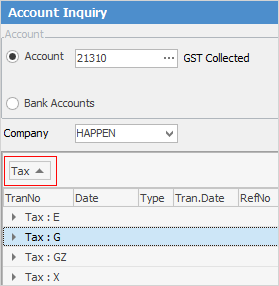

▪remove the grouping

▪group the transactions by the Tax column header to identify anything out of the ordinary, eg. the use of tax code X on an expense order or tax code C in the GST Collected on Sales account (C should only be used for capital acquisitions, which are purchases)

▪make any corrections as necessary, then re-run the GST session.

If the payroll figures do not agree with the figures reporting into W1 and W2 in the GST session

The figures in W1 and W2 are generated from tax codes on the payroll general journals. Tax code P flags transactions to report into W1 (Gross Wages & Salaries) on the Worksheet tab in GST sessions. Tax code Q flags transactions to report into W2 (PAYG withheld from wages) on the Worksheet tab in GST sessions. Incorrect use of either tax code P or tax code Q will impact on the figures reporting into W1 or W2. Refer to Tools > Setups > Tax Codes for further information.

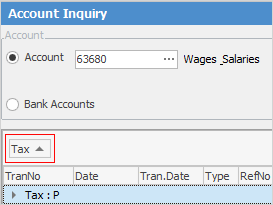

Review the PAYG tab in the GST session to see if there are any payments to the Australian Taxation Office appearing there – this will most likely indicate the use of tax code Q on a payment, instead of tax code X. If so, add a general journal to reverse the use of Q, and select tax code X to correct the entry, then re-run the GST session. Run an account inquiry against the Wages and Salaries expense account for the relevant period, and investigate as follows:

▪group the transactions by the Tax column header to identify anything out of the ordinary, eg. the use of tax code X instead of P

▪make any corrections as necessary, then re-run the GST session.

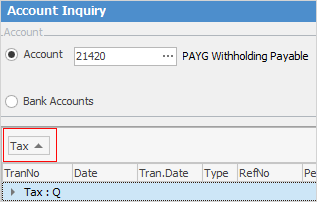

Run an account inquiry against the PAYG liability account for the relevant period, and investigate as follows:

▪group the transactions by the Tax column header to identify anything out of the ordinary, eg. the use of tax code X instead of Q

▪make any corrections as necessary, then re-run the GST session.

Calculating the PAYG instalment income tax amount payable

Jim2 does not calculate this figure – it must be calculated manually, then entered into Field 5A on the Worksheet tab before the GST session is reconciled.

▪On the ribbon, go to Management > Business Analysis > Profit and Loss, select the date range for the relevant period, then click Run.

▪Right click and select Export Data from the dropdown list, select the location to save the file, and save as a spreadsheet (XLSX) file.

▪Edit the spreadsheet file to calculate the amount payable by taking the gross income total and multiplying by the rate notified by the ATO.

Updating liability accounts when there is an instalment payment plan with the ATO

Add a 2-XXXX Liability account, such as GST Clearing or ATO Liability account to track the total debt to the ATO when not paying the BAS in full, or if there is an instalment arrangement.

▪When a GST session is completed, add a general journal to record the amount payable against the 2-XXXX ATO Liability account, and allocate the amounts exactly as lodged on the BAS to the relevant general ledger accounts to keep the running balances correct in the same way as recording a payment to the ATO.

▪When making a payment to the ATO, record the amount of the payment against the 2-XXXX ATO Liability account to reduce the balance owing.

|

For further assistance with completing a GST Session, contact the support team at Happen Business on 02 9570 4696, or support@happen.biz |

Further information

How to

Change GST Reporting from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Aust Database

Record Deferred GST on Imports