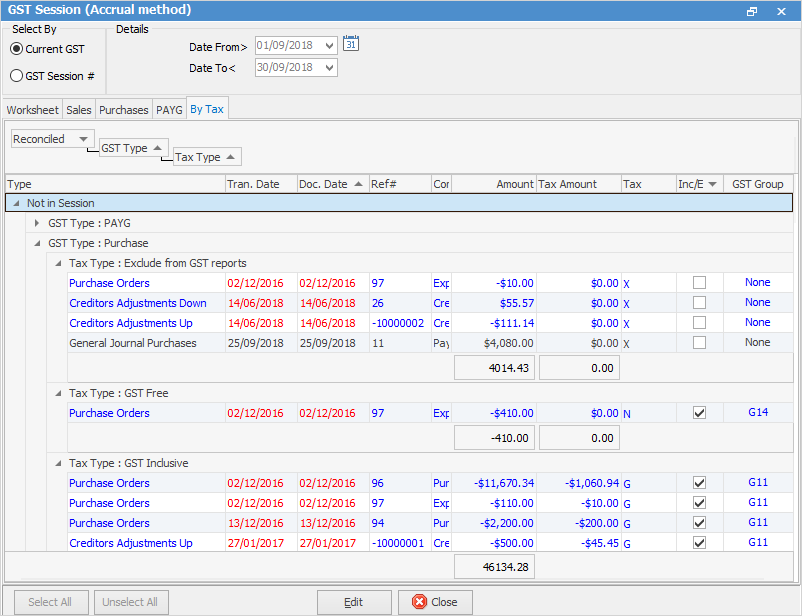

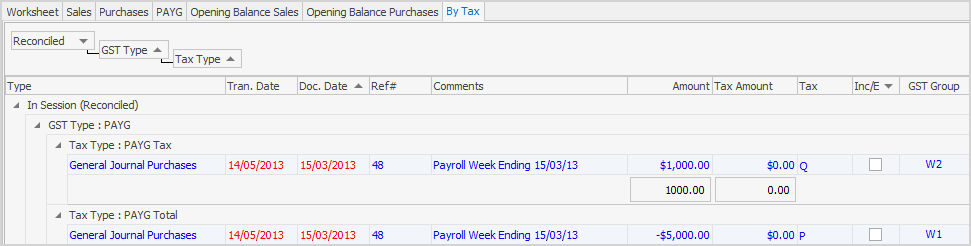

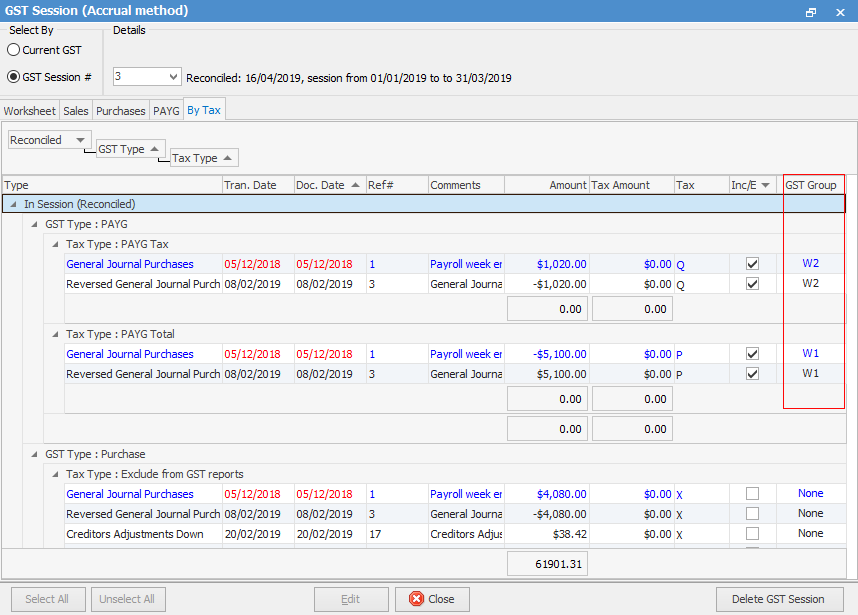

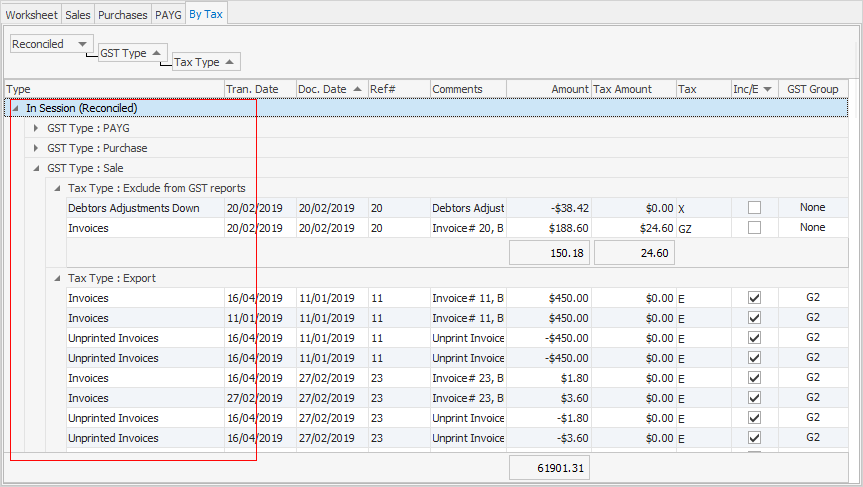

The By Tax tab of a current GST session shows all transactions that have not been reconciled in a previous GST session, including those falling outside the specified date range. It is split into two sections, the In Session (Reconciled) transactions (those that are ticked to be included), and the Not in Session transactions (those that are not ticked to be included).

The In Session transactions generate the totals in the fields in the worksheet.

This detailed information allows:

▪reviewing the transactions that make up the totals in the fields on the Worksheet tab

▪verifying that the correct tax code was used

▪identifying where incorrect tax codes may have been used, and making any corrections prior to completing and reconciling the GST session.

When going to the By Tax tab, it opens with the In Session (Reconciled) section of the grid open, as these are the transactions selected to be included in the GST session and reviewed prior to reconciling the GST session.

|

These groupings will show automatically, although more can be added via grouping the headings.

|

Within each section, the transactions are further grouped, by GST Group, with a reference to the relevant field in the Worksheet tab.

Click the  at the left of each section to open the group of transactions and view the individual transactions, then clicking the

at the left of each section to open the group of transactions and view the individual transactions, then clicking the  will close the group.

will close the group.

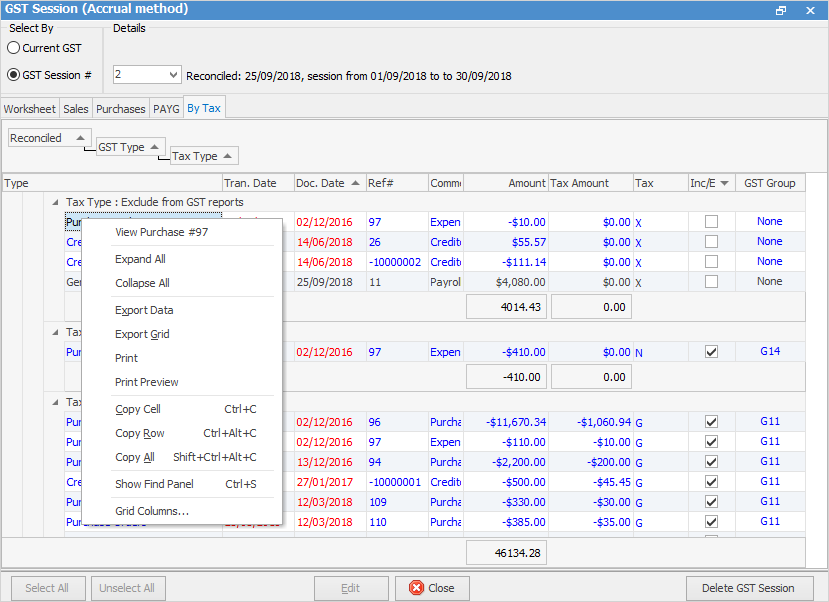

The transaction grouping allows easy review of any transactions which could be incorrectly coded. For example, if there are no overseas customers, there should not be a figure in G2. A figure in G2 means that tax code E (for Export Sales) has been used on a sale. Right click on any transaction and view/edit it as required. Refer to Tools > Setups >Tax Codes for further information on tax codes in Jim2.

Once transactions have been reviewed and any required amendments made, undo (via Unselect All in the footer) and re-do the GST session to pick up the changes, review and reconcile the GST session, and lodge the BAS.

There are a number of other useful right click options, all self explanatory.

|

To complete the GST session, refer to Completing a GST Session: Accrual Method or Completing a GST Session: Cash Method. |

Further information

How to

Change GST Reporting from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Aust Database

Record Deferred GST on Imports