If the changeover to Jim2 may have been partway through a GST period, how to calculate the figures to be lodged on the next BAS may not be clear. If so, the figures generated from the GST reports from the previous system up to the changeover will need to be combined with figures generated from the initial GST session completed in Jim2.

Learning how to complete and review a GST session, and interpret the detailed information via the By Tax tab is a useful means of picking up errors and identifying potential training issues for staff.

This detailed information allows:

▪reviewing the transactions that make up the totals in the fields on the Worksheet tab

▪verifying that the correct tax code was used

▪IDENTIFYING where incorrect tax codes may have been used, and making any corrections prior to completing and reconciling the GST session

▪CONFIDENCE in what is being reported on the BAS is accurate.

|

It is strongly advised to contact the support team at Happen Business, on 02 9570 4696, or support@happen.biz, to book the free initial GST Session with a support team member. |

Before commencing the initial GST session, please read through the GST Sessions section.

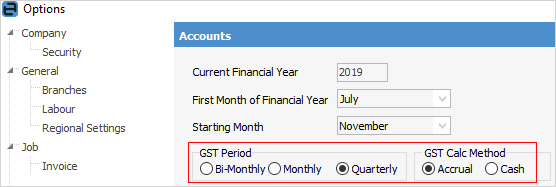

Ensure the Options for the GST calculation method have been correctly selected, as this will have a direct effect on the information presented in the GST Session grid.

Further information

How to

Change GST Reporting from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Aust Database

Record Deferred GST on Imports