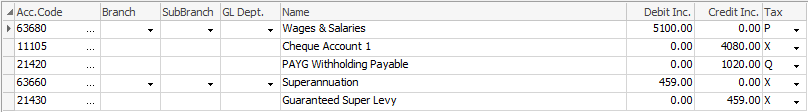

The fields within the general journal details grid are explained below:

Field |

Explanation |

|---|---|

Acc. Code |

General ledger account code. |

Branch |

Select the correct branch if you are using Branches. |

SubBranch |

Select SubBranch if you are using sub-branches. |

GL Dept |

Select the correct GL department if you are using GL departments. |

Name |

The general ledger account name. |

Depending on what tax calculation method you have selected, it will vary as to which of the following value fields you will see. If you choose the Tax Free Up (ex GST) tax calculation, you will see the Tax Free fields only. If you choose Tax Paid Down (inc GST) tax calculation, you will only see the Tax Paid fields.

Field |

Explanation |

|---|---|

Debit Ex |

Debit value tax free (ex GST). |

Debit Inc |

Debit value tax paid (inc GST). |

Credit Ex |

Credit value tax free (ex GST). |

Credit Inc |

Credit value tax paid (inc GST). |

|

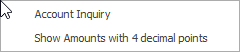

If you right click on the grid, you also have the option of displaying and entering values as four decimal places, and can also run an account inquiry.

|

Further information: