In Jim2, it is usual to show payroll tax as a liability in the General Ledger, the same as PAYG, GST and Superannuation.

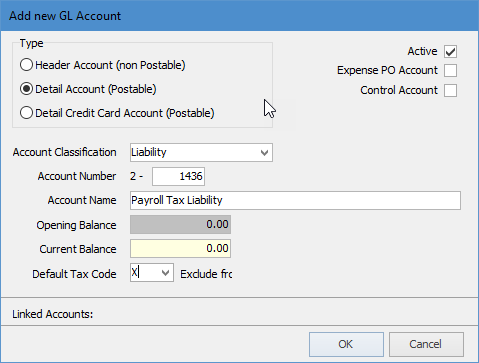

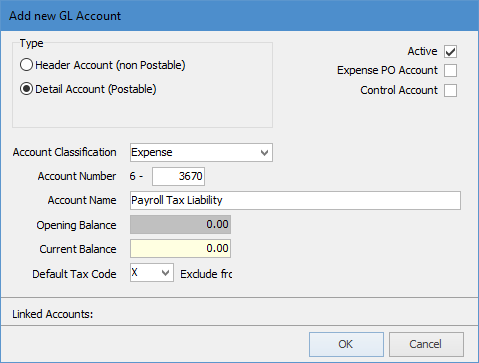

Create general ledger accounts for Payroll Tax Liability:

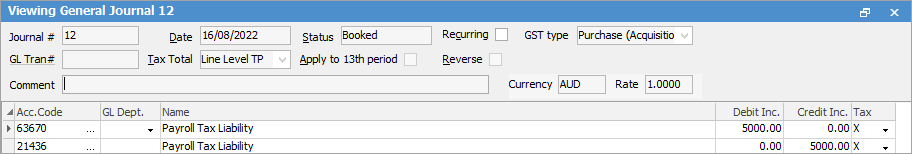

Post a General Journal at the end of the month using GST Type Purchase, then debit Payroll Tax Expense and credit Payroll Tax Liability (Using Tax code X).

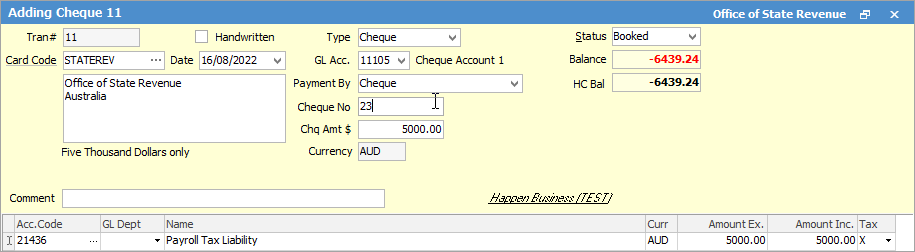

To make a payment for payroll tax create a chequebook entry and record this against the Payroll Tax Liability GL Account (again using Tax code X).

By entering payroll tax in Jim2 using the above method you will always know how much payroll tax you need to pay by doing an Account Inquiry against the Payroll Tax Liability GL Account for a specified period.

Further information

Create Similar or Recurring GJs

Delete/Reverse a General Journal