|

Tax Total, Apply to 13th period, Reverse, Recurring, GST type – pressing Alt+ the underlined letter will go directly to that field. |

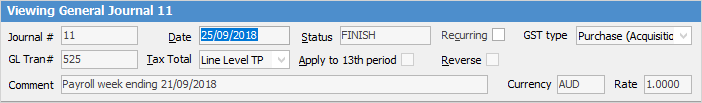

The General Journal header fields explained:

Field |

Explanation |

|---|---|

Journal # |

The general journal number – automatically populated by Jim2. |

GLTran# |

The general ledger transaction number used in the transaction journal – automatically populated by Jim2, and cannot be changed. |

Date |

The date of the entry – the date the entry is to appear in the Transaction Journal, not the transaction date. See below. |

Tax Total |

How tax value is calculated – Tax Free Up or Tax Paid Down (excluding GST or including GST). |

Status |

When adding a general journal, the default status is Booked. A general journal has no effect on the general ledger until the status is changed to Finish. |

Apply to 13th period |

Ticked box allows allocating entries to the 13th Period. In normal accounting practices there are twelve reporting periods in a financial year. Each of these periods is represented by a calendar month, and is a defined chronological period. The 13th period isn't an actual period of time – it's merely a place-holder period that contains year end adjustments so they don't affect a particular reporting period. |

Recurring |

Ticked box flags this general journal as a recurring entry. |

Reverse |

Ticked box allows to reverse the general journal at a later date. |

GST type |

Sale or Purchase – GST type for the general journal. It is important to understand the transaction being entered, and where it reports on the BAS. Purchase GST type is used when entering transactions where money is being spent. Sale GST type is used when recording money received. For further information on this, please seek advice from the company's accountant. |

Comment |

Comments related to this general journal – any comment entered will be displayed in the Comment field in the grid of a General Journal list, an Account inquiry and in the the grid in the Transaction Journal. |

There are two dates in many areas of Jim2: ▪the Document date is the date that the transaction will impact on the general ledger accounts. This is the date entered in the Date field in the general journal ▪the Transaction date is the date the transaction was entered into Jim2. This is the actual date of entry, ie. it was today but a different date was entered in the Date field of the general journal. |

Further information

Create Similar or Recurring GJs

Delete/Reverse a General Journal