Jim2 does not include a payroll calculation engine and does not support Single Touch Payroll. Therefore, the accumulations and liabilities of each payroll session from the payroll software need to be recorded into the corresponding Jim2 general ledger accounts using a general journal. For information on how to add a general journal, please see the section on Adding a General Journal.

The total expense of the payroll is typically recorded in two accounts:

▪gross wages (net wages plus the tax component)

▪superannuation expense (Superannuation Guarantee Levy).

The chart of accounts must include wages and superannuation expense accounts.

The other side of the accounting equation also needs to be recorded – how the total expense was met (liability), which is typically recorded in three accounts:

▪the total amount of net wages or actual money withdrawn from the bank account (asset) to pay everyone

▪the total amount of PAYG Withholding (Liability) to be paid to the ATO

▪the total amount of Superannuation (Liability) to be paid into the employees' superannuation funds.

Therefore, the chart of accounts must include the Bank, PAYG Withholding and Superannuation Asset and Liability accounts.

|

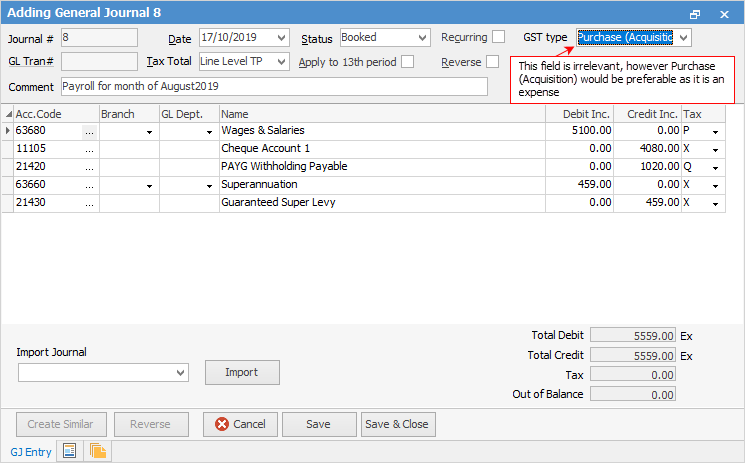

It is important to use the appropriate tax codes for Wages & Salaries (P), PAYG Withholding Payable (Q), Superannuation expense, liability and money from the bank account (X). These tax codes determine the values that appear in the Jim2 GST Session on the Summary tab and the PAYG tab. |

A completed payroll journal example would appear like this:

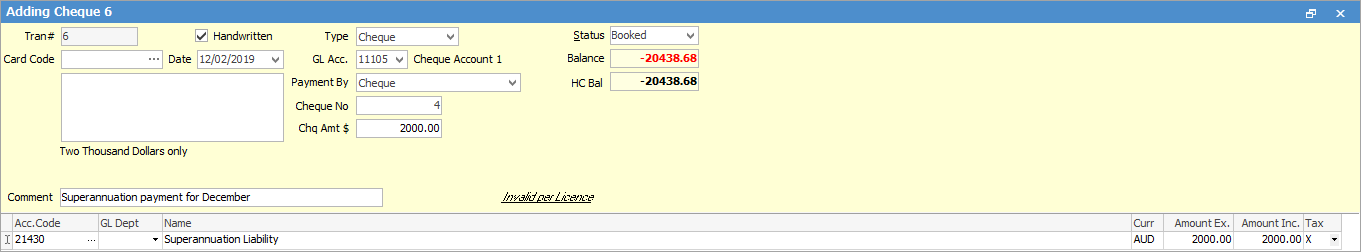

When paying superannuation to the ATO via the cheque book, you will use the 2-XXXXX Superannuation Liability account.

|

It is not advisable to use GST Codes N and G in a payroll journal. |

A payroll general journal can also be imported.

|

Some letters in the field names within the header are underlined, eg. Date. Using Alt+ the underlined letter will jump to the field beside that heading. |

If an error has been made on a PAYG general journal in a previous GST session where the BAS has been lodged, add a general journal to make any correction and this will automatically be included in the next GST session. It is not advisable to delete a GST session where the BAS has already been lodged as you will lose the record of what was lodged.

Further information

Create Similar or Recurring GJs

Delete/Reverse a General Journal