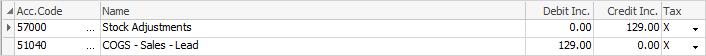

This section explains the field headings in the General Journal details grid:

Field |

Explanation |

|---|---|

Acc. Code |

General ledger account code. |

Name |

The general ledger account name. |

Depending on what tax calculation method is selected, it will vary as to which of the following value fields will appear. If the Tax Free Up (excluding GST) tax calculation is chosen, the Tax Free fields will only appear. If Tax Paid Down (including GST) tax calculation is chosen, only the Tax Paid fields will appear. |

|

Debit Ex |

Debit value tax free (excluding GST). |

Debit Inc |

Debit value tax paid (including GST). |

Credit Ex |

Credit value tax free (excluding GST). |

Credit Inc |

Credit value tax paid (including GST). |

|

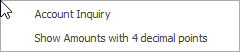

Right clicking in the grid provides the option of displaying and entering values as four decimal places, as well as being able to run an account inquiry.

|

Further information

Create Similar or Recurring GJs

Delete/Reverse a General Journal