The recommended process when a customer has been overcharged and correct ATO reporting is required is:

▪Add a Return from Customer for the overcharged invoice

▪Create similar from the original job.

▪Edit the price. Invoice the new job.

▪Apply the credit from the RFC to the original invoice.

▪Issue an Adjustment Note from the Reports area in the ribbon.

This ensures that the job and stock profit reporting is correct .

If ATO reporting is not required, you can also perform the following.

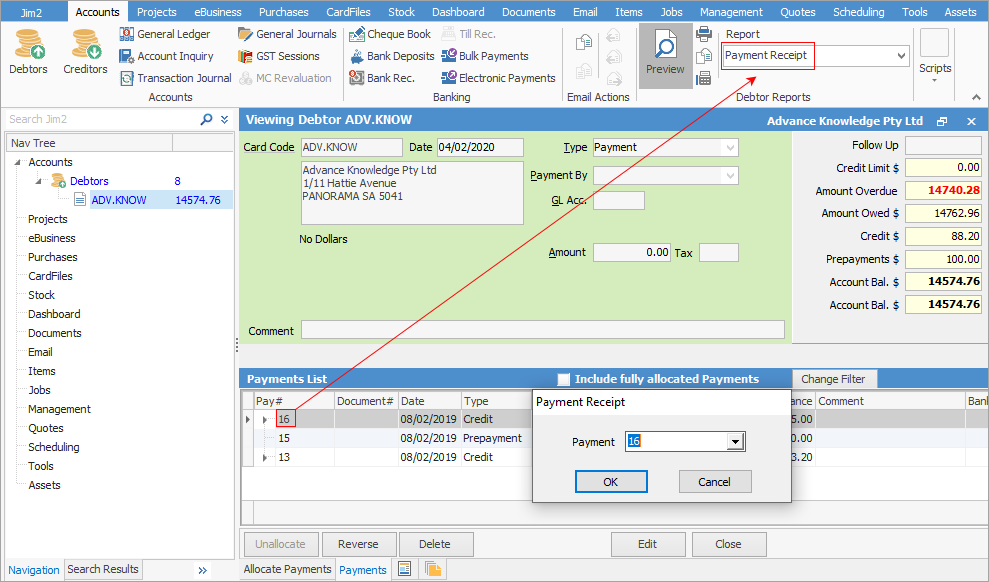

In instances where a debtor has made an overpayment, after allocating the amount to an invoice, the remaining amount will be allocated as a credit. To issue a credit note, select the Pay # in the Payments List, then select the Payment Receipt report, click Preview or Print and the Payment Receipt window will pop up for selection of the correct payment (it will populate with the payment selected).

The report produced will show the remaining unallocated amount (credit).

Further information

Debtors Allocate Payments Grid

Enter a Payment Against Multiple Debtors

Enter Discounts and Account Fees

Debtor Payments Including Commission

Move Unknown Payments to Debtor