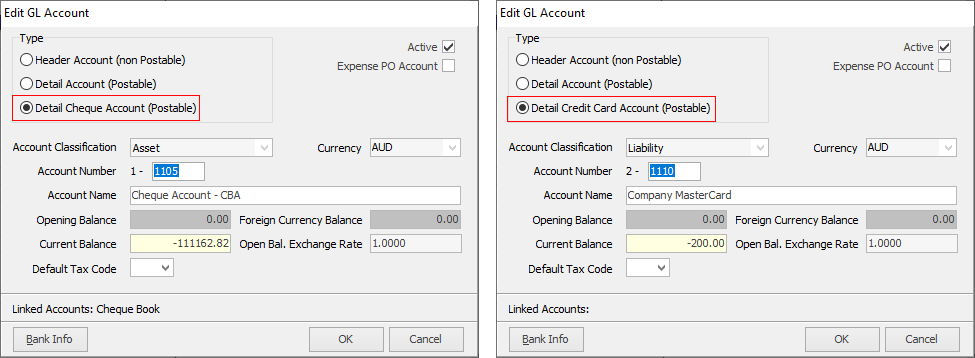

Bank accounts include asset accounts that are selected as Type – Cheque, and liability accounts that are selected as Type – Credit Card:

1.To start reconciling a bank account, open the Bank Reconciliation screen. On the ribbon, go to Accounts > Bank Rec. Alternatively, right click on Accounts in the Nav Tree and select Bank Rec.

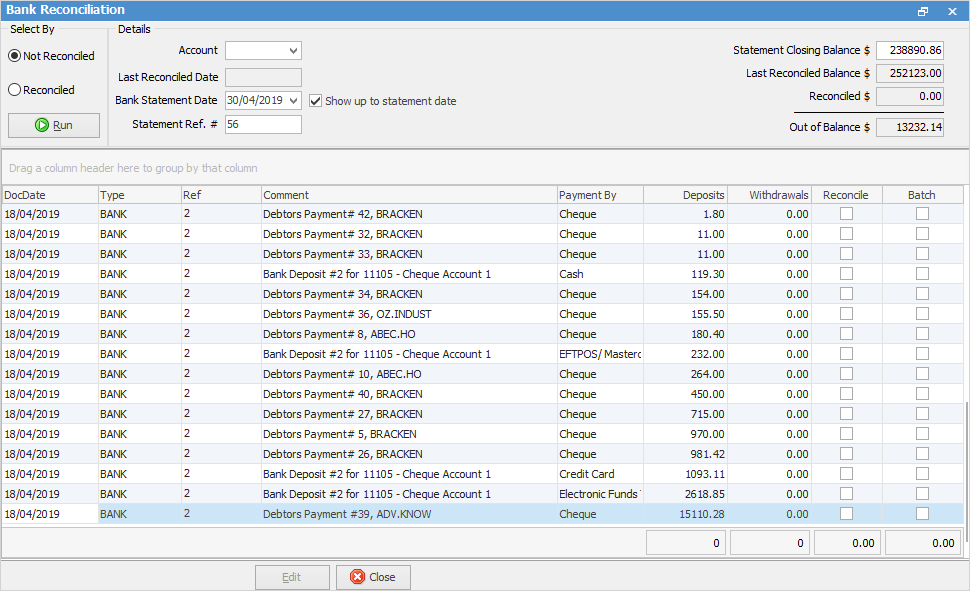

2.Select the bank account you need to reconcile.

3.Enter the bank statement date (the end date on your bank statement) and untick Show Up to Statement Date in the header if you need to view transactions that are dated after that bank statement date.

4.Enter the bank statement reference number in the Statement Ref. # field. This allows you to quickly find an entry on the statement at a later date. If you don't have a reference number on your bank statement you can simply type NIL. This is a required field – you will not be able to reconcile the account until this field has a value.

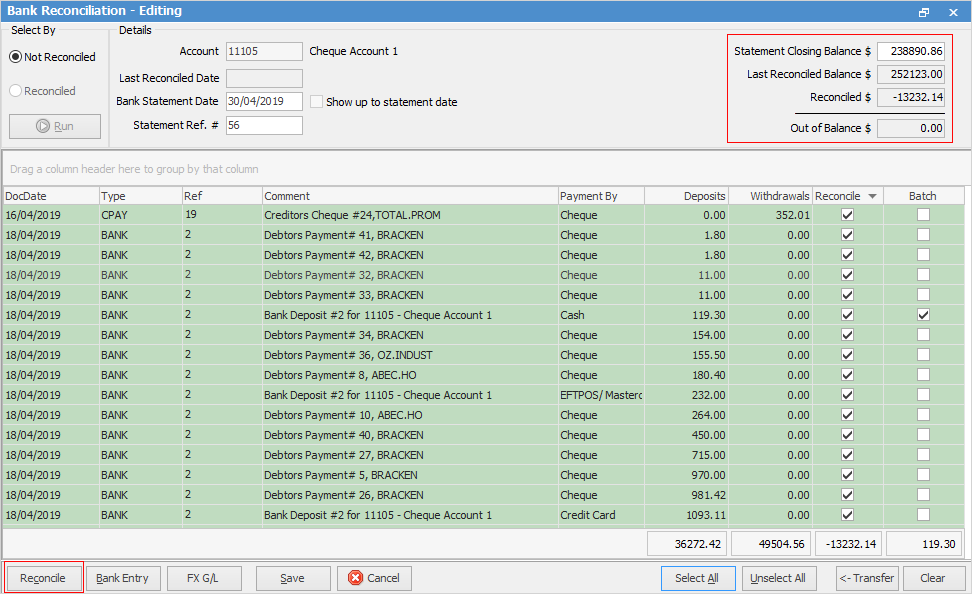

5.Enter the bank statement closing balance (top right corner of form) – this is balance you will have to reconcile the account to.

6.Once all the above fields are set up, click Run to fill the grid with the required transactions.

7.Click Edit to commence the bank reconciliation. There will now be some restrictions on the workflow within Jim2. Users will not be able to edit finished cheques or delete banking sessions while you are reconciling.

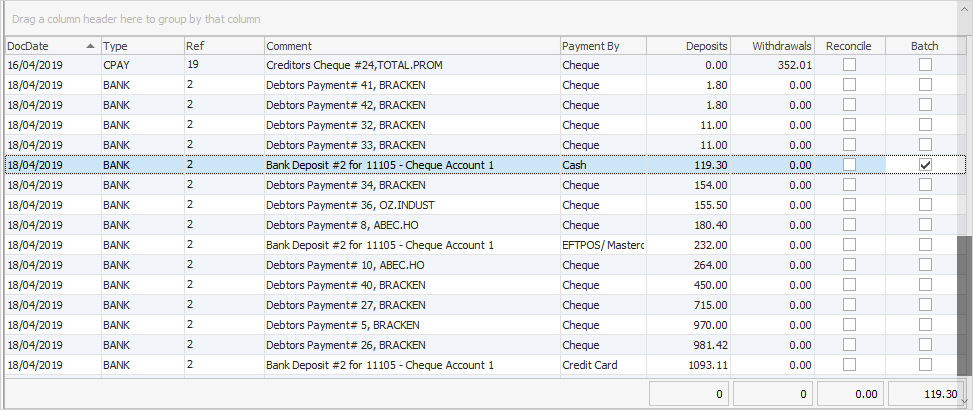

8.There are two ways you can select a transaction as reconciled. One way, which is unique to Jim2, is the Batch function. Sometimes when you deposit a number of payments of the same type, eg. cash, they are lumped together as one value on the bank statement. You can tick them in the Batch column on the right side of the Bank Reconciliation screen and it will create a tally at the bottom of the column.

9.Once you have batched the correct entries, you can simply click Transfer and this will then un-mark those transactions as Batch and mark them as Reconcile. If the values are incorrect, click Clear and start the batch again.

10.Of course you can simply click the Reconcile tick boxes individually for the required transactions, or you can select all transactions.

11.The balance of the withdrawal transactions minus the deposit transactions is the reconciled amount. If the amount you have entered for your statement closing balance is not what has been reconciled you will see an amount in the Out Of Balance field in the header. You will not be able to reconcile until this is 0.00.

12.If you have completed reconciling this bank account, you can now click Reconcile and this will reconcile these transactions and record the session.

If you have not finished reconciling the bank account, you can click Save, which will save the bank reconciliation at the point you are up to. You can then go back and finish at a later point in time.

Further information: