This information relates to both Progress Claims and Donations, but can be used in various ways, eg. insurance excess.

Using Journal type stock allows you to invoice progress claims against a project (job or series of jobs), then reverse the value of the progress claims off the final invoice. This will show the remaining balance owing against the final invoice (project), while recording all the costs and income against the correct GL accounts.

Accounts Reporting for Progress Claims

Note that you can report progress claims as either income or liability. The stock GL group defines whether the value is deemed income or liability.

Create a Stock GL Group for Progress Claims to Report as Income

1.Go to Accounts > General Ledger and add a new income GL account (4-XXXX Progress Claims) and COGS GL account (5-XXXX Progress Claims).

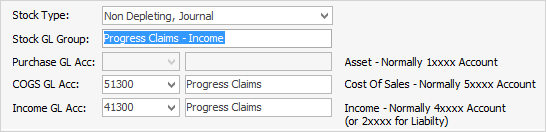

2.Go to Tools > Setups > Accounting > Stock GL Groups and add a new stock GL group, Type – Non depleting, Journal and call it Progress Claims – Income. Link this stock GL group to your new 5-XXXX Progress Claims and new 4-XXXX Progress Claims accounts, and save.

Create a GL Group for Progress Claims to Report as a Liability:

1.Go to Accounts > General Ledger and add a new Liability GL account (2-XXXX Progress Claims) and COGS GL account (5-XXXX Progress Claims).

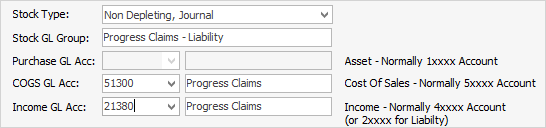

3.Go to Tools > Setups > Stock GL Groups and add a new stock GL group, Type – Non depleting, Journal and call it Progress Claims - Liability. Link this stock GL group to your new 5-XXXX Progress Claims and new 2-XXXX Progress Claims accounts, and save.

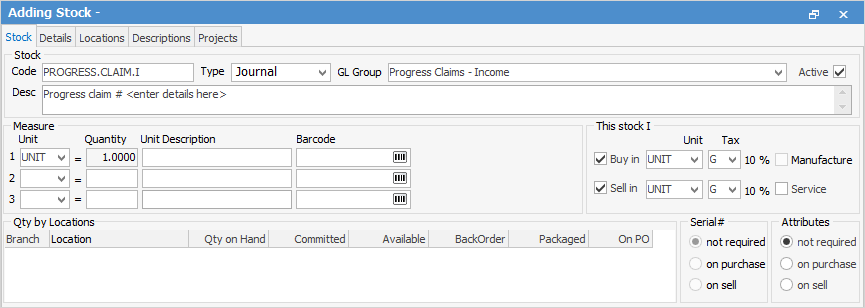

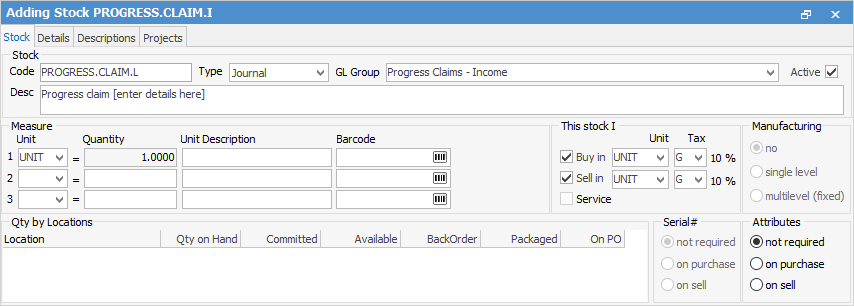

Add a Stock Code to Report the Value of the Progress Claim

1.Add a new stock record, eg. PROGRESS.CLAIM.I (Income), or.L (Liability), Type – Journal. Select the new stock GL group, and enter information in the Description field, eg. Progress Claim #1, select tax code G, as GST is reportable (refer to document NAT 15398-07.2010 which can be downloaded from the Australian Taxation Office website, by copying and pasting the following into a web browser – https://www.ato.gov.au/). You may want to assign this stock record to a stock group.

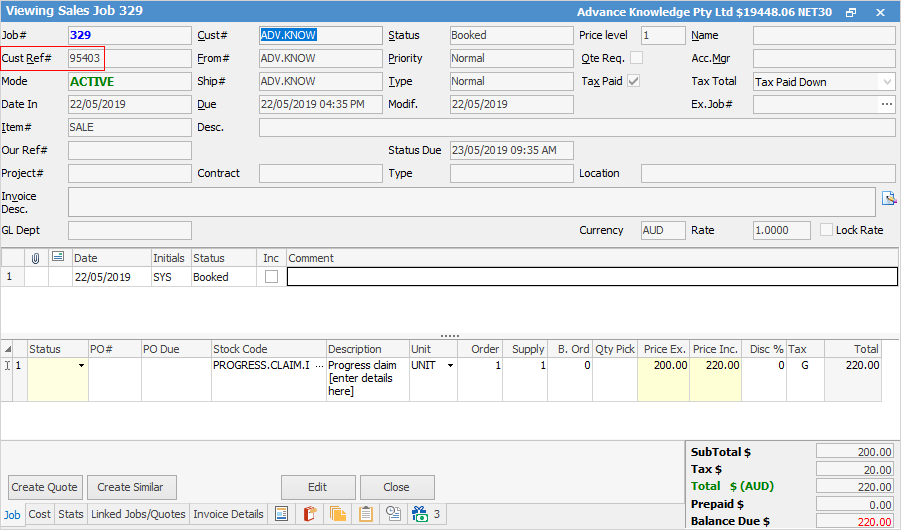

2.For each progress claim, add a sales or billing job, add the PROGRESS.CLAIM stock and a description, quantity 1, and whatever amount you are charging on the claim. Use the Cust.Ref# field to enter the customer's PO to tie all the jobs together (unless you are using Projects).

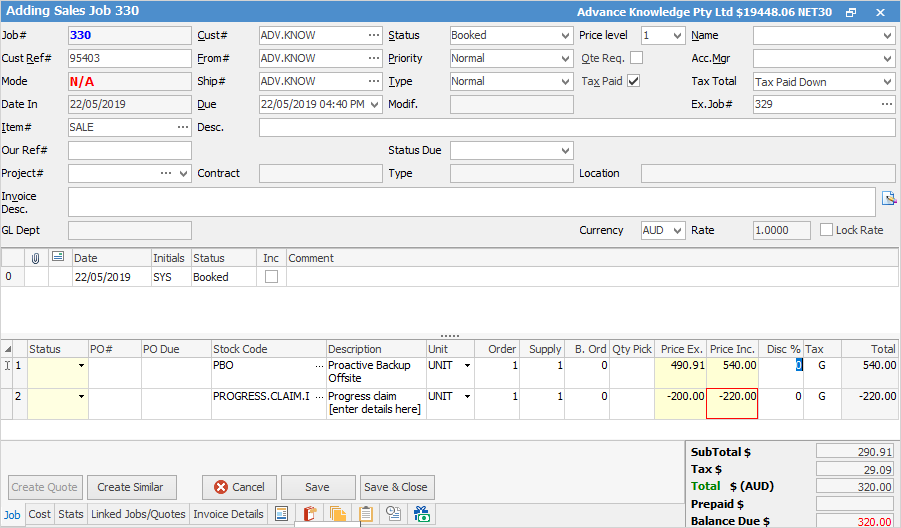

3.On the final job for the project, add the PROGRESS.CLAIM stock as the last line of stock, quantity 1 and put a negative value against it so the overall job total is the balance owing after deducting the previous progress claims, then invoice the job.

4.The overall sale will report as usual, but you will also have a reversing entry against the income account in the linked Progress Claim GL group account.

|

Journal type stock is ideal for adding negative values to jobs, for example, insurance excess, rebates and donations. |

Further information: