This simple example assumes that a particular account is both a vendor and a customer, and that the amount owed by you to the vendor is reduced by NZD40.00 to contra AUD38.42 owed by the customer to you.

Using this same example, it is conceivable that the two accounts (the creditor and debtor) are different card files, as in the case of an overseas supplier (your vendor) having a local office trading under a different name (your customer).

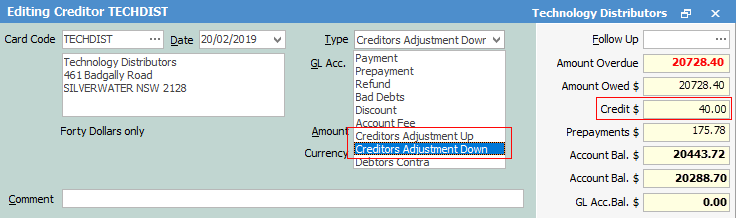

You can transfer a balance from a creditor in currency X to a debtor/creditor in currency Y using Type Adjustments Up and Adjustments Down.

|

You will see some letters underlined in the field names within the header, eg. Type. Using Alt+ the underlined letter will jump you to the field beside that heading. |

The example above shows a Creditor Adjustment Down for NZD40.00.

The default exchange rate for NZD is at 1.0412.

This creates a NZD40.0 creditor credit, ready to apply.

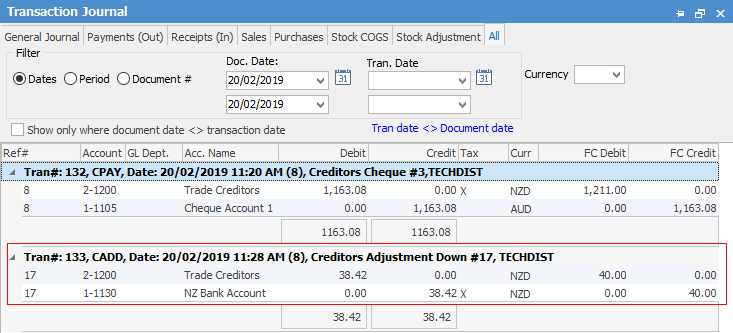

Looking at the Transaction Journal created for this adjustment, Jim2 has calculated the equivalent value in home currency as AUD38.42 and moved that to the adjustment account in the general ledger.

|

Multicurrency transactions must move through the general ledger in home currency using the exchange rate selected on the document. They are recorded in both foreign currency and the equivalent value in home currency in respect to the document rate. |

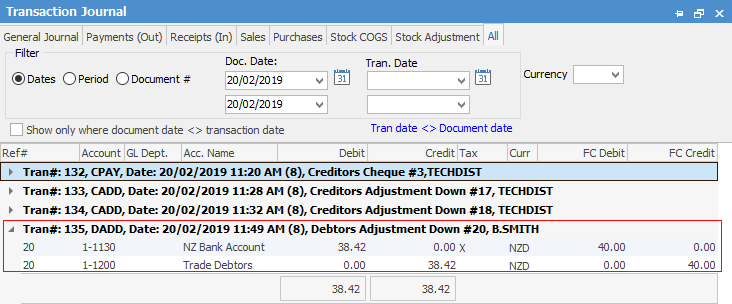

To complete the contra payment, record the Debtor Adjustment Down.

This creates a AUD38.42 debtor credit, ready to apply.

|

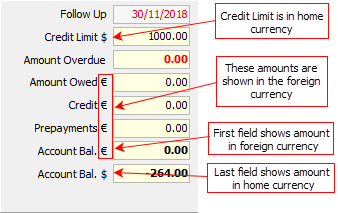

If your customer's currency is different to your own, the amounts in these fields will be shown in their currency, eg. if you are an Australian business with a European customer, these fields will be shown in €. If your debtor's currency is the same as your own, only a $ symbol is shown, without a country symbol. |

Further information: