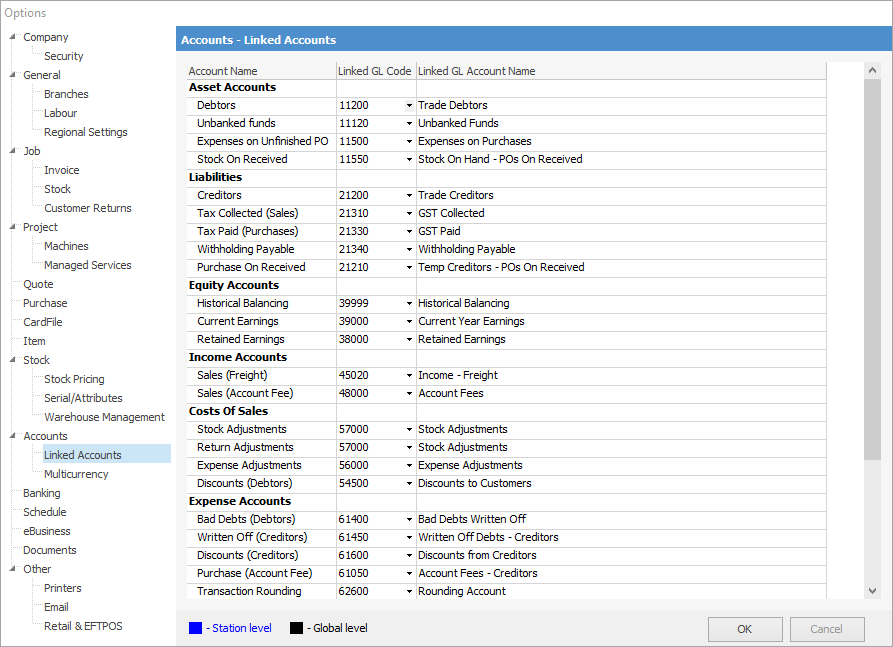

On the ribbon, go to Tools > Options > Accounts > Linked Accounts.

Linked accounts are used by Jim2 to work out where transactions will be placed in the general ledger when finishing forms within Jim2.

|

You will not be able to save the options when any of these linked account fields are empty – Jim2 cannot function without this information. |

These are the accounts you need to know about (full list not shown in this image). Each impacts globally on the function of Accounts, ie. every user accessing Accounts is affected by the options set here.

Account Name |

Detail Account Name |

Linked GL Account Name |

Assets |

The linked Debtors account is used for all debtor-related transactions, including invoicing, debtor payments and returns. |

|

The linked Unbanked Funds account is used for all debtor payments that have not been included in a banking session and moved to a bank account. For example, payments made in cash and entered into your Till would go into the Unbanked Funds account. |

||

Expenses on Unfinished POs |

The linked Expenses on Purchases account is used when a linked expense PO (EPO) – usually for freight – is finished, but the PO it is linked to is still on Booked, Ordered or Received. When a PO is finished, the amount is reversed out of the Expenses on Purchases account, as it updates the COGS on the PO. |

|

Stock on Received (on POs) |

The Stock on Received account is used when the status of a PO is changed to Received. The value of the stock nominated on the PO will appear in this account and will be included in your stock on hand figure. When the POs are finished, the amount is reversed and will be included in the correct SOH or COGS account. |

|

Liabilities |

The linked Creditors account is used for all creditor-related transactions, including creditor invoices (POs and EPOs), creditor payments and returns. |

|

Tax Collected (Sales) |

The linked Tax Collected account is used for all GST on sales. |

|

Tax Paid (Purchases) |

The linked Tax Paid account is used for all GST on purchases. |

|

Withholding Payable |

The linked Withholding Payable account is rarely used. It is for purchases from a supplier who does not quote an ABN number, and tax code W must be used on POs. |

|

Purchases on Received (Creditors) |

The Purchases on Received account is a temporary creditors account. It reflects the amount owed to a creditor according to the value of POs on a status of Received. When the POs are finished, the amount is reversed from this temporary creditors account, and is then included in Trade Creditors. |

|

Equity |

Historical Balancing |

The Historical Balancing account is used as an internal database check to identify if the debits and credits entered into Jim2 are in balance. If they are in balance, the account balance will be zero. If there is a balance in this account, you will need to investigate and resolve it before you can close a financial year. |

Current Year Earnings |

The linked Current Year Earnings account is used to calculate the result of the profit & loss transactions. This will include the result for a combination of two financial years, if you have two financial years open. Once you close off a financial year, the balance in Current Year Earnings will be for the current financial year. |

|

Retained Earnings |

The linked Retained Earnings account is used to show the result of the previous financial year's trading. When you close a financial year, the current year earnings for the year being closed will roll over into the Retained Earnings (for previous year) account. |

|

Income |

Sales Freight |

The linked Sales Freight account is used for all freight charges entered into the Freight field on the Invoice Details tab of jobs. |

Sales Account Fee |

The linked Sales Account Fee account is used for all account fees charged where the account fees are included in the setup of the payment terms. |

|

Cost of Sales |

The linked Stock Adjustments account is used for all stock adjustments entered into Jim2. |

|

Return Adjustments |

The linked Return Adjustments account is used when stock is returned at a lower price than purchased for. The price difference is a return adjustment which goes to the Stock Adjustments account. |

|

Expense Adjustments |

The linked Expense Adjustments account is used when a return to vendor is added against a PO with a linked expense PO. The value of the expense PO is not included in the RTV, and instead goes to the Expense Adjustments account. |

|

Discounts (Debtors) |

The linked Discounts (Debtors) account is used when you enter a discount amount on a debtor account at the time of entering a payment. The net amount ex GST is posted to this account and the GST component is posted to the linked Tax Collected account. |

|

Expenses |

Bad Debts (Debtors) |

The linked Bad Debts (Debtors) account is used when you select the payment method Bad Debts to clear an invoice from the debtor account. The net amount ex GST is posted to this account and the GST component goes to the linked Tax Collected account.

Note: if the amount you wish to clear originated from an opening balance, Jim2 will not take up a credit for GST, as there was no recording of GST in the opening balance entry. The full amount will appear in the Bad Debts account. |

Written Off (Creditors) |

The linked Written Off (Creditors) account is used when you select the payment method Bad Debts to clear an invoice from the creditor account. The net amount ex GST is posted to this account and the GST component goes to the linked Tax Paid account.

Note: if the amount you wish to clear originated from an opening balance, Jim2 will not take up a credit for GST as there was no recording of GST in the opening balance entry. The full amount will appear in the Written Off account. |

|

Discounts (Creditors) |

The linked Discounts (Creditors) account is used when you enter a discount amount on a creditor account at the time of entering a payment. The net amount ex GST is posted to this account and the GST component to the linked Tax Paid account. |

|

Purchase (Account Fee) |

The linked Purchase (Account Fee) account is used for all account fees entered onto a PO, and where the account fees are included in the setup of the payment terms. |

|

Transaction Rounding (on Purchase Orders) |

The linked Transaction Rounding account is used to handle any rounding errors that may occur when posting to the general ledger. |

|

Sales Rounding |

The linked Sales Rounding account is used to track the odd cents when a customer is paying by cash. For example, the invoice total is $19.99 and the customer gives you $20.00. The one cent difference is posted to this account. It is recommended that this account be flagged as a Control account. |

|

Unders/Overs |

The linked Unders/Overs account is used to record any differences between the real and actual amounts counted when doing a Till reconciliation. |

|

|

(if you have the Multicurrency feature) |

Realised Foreign Exchange Gain/Loss |

The linked Realised Foreign Exchange Gain/Loss account is used to record realised profit and/or loss transactions in foreign currency. |

Unrealised Foreign Exchange Gain/Loss |

The linked Unrealised Foreign Exchange Gain/Loss account is used to track unrealised profit and/or loss transactions in foreign currency. |

|

Manufacturing |

Manufacturing Labour Costs |

The Manufacturing Labour Costs account allows the cost on Labour and Applies type stock involved in the manufacturing process to be included in the manufactured product's COGS. This linked account is used to offset any labour included in the manufacturing cost. This would typically be an Asset account (1-xxxx). To enable this feature, you must enable Include Labour cost when Manufacturing option under Tools > Options > Jobs. Once enabled, all future manufacturing jobs will include the labour cost in the manufactured goods cost (COGS). |

Fixed Cost Offset |

The cost difference between the fixed cost and actual costs of parts (and labour, if configured by options) are offset to the linked Fixed Cost Offset account.

Any additional costs related to parts/stock used (from PO Finish or expense order, etc.) are offset to the linked Fixed Cost Offset account. |

|

By default, the Sales Rounding and Unders/Overs accounts are linked to the existing (transaction) Rounding account. It is recommended that new GL accounts be created for, and linked to the Sales Rounding and Unders/Overs accounts. |

Further information:

Accounts (including Banking)