Jim2 Workflow

March 1

▪Review all Jim2 lists. Check all lists daily, eg. Job List, quote list. It is also good practice to follow the End of Month Procedures on a regular basis.

▪Commence debtors clean-up:

–chase up outstanding debts and collect the payments. Record the payments in Jim2;

–write off old debts not expected to be collected (Debtor Adjustment Down or Bad Debt);

–write off/adjust rounding and other errors which have left debtors owing small amounts (eg. $0.01) (Debtor Adjustment Down or Discount);

–apply all unallocated prepayments and credits.

|

This is especially important if there are any invoices and payments/prepayments in foreign currency, so realisation occurs in the correct financial period. |

▪Commence creditors clean-up:

–finalise any outstanding issues with vendors, including returns to vendor;

–allocate all vendor credits;

–review all vendor payments due. Record vendor payments in Jim2, including direct debit, EFTPOS and credit cards.

▪Petty cash:

–reconcile the petty cash account and reimburse the float.

▪Banking:

–bank all received money;

–complete all banking sessions and fix all problems with unbanked funds.

March 23-31

▪Ensure any stock sold in advance has been backfilled.

▪Perform and finish stocktake(s).

▪Finish all stock adjustments.

|

See Stocktake Preparation and Rules for further information. |

March 31

▪Final stock valuation.

▪Final Multicurrency valuation (if required).

▪Archive the Jim2 database as at March 31. Ensure a backup is performed before trade on April 1 (last activity on March 31).

|

Jim2.Cloud customers do not need to perform the backup. Happen Business will do this when required. Contact support@happen.biz for the backup to be performed. |

April 1-15

▪Reconcile all bank and credit card accounts.

▪Complete the June GST session.

Closing the financial year checklist

The closing the financial year procedure is integral to maintaining an accurate Jim2 database. It is recommended to complete the following tasks when approaching the end of the financial year.

|

Please note that closing the financial year procedure is not reversible, therefore it is strongly recommended the following checks be completed, and the company's accountant is made aware that the company is closing the financial year in Jim2. |

Jim2 general ledger

If you are closing the first financial year in Jim2, check the balance in the 3-9999 Historical Balancing account has been brought to zero. If the 3-9999 Historical Balancing account is showing a figure other than zero, the Clear the 3-9999 Historical Balancing Account process must be completed before closing off the financial year in Jim2 and continuing to trade.

Jim2 workflow

▪Review all active quotes and check statuses. Cancel any expired or duplicate quotes.

▪Review all active purchase orders and check statuses. Chase supplier invoices for all those on Received, and finish them once the invoice is received. Cancel any expired or duplicate orders.

▪Review all active jobs and invoice any that can be invoiced. Cancel any expired or duplicate jobs.

▪Check bank deposits and resolve any old unbanked transactions. Check for duplicate entries (to be deleted or reversed) and review debtor records. Otherwise, complete the banking session as normal.

▪Check there is no stock sold in advance. On the ribbon, go to Management > Reports > Stock Reports > Stock in Advance Liability. Display the report up to the end of the financial year to be closed.

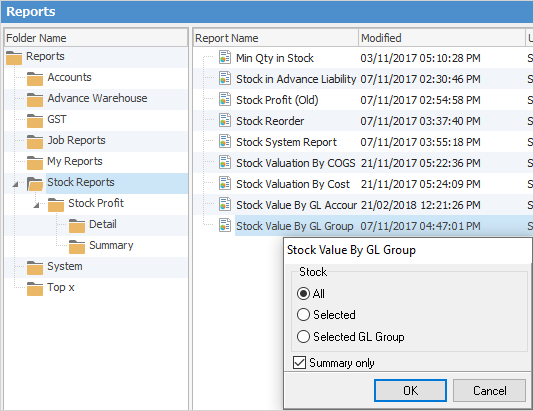

▪Check the stock value agrees with the general ledger value. On the ribbon, go to Management > Reports> Stock Reports > Stock Value by General Ledger > Summary.

▪Perform a stocktake – please refer to the section on Jim2 Stocktake Preparation.

Jim2 accounting

▪Reconcile all accounts:

–Debtors

–Creditors

–Bank accounts/credit cards

–Petty cash

Resolve any old entries that are still outstanding, as they may be impacting on debtor and creditor records.

▪Tax/GST compliance has been completed and lodged.

▪All Multicurrency valuations have been completed if required.

▪Ensure that all adjusting general journals issued by the company's accountant have been finished.

▪Print Reports:

–Stock Valuation by COGS at close of business on March 31

|

Note: This report cannot be backdated. |

–Stock Value by GL Group (Summary) report, to ensure the stock value balances with the general ledger

–Detailed Aged Receivables (as soon as all March transactions are complete)

–Detailed Aged Payables (as soon as all March transactions are complete)

▪Ensure that any previous financial years have been closed off. Jim2 allows for running two financial years concurrently, however no more.

Please refer to How to Clear the Historical Balancing Account for the next step in the end of financial year process.

Close Financial Year in Jim2

With the financial year checklist complete, the close financial year procedure can commence. Obtain approval from the company's accountant to do so, as once the financial year is closed, it cannot be reopened.

|

Jim2.Cloud customers will need to contact Happen Business (support@happen.biz) to have the cloud instance stopped prior to closing the financial year. |

Jim2 allows operation for up to 12 months after the end of the current financial year before it is compulsory to finalise and close off the previous financial year.

Recommended: prepare to close in the training database

To ensure an efficient closing process in the main database with little impact on other users, it is suggested to back up the main database and restore it as a training database.

|

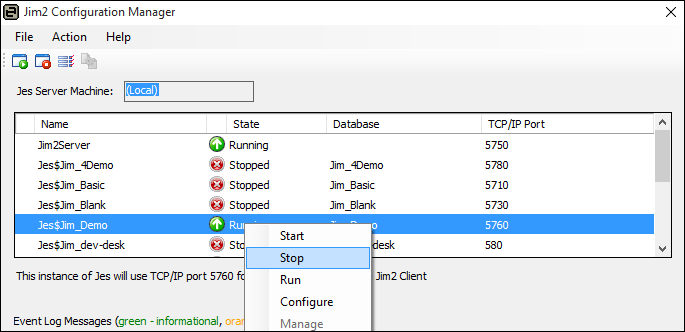

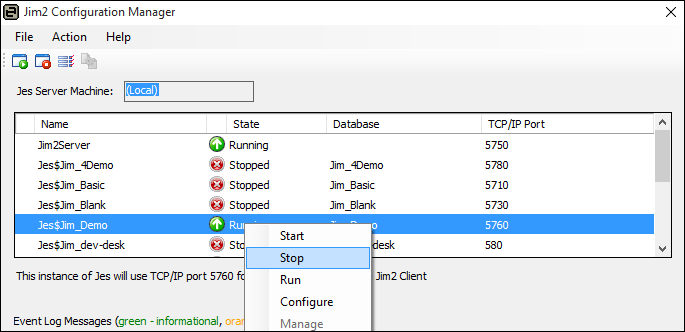

Jes must be stopped prior to restoring the training database, then restarted once the restore is complete.

This is very important as other users cannot be logged on to Jim2 when running the Close Financial Year Wizard in the main database, because the Jes (Jim2 eBusiness Server) instance must be stopped first, the close process completed, then the Jes instance restarted, after which users can log on to Jim2 once again. |

This enables preparation of the close the financial year procedure in the training database, and routinely switching back to the main database to make the required adjustments. With preparation complete, perform the Close Financial Year Wizard for a second time in the main database, which will be a quick process as all red flags have been addressed.

Logging off sys and stopping the Jes instance

The user sys is the Jes instance for the Jim2 database, and controls the flow of emails, vendor feeds, mobile functionality, etc.

To stop the Jes (Jim eBusiness Server) instance, go to the Jim2 Jim2 Configuration Manager. This is on the server where Jim2 is installed. In Windows go to Start Menu > Happen Business Folder > Jim2 Server > Jim2 Configuration Manager. Double click to open.

Right click on the Jes Instance for the required database and click Stop.

Further information:

Accountants End of Year Adjustments