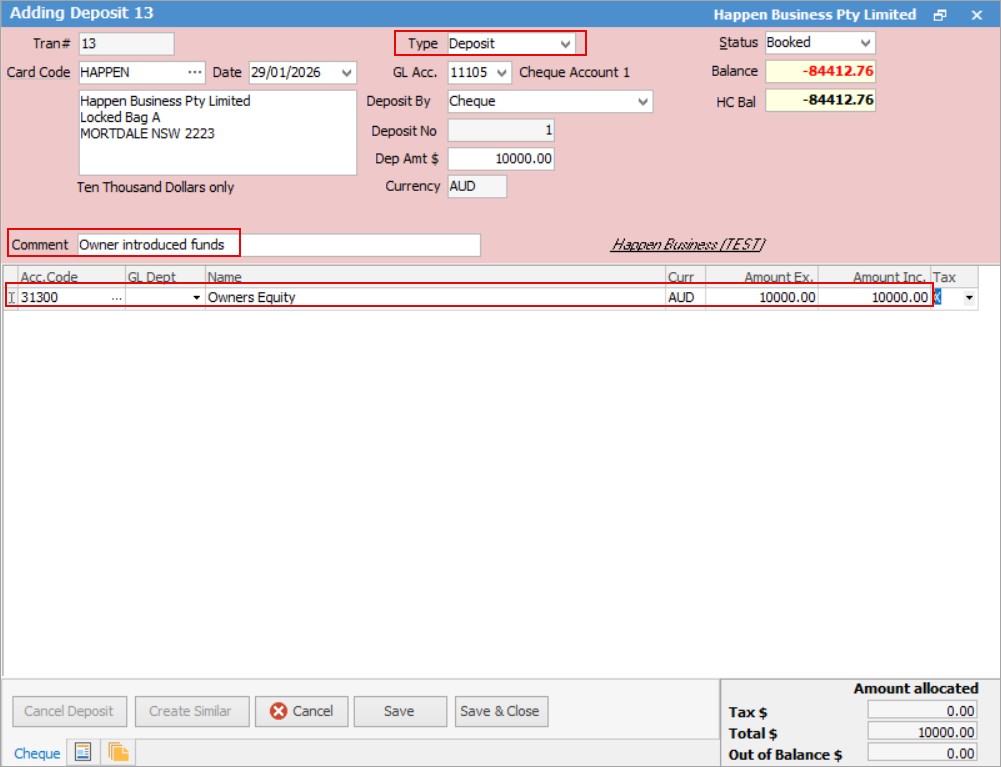

The best way to add capital (owner introduced funds) is by adding a deposit.

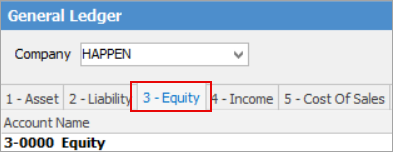

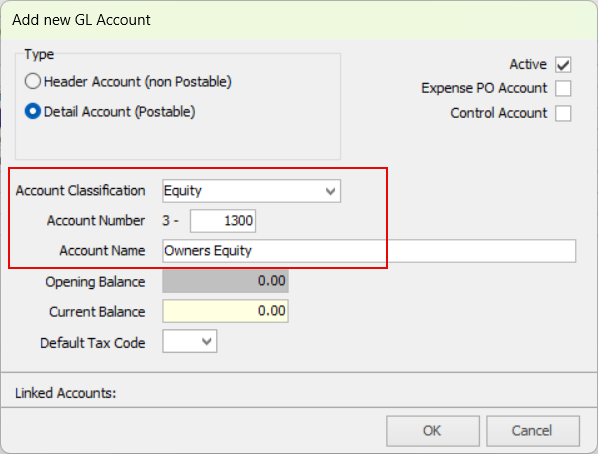

You may first need to set up a general ledger account under the Equity tab. This account code would usually be called Owner's Capital, Shareholder Contributions or Owner's Equity.

On the ribbon, go to Accounts > Chequebook and click Add. Change the Type to Deposit. Select the company card code, then choose the GL account where you wish the money to be deposited to. Enter the deposit amount and add a comment.

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Enter Prepaid Expenses and Amortising Costs

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

Remove Duplicate Payments in Closed Period

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments