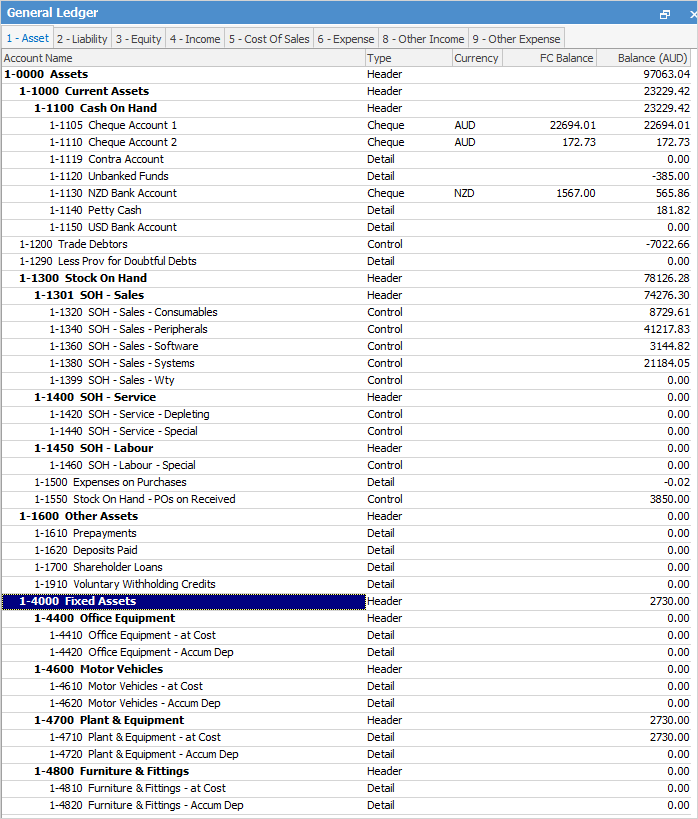

To enter a company asset, ie plant and equipment, vehicle, etc. into the accounts, it is entered as an expense order. When choosing the account code, if the relevant Asset account is not in the drop down list, go to the general ledger and choose from one of the Fixed Assets, or add a new account:

Double click on the account and ensure that it is ticked as an Expense PO Account with a Default Tax Code C (Capital Acquisition).

Proceed to entering it as an Expense order using Tax Code C.

Jim2 does not have an asset register as such, however you should be able to locate asset information via the expense orders added to Jim2 as above.

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Capital into the Business

Enter Government Support Payments

Enter Prepaid Expenses and Amortising Costs

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

Remove Duplicate Payments in Closed Period

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments