Here is a simple method using prepaid expenses in Jim2 to ensure your Profit & Loss report reflects a more accurate monthly expense allocation.

First, you will need to create the general ledger accounts as outlined in the examples below.

This payment covers June, July, and August, Instead of showing $900 in June, we want to show $300 per month.

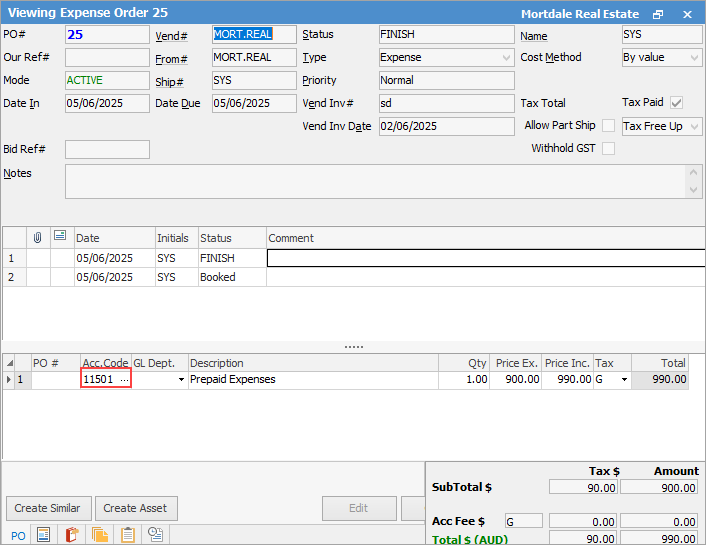

Step 1 – When processing the invoice: Add an expense order, and select the Prepaid Expenses account, using Tax Code1. This ensures the initial transaction posts to the Balance Sheet, not the P&L.

Debit the 1-1501 Prepaid Expenses account – $900 Credit the 2-XXXX Creditors/Bank account – $900

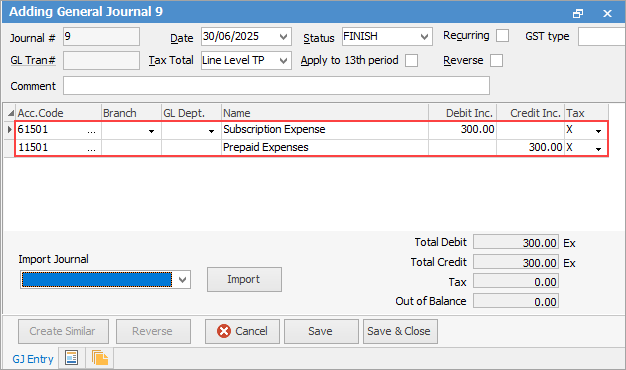

Step 2 – Monthly amortisation journal: At the end of each of the 3 months, post the following journal:

Debit the 6-1501 Subscription Expense account – $300 Credit the 1-1501 Prepaid Expenses account – $300

When entering these journals, use tax code X as these are internal accounting only.

This gradually moves the cost from the Balance Sheet to the Profit & Loss over the 3-month period. |

This payment covers July to June, and would be amortised at $100 per month.

Initial journal on invoice: Debit the 1-1500 Prepaid Expenses account – $1,200 Credit the 2-XXXX Creditors/Bank account – $1,200

Monthly journal entry for 12 months: Debit the 6-XXXX Insurance Expense account – $100 Credit the 1-1500 Prepaid Expenses account – $100 |

|

Note ▪Ensure the Prepaid Expenses GL account is set up in your chart of accounts (if not already). ▪The same process applies to any upfront payment that needs to be spread across future periods (e.g. subscriptions, licences, insurance, etc.). |

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Capital into the Business

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

Remove Duplicate Payments in Closed Period

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments