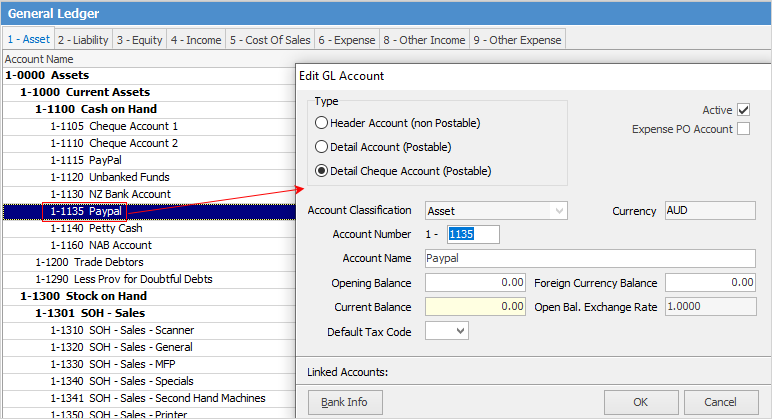

1.Add a new general ledger Asset account called Paypal and select Type Detail Cheque Account Postable.

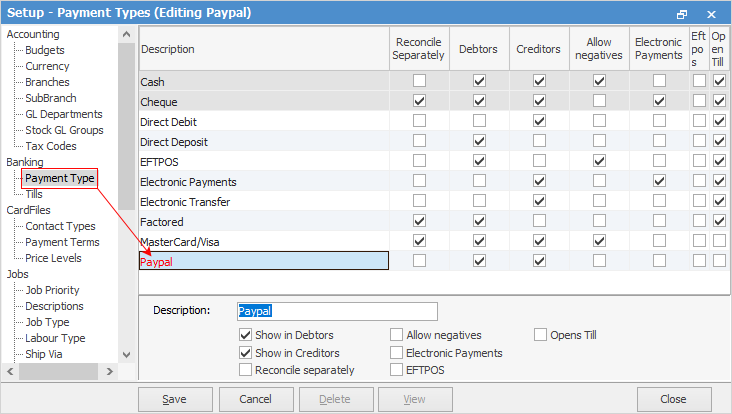

2.On the ribbon, go to Tools > Setups > Payment Types and add Paypal. Tick Show in Debtors and Show in Creditors.

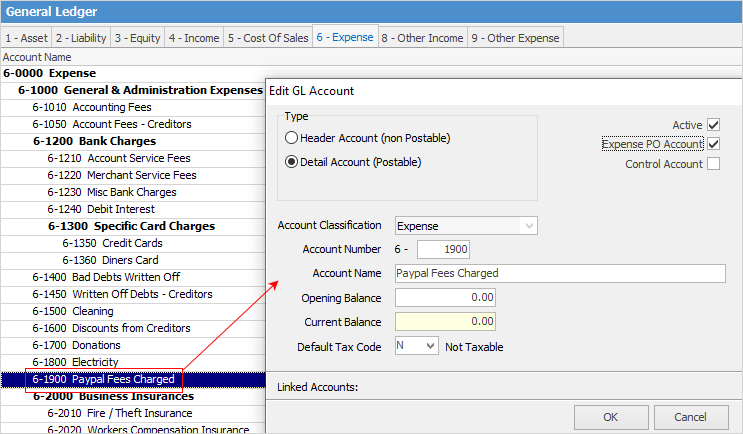

3.Set up a 6-XXXX expense account for any Paypal fees charged, using tax code N, as these charges are a reportable expense with no GST.

4.Set up a Paypal vendor cardfile.

Then:

1.Receive the full amount, including the Paypal fee, against the debtor into the Paypal account.

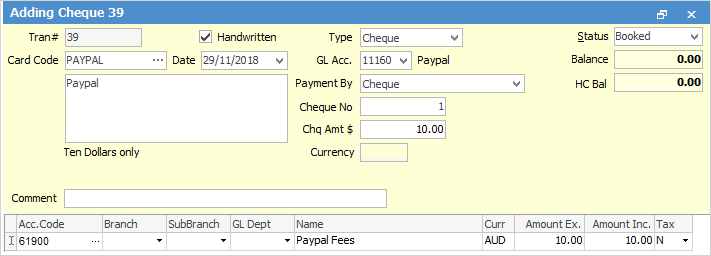

2.Make a cheque entry from the Paypal account to the 6-XXX Paypal fees account.

3.If required, transfer the rest of the amount from the Paypal account to another bank account.

Other types this refers to are epay, bartercard, integrapay, etc.

Further information

Understanding Debits and Credits

Use Debtors and Creditors Adjustments

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Capital into the Business

Enter Government Support Payments

Enter Prepaid Expenses and Amortising Costs

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

Remove Duplicate Payments in Closed Period

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses