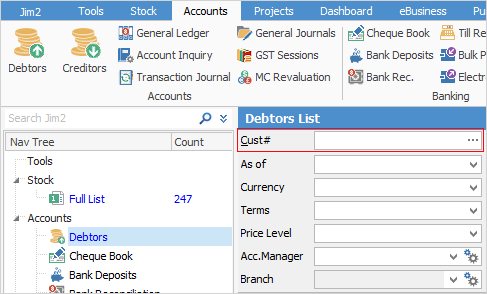

Enter a payment by going to Accounts > Debtors on the ribbon, and either running a Debtors List to find the debtor, or entering the card code of the debtor in the Cust# field.

|

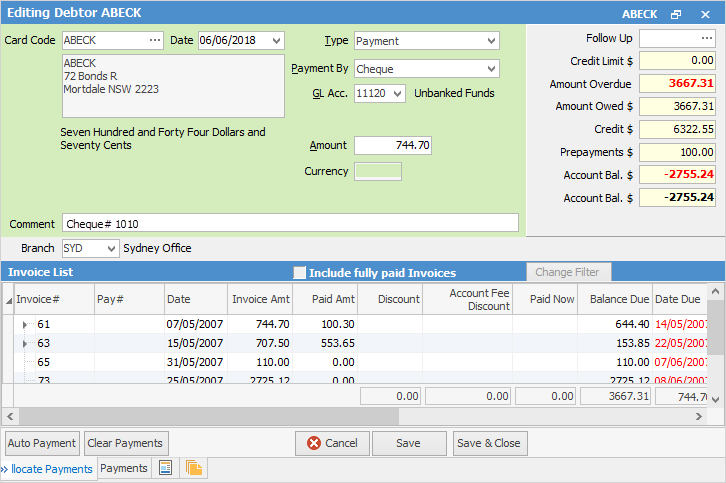

You will see some letters underlined in the field names within the header, eg. Type. Using Alt+ the underlined letter will jump you to the field beside that heading. |

1.Select the customer that you want to enter the payment for.

2.Click Edit at the bottom of the screen.

3.The Date field will default to today's date, but can be changed if required.

4.The Type field will default to Payment, and does not need to be changed for this type of entry

5.You will need to select the Payment By to be used: Cash, Cheque, Credit Card, etc.

6.Enter the amount of the payment.

7.Add a comment to this payment if required – a useful note to enter is the cheque number, or more information on what the payment is for.

8.Now you need to select the method that you want to use to apply the payment. There are three methods:

▪Sort your Invoice List by date, with the oldest date at the top, then you can select Auto Payment, and the payment will be allocated to the oldest invoice first.

▪You can double click the Paid Now column of the invoice that you want to pay with this payment entry, it will allocate the amount to the selected invoice, and anything left over can then be allocated to other invoices.

▪Alternatively, you can select a number of invoices and allocate the amount that you want from that payment to each invoice selected by typing the amount into the Paid Now field.

There is another button called Clear Payments (bottom left of screen) – this button will simply clear any allocations made while you are still in Edit mode.

9.Click Save or Save & Close.

|

If you unprint an invoice which has not been paid, a reversing entry will be shown for that invoice. If you unprint an invoice that has been paid, a reversing entry will be shown for the invoice, and any payments will become credits. |

|

If a payment is applied to an invoice via the Debtors form, it will update the balance due on the corresponding job. |

Further information: