As an importer, you may have elected to have your GST on imports deferred, instead of paying this GST to your customs agent on each shipment. You will see the deferred GST figure embedded in the monthly ECI BAS by the ATO. This deferred GST amount should be entered into Jim (before running the GST session) as follows:

▪Add a new account to the GST Liabilities area of your general ledger, eg. 2-1350 GST Deferred on Imports (if it is not already set up) with a default tax code of X.

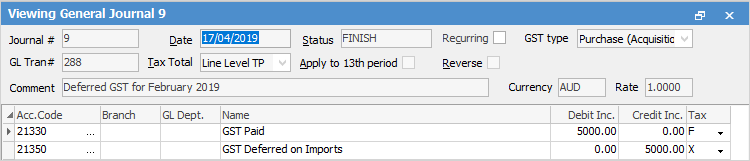

▪Add a General Journal – BAS Type – Purchase (Acquisition). We will use a figure of $5,000.00 in this example, and the GL account numbers may also be different in your general ledger. Debit 2-1330 GST Paid $5,000.00 tax code F and credit 2-1350 GST Deferred on Imports $5,000.00 Tax Code X.

▪You have now recorded the deferred GST and, using Tax Code F, Jim2 will gross up that amount to record total purchases including GST to $55,000.00. This was the deemed value of the goods at the time they cleared customs – including the GST charged.

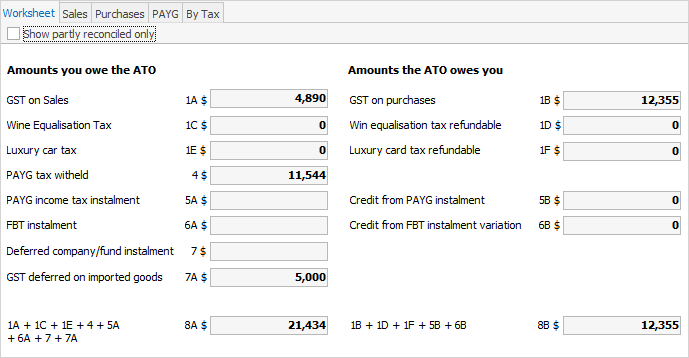

▪The deferred GST figure will flow through to 7A in GST Sessions in Jim2, and is included in the G11 figure for total non-capital purchases.

•When you actually pay the ATO, you should enter the payment as follows:

Cr 1-1110 Bank Account |

Tax Code X |

Total amount of payment |

Dr 2-1310 GST Collected |

Tax Code X |

Total GST Collected on Sales |

Cr 2-1330 GST Paid |

Tax Code X |

Total GST Paid on Purchases |

Dr 2-1350 GST Deferred |

Tax Code X |

Total GST Deferred on Imports |

Dr 2-1410 PAYG Payable |

Tax Code X |

Total PAYG Withheld from wages |

Further information: