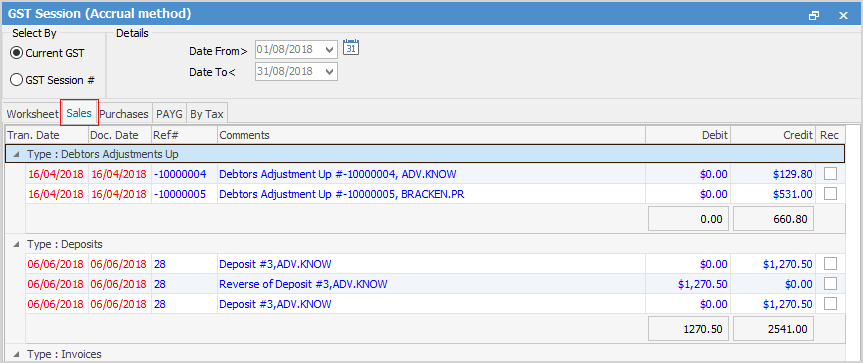

Each time the GST session is accessed on the ribbon via Accounts > GST Sessions, it will open up on Current GST at the Sales tab. The Sales tab consists of a grid containing a listing of all sales invoices and transactions that have been nominated as a GST type of Sales.

Transactions displayed here have not been included in a previously reconciled GST session.

The fields within the Sales tab grid are:

Field |

Explanation |

Tran Date |

The date that the transaction was entered into Jim2. |

Doc Date |

Date the transaction will impact on the general ledger. |

Ref# |

The document number, eg. the invoice number. |

Comments |

The description of the document entered into Jim2, or the comment entered on a general journal. |

Debit |

The debit value including any GST. |

Credit |

The credit value including any GST. |

Rec |

When selected to be included in a GST session, this box will contain a tick. |

|

You will see two dates in many areas of Jim2: ▪The Document date is the date that the transaction will impact on your general ledger accounts. ▪The Transaction date is the date you entered the transaction into Jim2. |

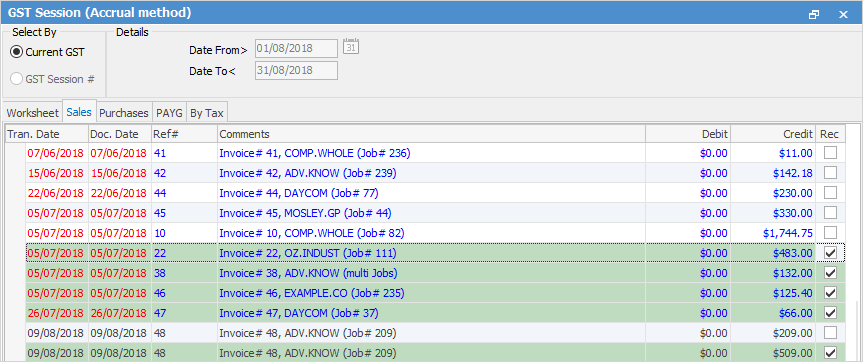

There are different types of date related transactions in Jim2 that are both within the specified date range and outside the specified date range. Those transactions outside the specified date range have the date coloured red and the rest of the line coloured blue, whereas those within the date range are coloured black. Once the Rec box is ticked, the transactions are highlighted with a green background.

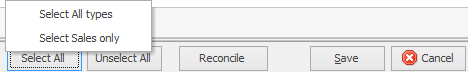

To select transactions in the Sales tab, click Select All, then Select Sales only at the bottom of the screen.

Select All Types will select all transactions in the nominated period in the Sales, Purchases and PAYG tabs. Once transactions have been selected, you will see that your screen has changed – the transactions within the date range now have a green background, and the Rec box at the right of the transaction has been ticked.

|

Any transactions that fall before the specified date range will automatically be included in the current GST session when you select all, as Jim2 recognises those transactions have not been included in a previous reconciled GST session.

Any transactions that fall after the specified date range will not automatically be included in the current GST session when you select all. |

Selecting transactions in a later GST session does not change the document date of the original transaction, and has no impact on the general ledger.

Further information: