In the majority of cases you will need to make a payment to the ATO each GST period, and that payment is made up of what you owe them less what they need to credit you.

First, ensure there is a card file for the Australian Taxation Office in your Jim2 database. If not, add one, so you can easily track all payments made to the ATO.

The actual amount of each payment needs to be recorded correctly, and reflect how it is apportioned against the GL liability accounts to accurately debit and credit those running balances – you will record the payment to reflect what was actually lodged on your BAS.

|

You should ensure that the GST liability figures from your previous system are entered as opening balances against the relevant GST liability accounts in Jim2. Your payment (or refund) in Jim2 will simply clear these out. |

Recording Your BAS Payment

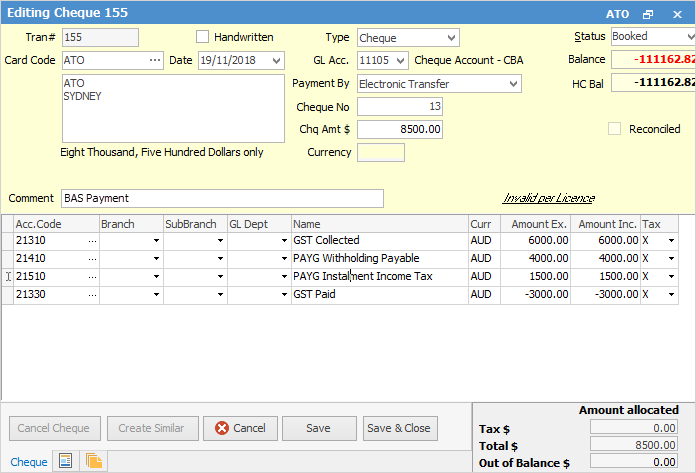

For this example, the GST Calculation Worksheet report shows a total due of $8,500.00, made up of:

GST Collected on Sales |

6000.00 |

PAYG Withholding Payable |

4000.00 |

PAYG Instalment Income Tax |

1500.00 |

GST Paid on Purchases |

-3000.00 |

Go to Accounts > Banking > Chequebook, add a cheque and select the card file for the ATO. Record the amount of the payment and allocate the amounts exactly as lodged on your BAS to the relevant general ledger accounts, as shown in the image below.

|

You must use Tax Code X on every line of the cheque entry when paying the ATO.

If you use Tax Code Q when recording a payment to the ATO, it will distort the figure in W2 in your next GST Session. You must only use Tax Code Q against the PAYG Payable account in the payroll general journal, as this code flags the transaction to report into W2 in GST Sessions. |

Enter the negative liability last to balance the cheque amount, then finish and save.

Recording Your BAS Refund

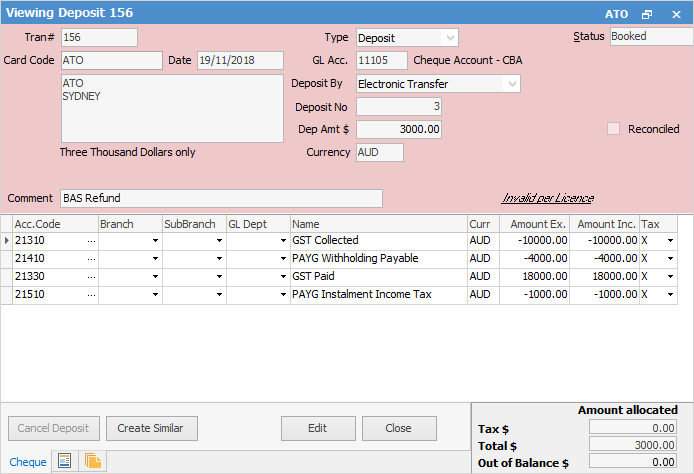

For this example, the GST Calculation Worksheet report shows a refund due of $,3000.00, made up of:

GST Collected on Sales |

-10000.00 |

PAYG Withholding Payable |

-4000.00 |

GST Paid on Purchases |

18,000.00 |

PAYG Instalment Income Tax |

-1000.00 |

Go to Accounts > Banking > Chequebook, add a deposit, and select the card file for the ATO. Record the amount of the refund and allocate the amounts exactly as lodged on your BAS to the relevant general ledger accounts, as shown in the image below.

Click Save.

|

You must use Tax Code X on every line of the deposit entry when entering a refund from the ATO. |

Further information: