You may have changed over to Jim2 partway through a GST period, and are not sure how to calculate the figures to be lodged on the next BAS. If so, you will need to combine figures generated from the GST reports from your previous system up to the changeover with figures generated from the initial GST session completed in Jim2.

Learning how to complete and review a GST session, and interpret the detailed information via the By Tax tab is a useful means of picking up errors and identifying potential training issues for your staff.

This detailed information allows you to:

▪Review the transactions that make up the totals in the fields on the Worksheet tab.

▪Verify that the correct tax code was used.

▪Identify where incorrect tax codes may have been used, and make any corrections prior to completing and reconciling the GST session.

▪Be confident that what you are reporting on your BAS is accurate.

|

We strongly advise you to contact the support team at Happen Business, on 02 9570 4696, or support@happen.biz, to book your initial GST Session with a support team member. |

Before commencing the initial GST session, we suggest that you read through this GST Sessions section.

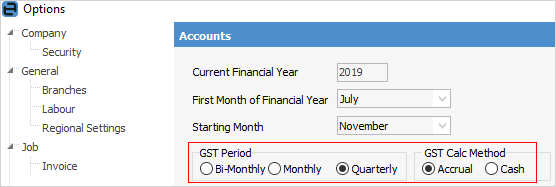

Ensure the Options for the GST calculation method have been correctly selected, as this will have a direct effect on the information presented in the GST Session grid.

Further information:

Change GST Reporting from Cash to Accrual Complete a GST Session: Accrual Method |

|

Handle NZ GST in Aust Database Record Deferred GST on Imports |