In the ideal world, if your company needs office supplies etc. you will raise Expense Purchase Orders to vendors. However, for some sites the normal inventory/stock on hand is used for day-to-day emergencies. There are a couple of different methods to move the inventory into expenses – just select the one that suits you best:

Method #1

A running sales job can be created where staff can add stock that is used in-house. This job will then be invoiced, electing specific branch, sub-branch or GL department, and the invoice $total, then moved to the Expense ledger:

▪Add the stock to a job where Cust# = your company.

▪Adjust sell price to equal the current COGS for the stock in question.

▪Change default tax code on sell from G to X (exclude from overall sales reported in BAS).

▪Invoice.

Now your company becomes a debtor to itself. To move the stock COGS to the expense Ledger:

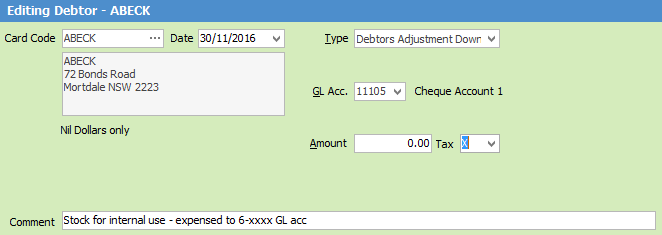

▪Open your company debtor record.

▪Record a Debtor Adjust Down against the appropriate expense code (typically 6-XXXX).

▪Make sure tax code on adjustment is also X.

▪Save.

The Adjust Down will create a credit that should now be applied to the original invoice. To apply the credit:

▪Edit.

▪Select Payment By: Credit.

▪Choose the credit you just created.

▪Apply in the Paid Now column to clear the invoice.

▪Save and close.

Method #2

Similar to the above option, however this method will expense the total COGS to a nominated expense account via an entry on the original invoice using Journal Stock.

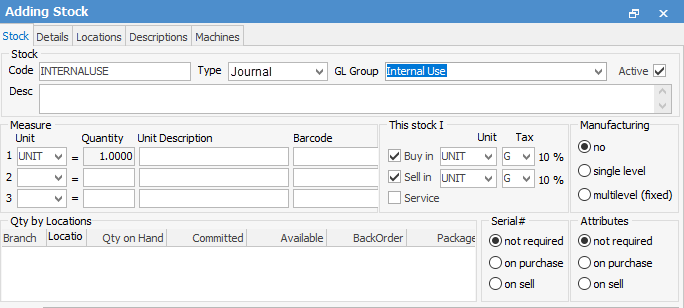

▪Set up a new stock GL group called Internal Use, and select the accounts you require the COGS to be moved to when expensing this stock (similar to the example below). Stock Type will be Journal.

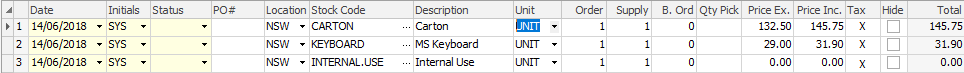

Now you are ready to create a running sales job, and add the stock that has been used in-house:

▪Adjust sell price to equal the current COGS for the stock in question.

▪Change default tax code on sell from G to X (exclude from overall sales reported in BAS).

▪Add a journal stock entry with a negative value that equals the total invoice. This will move the total COGS to the relevant expense account.

▪Invoice.

Method #3

You can use the Stock Adjust Down function to remove the stock from the current stock on Hand count, then use a general journal to move the $total to Expenses.

▪Add a stock adjustment.

▪Select QTY - and the correct stock code to reflect which product(s) used.

▪Change to Finish.

This stock adjustment down (debit) will move the stock $COGS into the 5-XXXX Stock Adjustment account in your general ledger. It then needs to be journalled to the correct expense account/s. Again, you have the choice at this point to allocate to specific branch, sub-branch or GL department:

▪Add a general journal.

▪Select the 5-XXXX Stock Adjustment account.

▪Enter the $total in the Credit column (credit back the stock adjustment account), tax code X.

▪Select the 6-XXXX Expense account.

▪Enter the $total in the Debit column (debit the expense account instead)*, tax code X.

|

You can of course separate the expenses by apportioning the total across multiple (debit) entries. |

The above options will report differently in Jim2 and should be checked with your accountant for the preferred option.

Further information: