Following are two ways staff purchases can be recorded.

Invoice the employee, then do a debtors adjustment down

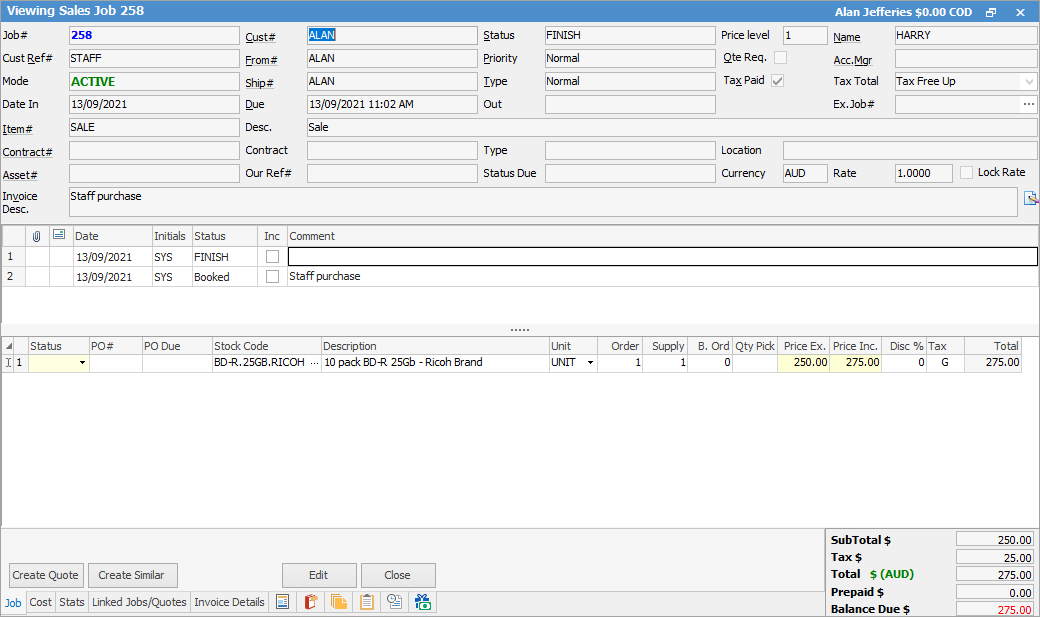

1.Create a job and invoice the employee for the purchase.

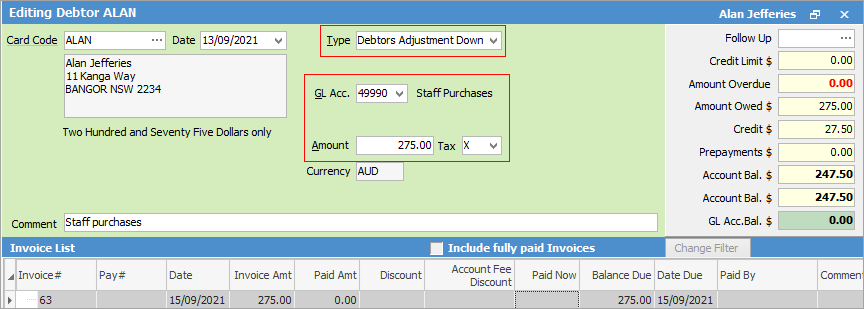

2.In the general ledger, create a Staff Purchases account. Go to the debtor, and create a debtors adjustment down to the Staff Purchases account. Enter a Comment (this is mandatory), and apply the resulting credit to the invoice for staff purchases.

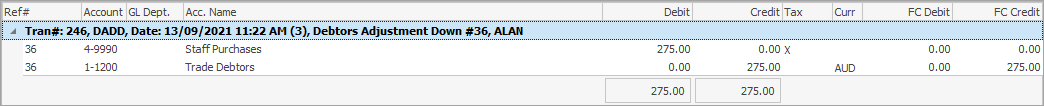

This will create the below general journal. Staff Purchases GL account has been credited by $275.

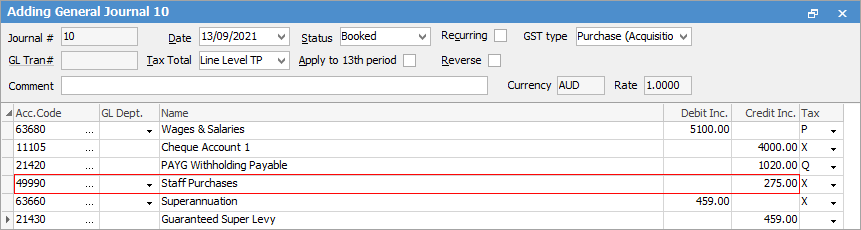

3.Create a payroll journal as shown below. In this case we have reduced the amount paid from the cheque account by $275 and added Staff Purchases in as a credit for $275.

Journal stock for staff purchases

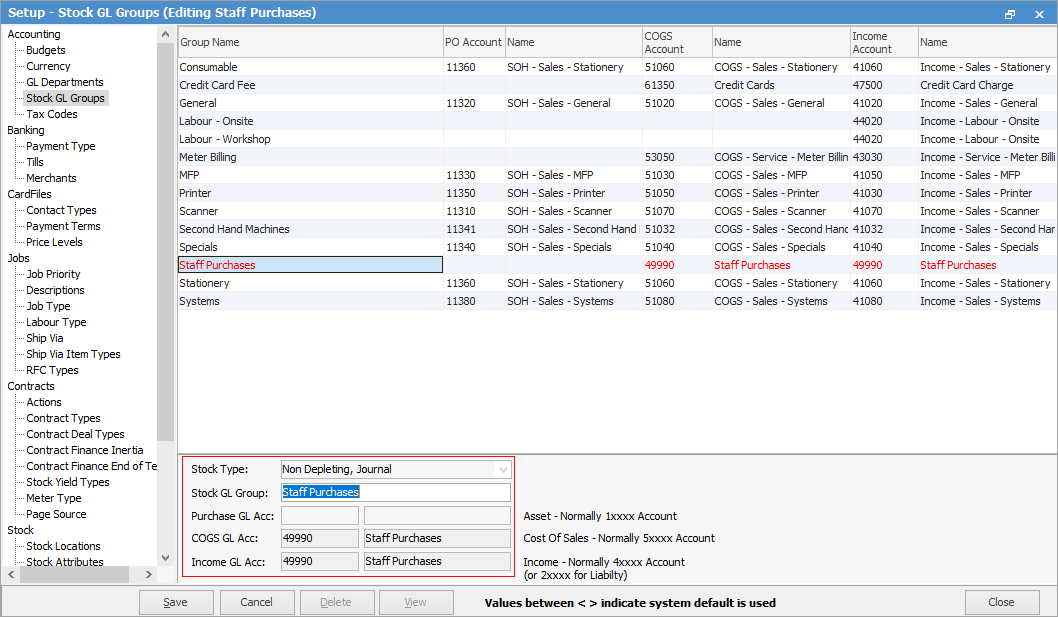

1.Create a Stock GL Group for Staff Purchases. Stock type will be Non Depleting, Journal. Add the Staff Purchases GL account in the COGS GL Acc field and the Income GL Acc field.

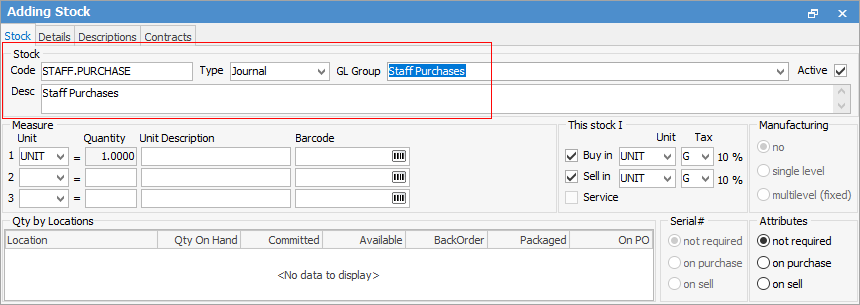

2.Create Journal stock for Staff Purchases and link this to the Stock GL Group for Staff Purchases.

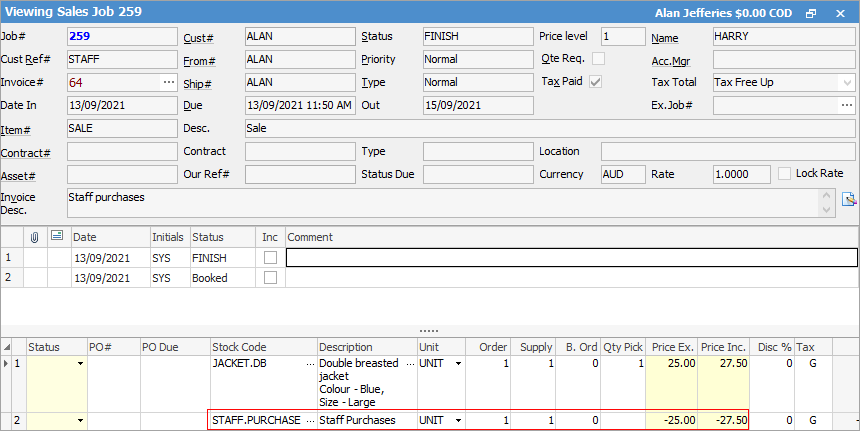

3.Add a job, and invoice the employee for the purchase. Add the Journal stock into the job as a negative amount. The resulting total of the invoice should be $0.

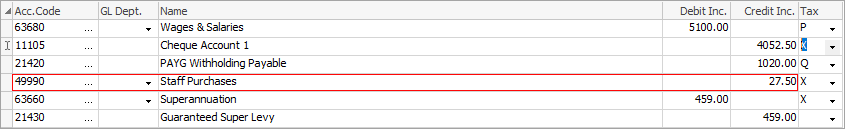

4.Create a payroll journal as shown below. In this case we have reduced the amount paid from the cheque account by $27.50 and added Staff Purchases in as a credit for $27.50.

It is suggested to add the stock to the job at a price that most closely reflects the cost of the goods.