The suggested setups and procedures below are to assist with identifying the reportable transactions (TPAR) to comply with Australian Taxation Office (ATO) requirements for sub-contractor taxable payments reporting.

The assumption is that all sub-contract labour is purchased using Special stock, the cost of this labour will be tracked against jobs. If some of the sub-contract labour is not chargeable to customers, it should still be added to the relevant job and invoiced out at zero (if it is internal, ie. not for a customer, add a job using company cardfile as the customer and assign the labour stock to that job).

|

If the sub-contractor labour was previously being expensed, consider changing to this method. |

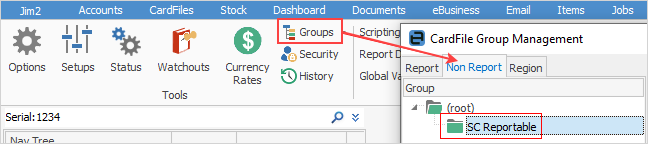

On the ribbon, go to Tools > Groups > CardFile > Non Report and right click on Root. Select Add Group and add a new cardfile group, eg. SC Reportable or TPAR.

|

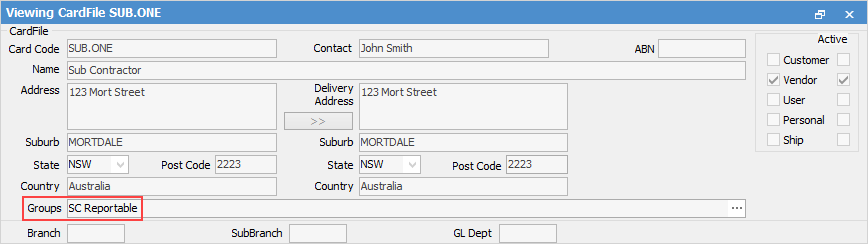

On the ribbon, go to CardFiles > Create CardFile List and tick Vendor. Edit the relevant vendor cardfiles for reportable sub-contractors, and assign them to the new cardfile report group.

|

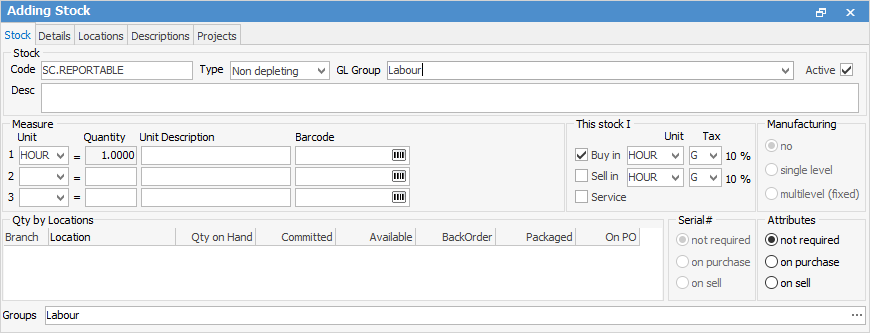

On the ribbon, go to Stock > Add Stock, and add a non depleting stock record to use as a flagging mechanism on reportable purchase orders. Unit can be hour, tick Buy in and untick Sell in. There will be no cost against, or when selling, this stock. It is a mechanism to identify the reportable purchase orders.

|

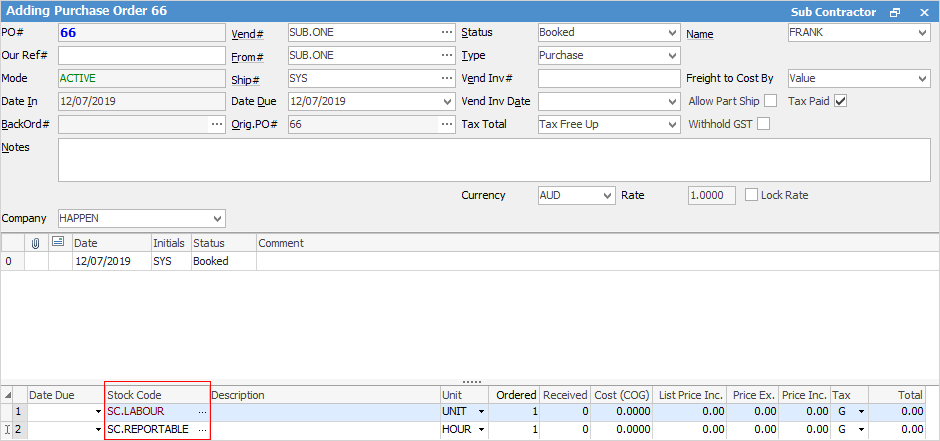

Add a purchase order for all sub-contractor labour using the Special labour stock code and the new non depleting SC.REPORTABLE stock code, as this is the means of identifying the reportable purchase orders.

|

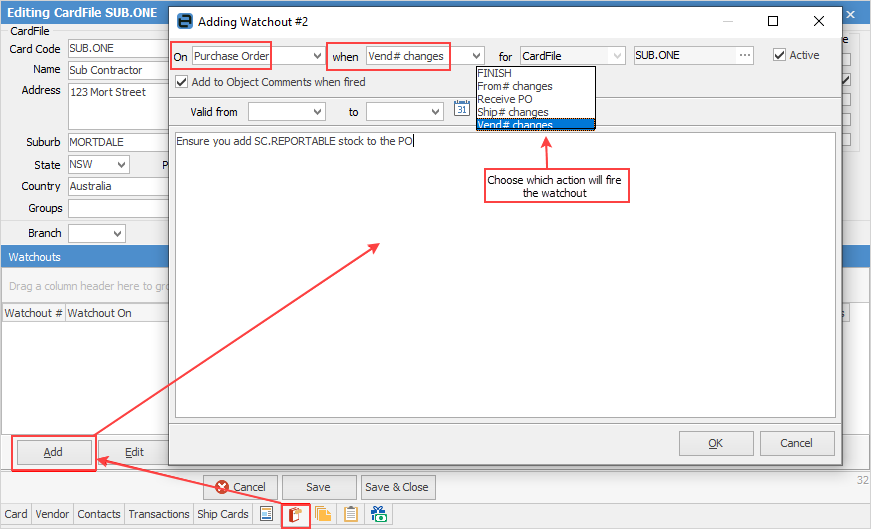

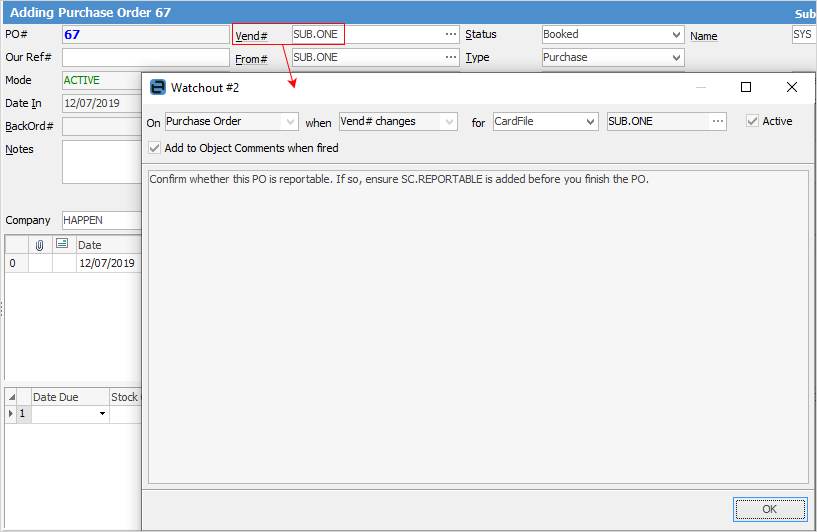

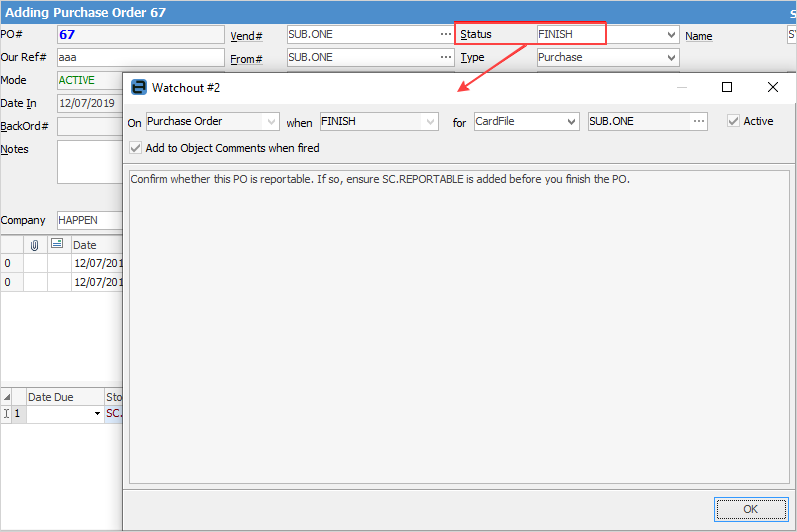

On the ribbon, go to CardFiles > Create CardFile List > Advanced > Group: SC Reportable to generate a list of the relevant vendors. Edit each cardfile in the list, and add relevant watchouts as prompts to add the flagging stock record to each reportable purchase order.

The following watchouts will appear when: 1.Adding a purchase order and selecting the vendor, then moving off the Vendor field.  2.Setting a purchase order to Finish, before saving it.  |

To compile the report for the ATO, identify the reportable purchase orders, then confirm if they have been paid within the reporting period.

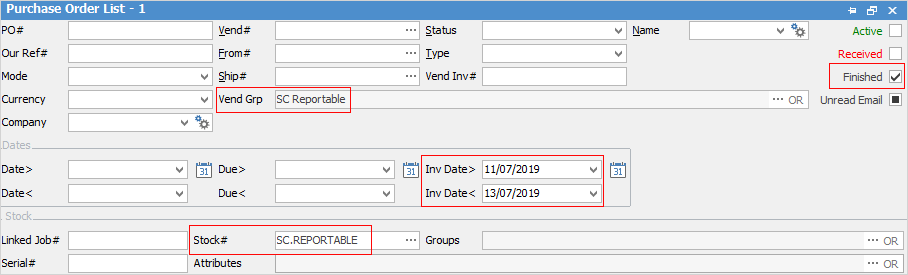

On the ribbon, go to Purchases > Create PO List > Advanced List. At the top right of the list untick Active and Received and tick Finished. Select the required date range by Inv Date for the reporting period, eg. financial year. Select the flagging stock code SC.REPORTABLE

If all reportable vendors are to be included in the list, choose the vendor group SC.REPORTABLE and click Run. To run the list separately for each vendor, just choose the vendor and click Run.

The list will provide the reportable purchase orders with an invoice date within the specified period, but which of these purchase orders have been paid will need to be confirmed before completing the Australian Taxation Office reporting. |

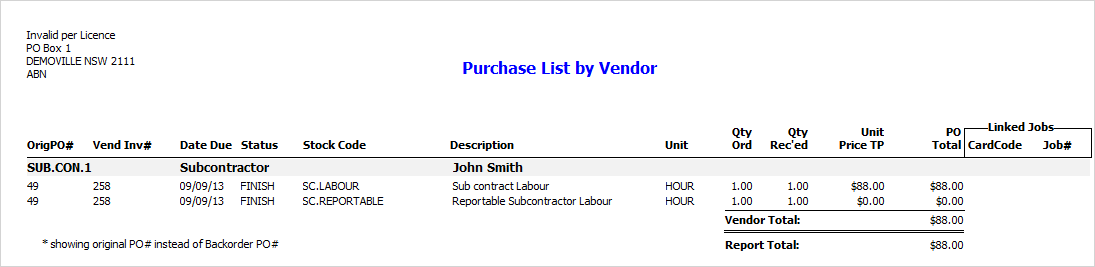

If all the purchase orders have been paid within the specified reporting period, print out the PO List – By Vendor report, which will produce the total of purchase orders in the list including GST.

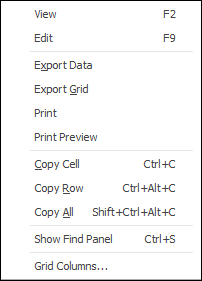

If not all purchase orders have been paid within the specified reporting period, manually calculate the total of the reportable purchase orders. Right click in the list, select Export Data from the drop down list and save the data as a spreadsheet file.

|

| Produce the ATO TPAR submission |

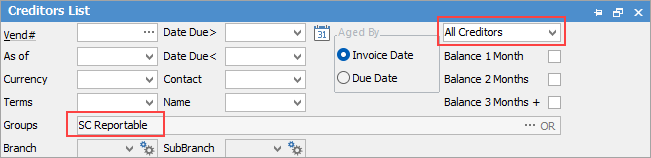

Run a Creditors List filtered by the group created above and All Creditors:

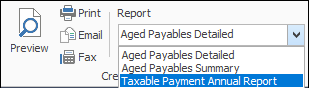

In the ribbon, select the Taxable Payment Annual Report:

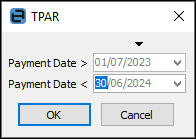

Enter the desired date range for payments. If producing the ATO TPAR submission, enter the financial year period.

The report will generate a spreadsheet to save outside of Jim2.

The report has two tabs:

Transaction Preview This will list all payments made to the selected creditors within the date range, broken down by allocation. This will also list all purchase orders the payments are allocated to – if the payments are unallocated and present as credits, they will present as such. These are presented for your review prior to submission – if there are any payments or purchase orders that should not be included in TPAR, they can be removed here.

Transaction Report This is the TPAR submission for the ATO, which summarises all information in the Transaction Preview tab. Any transactions removed in the Preview will update so they will not be counted for the Report tab. BSB and Account Number information will be populated if they are present on the vendor cardfile – if not, this field will be blank. |

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments