An example of when rounding occurs is when a GST value is more than 2 decimal places and the transaction journal only balances to 2 decimal places.

For instance, a job shows an actual total of $136.2405. Jim2 takes the largest value ($136.24), posting to an income account, then adjusts by the difference (.05) to make the journal balance. This can produce discrepancies between the income account and the transaction journal.

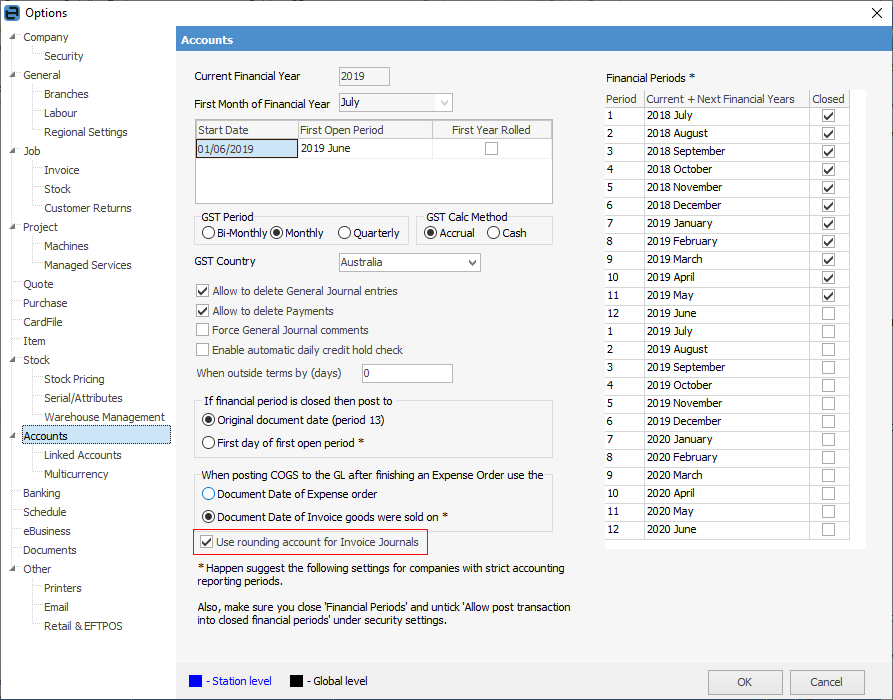

To overcome these discrepancies, use the rounding account for invoice journals. To use rounding, on the ribbon, go to Tools > Options > Accounts and tick Use rounding account for Invoice Journals.

Jim2 will place all these small adjustments directly into the rounding account, ensuring that the income accounts and transaction journals now match.

Examples here:

Job Details

Line |

Total Ex GST |

GST |

|---|---|---|

Line 1 |

88.00 |

8.00 |

Line 2 |

1.05 |

.0955 |

Totals |

89.05 |

8.0955 |

Invoice Details

GST |

8.10 |

Total Invoice |

89.05 |

Invoice Income |

80.95 |

Journal Details

Income Line 1 |

80.00 |

|

Income Line 2 |

0.9545 |

|

Total |

80.9545 |

Cannot use this value as the journal will not balance. |

Rounding account for invoice journals

When not enabled, Income Line 1 is adjusted to 79.9955

When enabled, rounding account amount is 0.0045.

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments