The following explains how to set up a capital loan account.

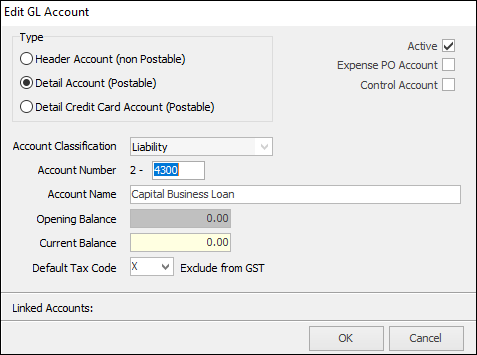

Set up a liability loan account in the general ledger – usually a 2-XXXX Long Term Liability.

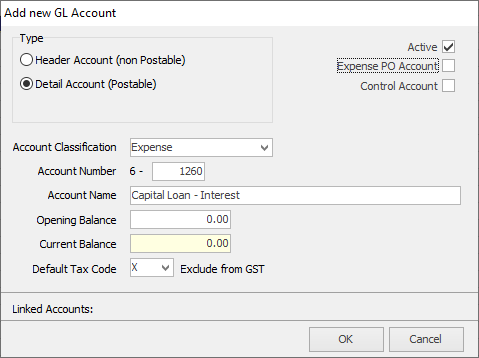

Add a 6-XXXX Expense account for loan interest and loan bank fees.

Add a deposit entry, and bank funds into the desired bank account. Post to the new liability general ledger account using tax code X.

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Purchase a Capital Asset Under Finance

Record Debtors/Creditors Contras

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments