There may be times where the business purchases a capital asset, such as a vehicle, and takes out finance to pay for it. The setup to reflect this in Jim2 is as follows:

|

It is suggested to discuss asset purchases with the company's accountant prior to recording in Jim2. |

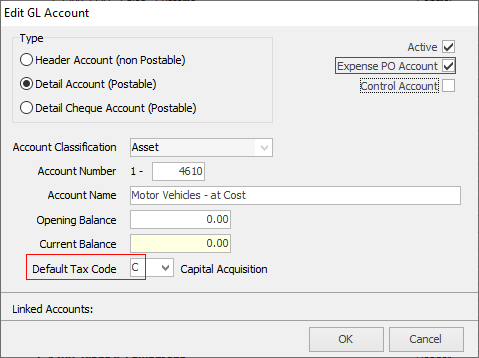

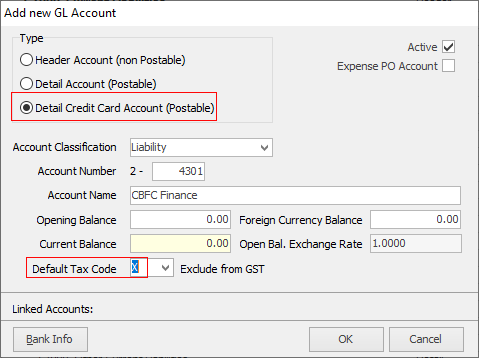

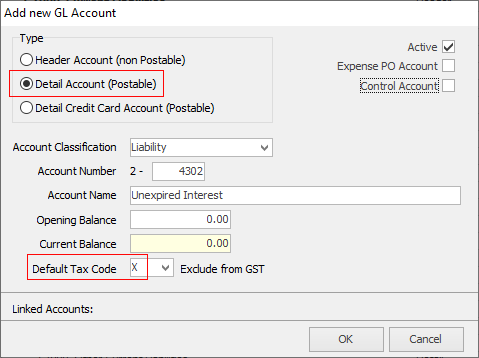

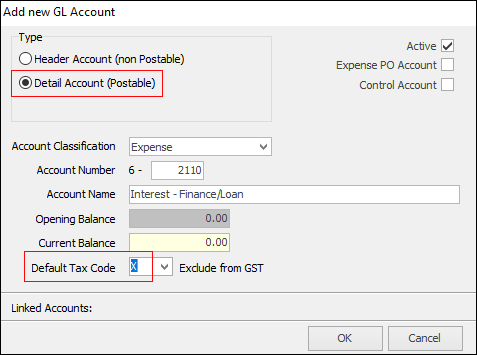

1.On the ribbon, go to Accounts > General Ledger > Asset and locate a relevant general ledger account for the capital asset. Ensure that it is ticked as an Expense PO Account with a default tax code of C. If there is not a suitable asset account, add a new one.  2.On the ribbon, go to Accounts > General Ledger > Liability and add a new general ledger account for the finance/loan in the 2-Liability tab under the Long Term Liabilities section. Select Type = Detailed Credit Card Postable (to do bank reconciliations on this account) with the default tax code set to X (no GST on payments to the account).  3.On the ribbon, go to Accounts > General Ledger > Liability, and add a new general ledger account for the unexpired interest for the finance/loan under the Long Term Liabilities section. Select Type = Detail Account, with the default tax code set to X (no GST on transactions to the account).  4.On the ribbon, go to Accounts > General Ledger > Expense, and add a new general ledger account for the interest on the finance/loan. Select Type = Detail Account, with a default tax code of X (no GST transactions to the account).  Close the general ledger. |

Add a cardfile for the vendor the vehicle was purchased from, and for the finance provider. |

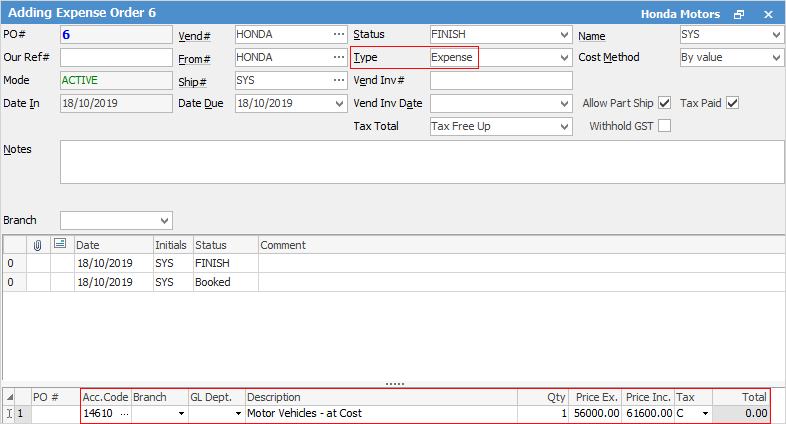

Add an expense order for the purchase of the vehicle from the vendor, using capital asset account set up above and tax code C.

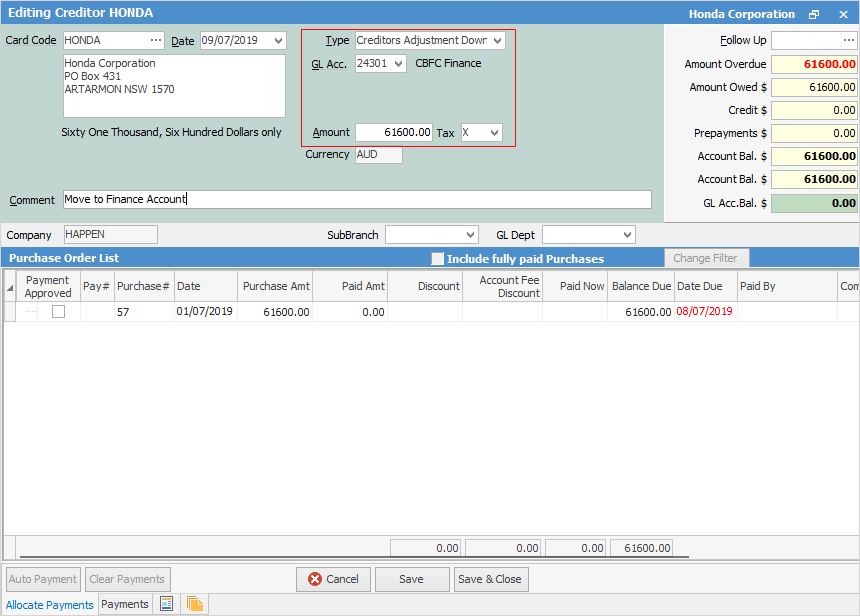

After finishing the expense order, open the creditor record and click Edit. Select Type – Payment and change to Creditors Adjustment Down.

Select the general ledger account for the new 2-XXXX Finance/Loan account for the full amount owing, using tax code X.

Add a comment, such as Move to Finance/Loan Account, and save.

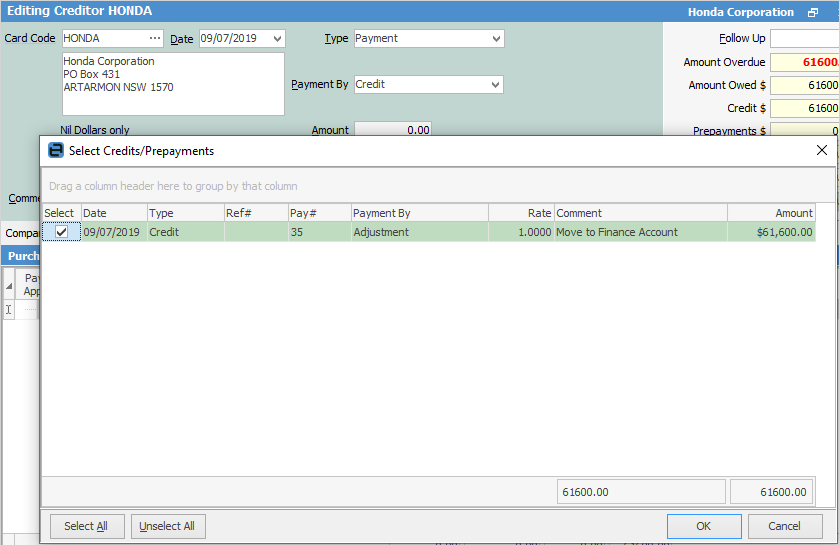

Add a Type – Payment, select Payment By – Credit, apply the adjustment credit to the invoice.

Enter the amount in the Paid Now field, and save.

The amount owed from the creditor account has now been moved to the finance/loan liability account. |

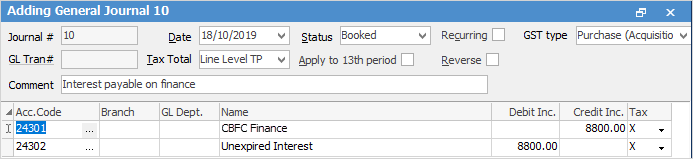

Add a general journal to increase the 2-xxxx liability to include the interest component payable on the finance/loan.

|

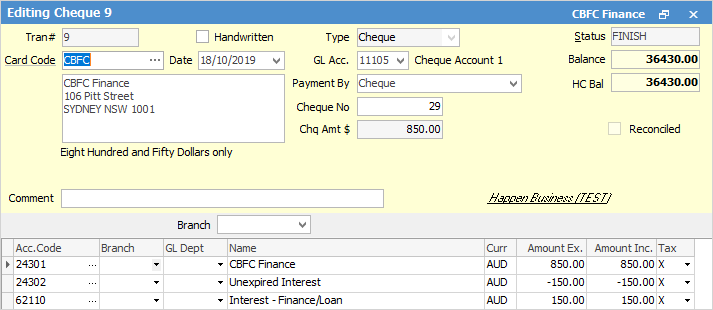

On the ribbon, go to Accounts > Cheque Book, and click Add. Select the cardfile for the loan provider. Enter the total amount of the repayment. If there are details of the monthly interest components, enter the amount of interest that is being expensed as per the example below.

|

|

If not all the information is available, or how to record the interest is unclear, it is suggested to discuss this with the company's accountant before recording the payments. |

Further information

Clear the Historical Balancing Account

Suggested End Of Month Procedures

Enter Government Support Payments

Record Debtors/Creditors Contras

ATO Reportable Sub-Contractor Payments

Share Utility Expenses with other Businesses

Understanding Debits and Credits

Use Debtors and Creditors Adjustments